As a seasoned crypto enthusiast who has witnessed numerous projects rise and fall, I must admit that the trajectory of Catizen mirrors a rollercoaster ride. The unexpected changes in rules and the apparent advantage given to those with financial investment over time investors have left a sour taste for many participants. It’s like playing a game where the rules keep changing while the goal post moves – not exactly fun or fair.

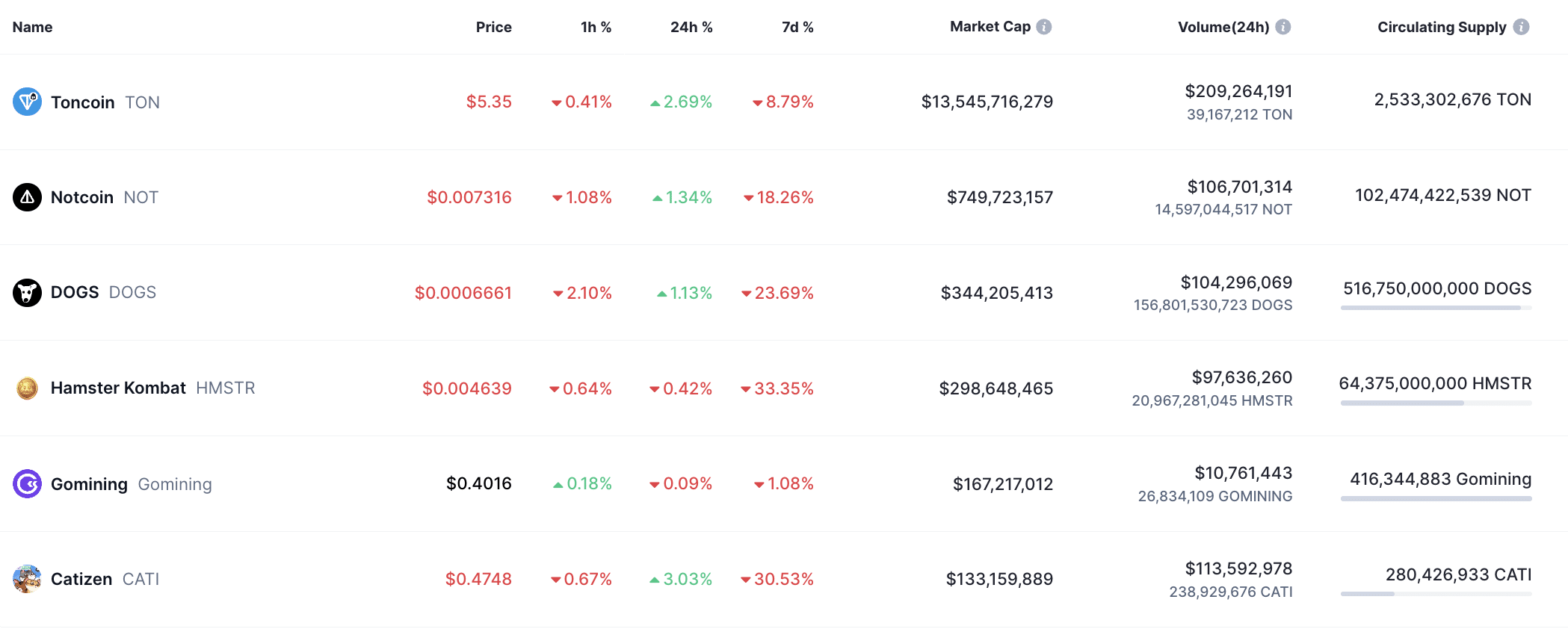

TON ecosystem tokens recently listed on major crypto exchanges have significantly dropped.

Table of Contents

In the TON ecosystem, the tokens with the highest market value have experienced a significant decrease over the last few days. Compared to their all-time high, this decline ranges between 30% and 50%.

To highlight, several cryptocurrencies such as DOGS (Dogs), HMSTR (Hamster Kombat), and CATI (Catizen) have been added to prominent crypto trading platforms. Additionally, the value of Toncoin (TON) has decreased noticeably, falling by over 8% in just a week’s time.

As a researcher, I’m observing a concerning trend within the TON ecosystem: the market capitalization of its tokens is steadily decreasing. In just a short span, trading volumes have dropped by over 27%, landing at approximately $675 million. This downward trend is further supported by the imbalance in buy and sell orders on the Binance crypto exchange, indicating that traders are hastily offloading their once-prized TON tokens.

DOGS plummeted by 58%, but developers have a plan B

Ever since its debut on August 26th, the value of the DOGS token, which makes up 81.5% from the community, has dropped by over 58%, currently standing at $0.0006599. It’s important to mention that there is no vesting period for this token, enabling users to trade their DOGS tokens immediately following the airdrop and subsequently sell them straight after the listing.

In response to the recent drop in DOGS token prices towards the end of September, the DOGS team has planned a token burn event scheduled for the near future. This action is aimed at decreasing the overall supply of DOGS tokens. The number of unused coins to be destroyed from circulation will be decided by a vote among the asset owners.

Hamster Kombat did not live up to expectations after the airdrop

The enthusiasm within the Hamster Kombat community took a downturn following the token distribution. While there was initially a lot of curiosity about the project, the widespread selling of HMSTR tokens caused them to plummet in value over the past week.

