As a seasoned analyst with years of experience navigating the tumultuous cryptocurrency market, I have witnessed many twists and turns that can only be compared to a rollercoaster ride. Monero (XMR) is one such coin that has shown resilience despite facing regulatory challenges.

Monero appears to be on an upward trend, having recorded a 5% increase over the last 24 hours, placing it among the day’s leading market performers.

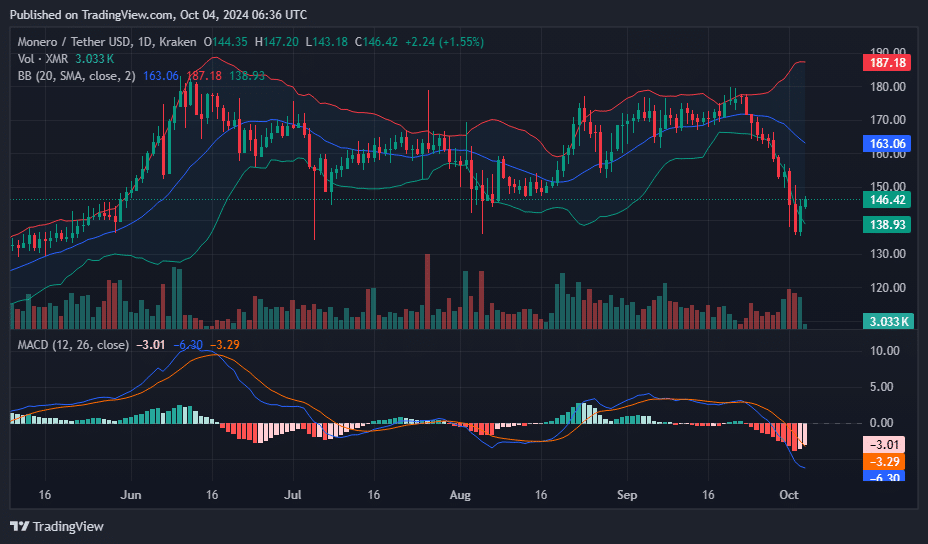

Currently, Monero (XMR) is being exchanged for approximately $146.63, holding a market value of about $2.7 billion. This provides a bit of respite to investors following a turbulent beginning to October. Initially, XMR started the month at $153.80, but it plummeted significantly, reaching $142.96 on Oct. 2 and continuing its descent to reach its lowest point of $136.43 the next day.

The drop in price occurred at the same time as it was revealed that Kraken, a significant cryptocurrency trading platform, intends to remove Monero from its European offerings due to regional regulations. This move may be in preparation for the forthcoming Markets in Crypto-Assets Act, which becomes effective in December.

Kraken delisting fuels downtrend

The action taken by Kraken to remove Monero from their exchange within the European Economic Area caused a stir in the market, sparking worries about increased regulation focused on privacy coins. Given that Monero’s private-centric technology conceals transaction information, it has historically been under regulatory scrutiny. Moreover, the impending MiCA framework seems to be making the situation more stringent.

What raised eyebrows, however, was the timing of Monero’s price drop. There are allegations that XMR started to sell off before Kraken’s delisting announcement, sparking speculation that insiders may have acted on non-public information. This is particularly suspicious as the broader cryptocurrency market was rallying at the time, yet Monero bucked the trend with a sharp downward move.

It’s now clearer why XMR experienced a downturn while other cryptocurrencies were rising. Insiders were aware that Kraken was planning to delist XMR within the EU.— BawdyAnarchist (@BawdyAnarchist_) October 1, 2024

In spite of the regulatory challenges that Monero encounters, supporters of privacy coins maintain a positive outlook. They contend that Monero’s focus on anonymized transactions makes it indispensable, even if it gets removed from certain exchanges due to its nature.

Regarding Monero, as suggested by the user known as ‘Klaus’, it’s expected that even if its price remains at this level or drops below a dollar, large investors (whales) are likely to employ this technology for managing their wealth.

Despite some recovery since its October lows, the token hasn’t regained full strength yet, and trading activity continues to be relatively quiet. The daily trading volume for Monero (XMR) has decreased by about 24.5%, currently standing at approximately $67.8 million, which indicates a potential decline in trader engagement.

XMR testing key resistance levels

Looking from a technical standpoint, Monero has regained its footing after hitting an important support point at around $134. This critical support point has been steady since early July. The rebound has pushed XMR back above the lower boundary of the Bollinger Band, and the next major challenge is at $163, which represents the midline of these bands. In order to ensure a lasting bullish turnaround, Monero needs to surpass this level with significant power.

Above $163, the significant resistance at approximately $180 poses a tough challenge. This level has thwarted price increases back in June and September. Overcoming this hurdle is crucial for Monero to resume its more robust uptrend.

As a researcher, I’m observing that technical indicators are subtly optimistic, with the Moving Average Convergence Divergence (MACD) currently in a bearish phase. The MACD line is still beneath its signal line, but I notice a narrowing gap between them, suggesting a possible change in momentum in the near future.

The histogram continues to display red, suggesting that selling activity might be diminishing and control could soon pass to buyers. As of this report, volume levels are steady but not yet high enough to indicate a clear bullish surge. For Monero to regain momentum for a more powerful comeback, there needs to be an increase in the volume of trades.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-10-04 11:44