As a seasoned analyst with over two decades of experience in the crypto market, I must say that the recent milestone achieved by Solana is nothing short of impressive. It’s been a while since I’ve seen such significant growth and adoption in a blockchain network as quickly as Solana has managed to achieve it.

For the first time since Solana launched, six SOL-based platforms held over $1 billion in user deposits.

Based on DefiLlama’s statistics, the blockchain network Solana (SOL) has seen several projects – Jito (JTO), Kamino, Jupiter (JUP), Raydium (RAY), Marinade, and Sanctum – reach or exceed a value of $1 billion.

On October 1st, it was a historical milestone for SOL as the combined value of its leading six protocols reached close to $9 billion for the first time in its four-year existence. Notably, liquid staking provider Jito stood out among other smart contract projects with over $2 billion in Total Value Locked (TVL).

On Solana, Kamino, a lending platform, ranked second with approximately $1.58 billion in total value locked (TVL), while decentralized exchanges Jupiter and Raydium held the third and fourth spots, each with about $1.26 billion and $1.24 billion of user deposits respectively. Lastly, liquid staking platforms Marinade and Sanctum rounded off the top six Solana projects, with users locking away around $1.21 billion in Marinade and slightly over $1 billion in Sanctum.

🚨BREAKING: For the first time in three years, six Solana DeFi protocols boast over $1B in TVL.

— SolanaFloor (@SolanaFloor) October 1, 2024

Bitget: $180 possible for Solana in October

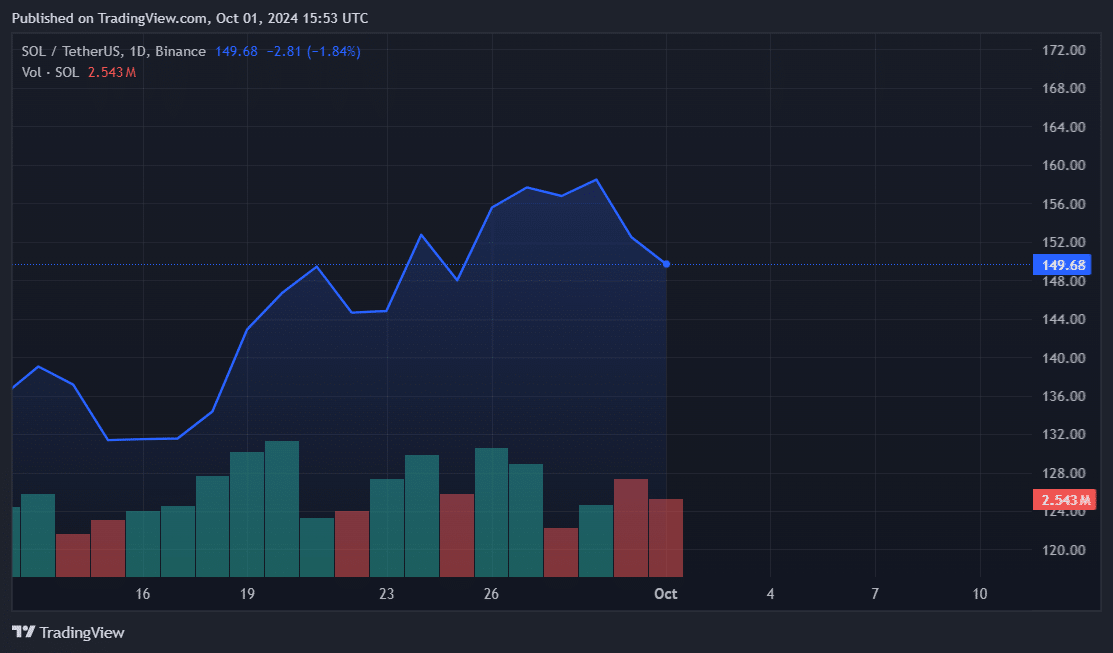

Enthusiasm for Solana’s projects Jito, Kamino, Jupiter, Raydium, Marinade, and Sanctum has surged simultaneously with a rising demand for SOL. The native token has experienced a significant growth of more than 547% in the past year, with each token currently valued at nearly $150 according to CoinGecko at the time of press.

Supporters within the cryptocurrency world praised the unique aspects of the SOL blockchain, such as Actions and Blinks, for their role in driving retail acceptance. However, some critics contend that the rapid transaction speeds and meme coin speculation are primarily responsible for the on-chain activities observed on the SOL network.

According to a note sent to crypto.news, Bitget Research’s top analyst Ryan Lee concurs with the idea that memecoins will rise and predicts Solana (SOL) could reach $180 by October, driven by excitement around this trend. Additionally, he believes the backing of Franklin Templeton and Citibank might enhance SOL’s attractiveness to institutional investors.

In periods of market decline, the $110 support level has proven remarkably resilient, and following each recovery, SOL has often been among the top-performing cryptocurrencies with a large market capitalization. Furthermore, within the Solana ecosystem, the meme sector has consistently demonstrated strong resilience during market rebounds.

Ryan Lee, Bitget Research chief analyst

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-10-01 19:20