Currently, when the token was initially listed, it cost around $0.014 on various platforms. However, heavy selling pressure immediately caused a significant drop in its worth. From the day of its launch on September 26th, the token’s value has decreased by approximately 50%.

It seems the main cause of the decline was likely due to the failed airdrop and listing. Users frequently expressed concerns about the biased distribution of rewards, delayed timelines, rule changes, low initial trading price of HMSTR tokens, and difficulties in selling HMSTR. For many project participants, the reward for tapping the hamster was only a few dollars.

Such users needed help selling tokens since many exchanges restrict opening orders.

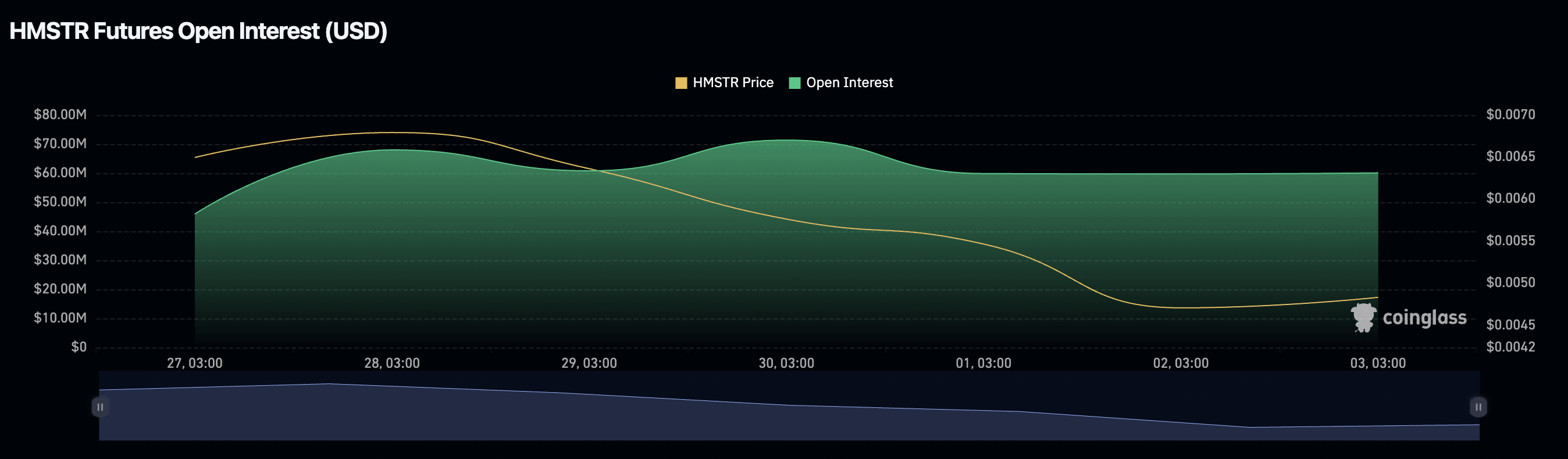

Nevertheless, even as the rate drops swiftly, the open interest in HMSTR Futures stays constant. As per Coinglass, this amount has remained around $60 million since the start of October.

Hamster Kombat mirrored the narrative seen in Catizen, another initiative on Telegram, which left users disillusioned following the airdrop.

An unexpected change in the rules of the game or why they started to dump CATI

In a recent update, CATI disclosed the rankings for the top performers in the decline of tokens within the TON environment. Similar to other comparable projects, the value of their coin has dropped approximately 50% since September 20th.

The rise and fall of Catizen are reminiscent of the path of Hamster Kombat. Shortly before the start of the distribution, the team unexpectedly changed the rules of the game.

Originally, I had envisioned that approximately 43% of the entire CATI token allocation would be earmarked for our valued players. Unexpectedly, though, the developers altered the terms, resulting in the community receiving just 30%.

It wasn’t just the community that felt dissatisfied; there were more issues at hand. Shortly after the token airdrop, it was discovered that the amount of money users spent within the game determined the distribution of tokens. This meant that those who invested financially, rather than time, gained a substantial advantage.

Following this, numerous athletes recounted instances where they clinched top spots but were barely compensated. This sparked a surge of dissatisfaction, with the hashtag #unfairpayments trending across social media platforms.

#CatizenScam #Scamtizen

Top 5 lies Catizen team gave its community

1 Airdrop is on June/July

2 Most impt criteria is vKitty/s or cat level

3 Claimed tokens will be received before Sep 28 10AM UTC.

4 Airdrop is 43%

5 If you can’t hold you won’t be rich (then token dumps)— rajel💢 (@jela7in) September 28, 2024

Why Telegram project tokens continue to fall

Airdrops, a widely-used tactic, often entice users to join a project. Numerous initiatives that debuted on the Telegram platform have employed this method.

Examples like Dogs, Hamster Kombat, Catizen, and others regularly granted users tokens for basic tasks. Consequently, these tokens dispersed via airdrops often fail to sustain long-term engagement or retain their worth over time.

In other words, airdrops, which were initially effective at boosting project participation and dispersing tokens among users, might not hold the same impact they once did due to user fatigue from encountering these tactics too frequently.

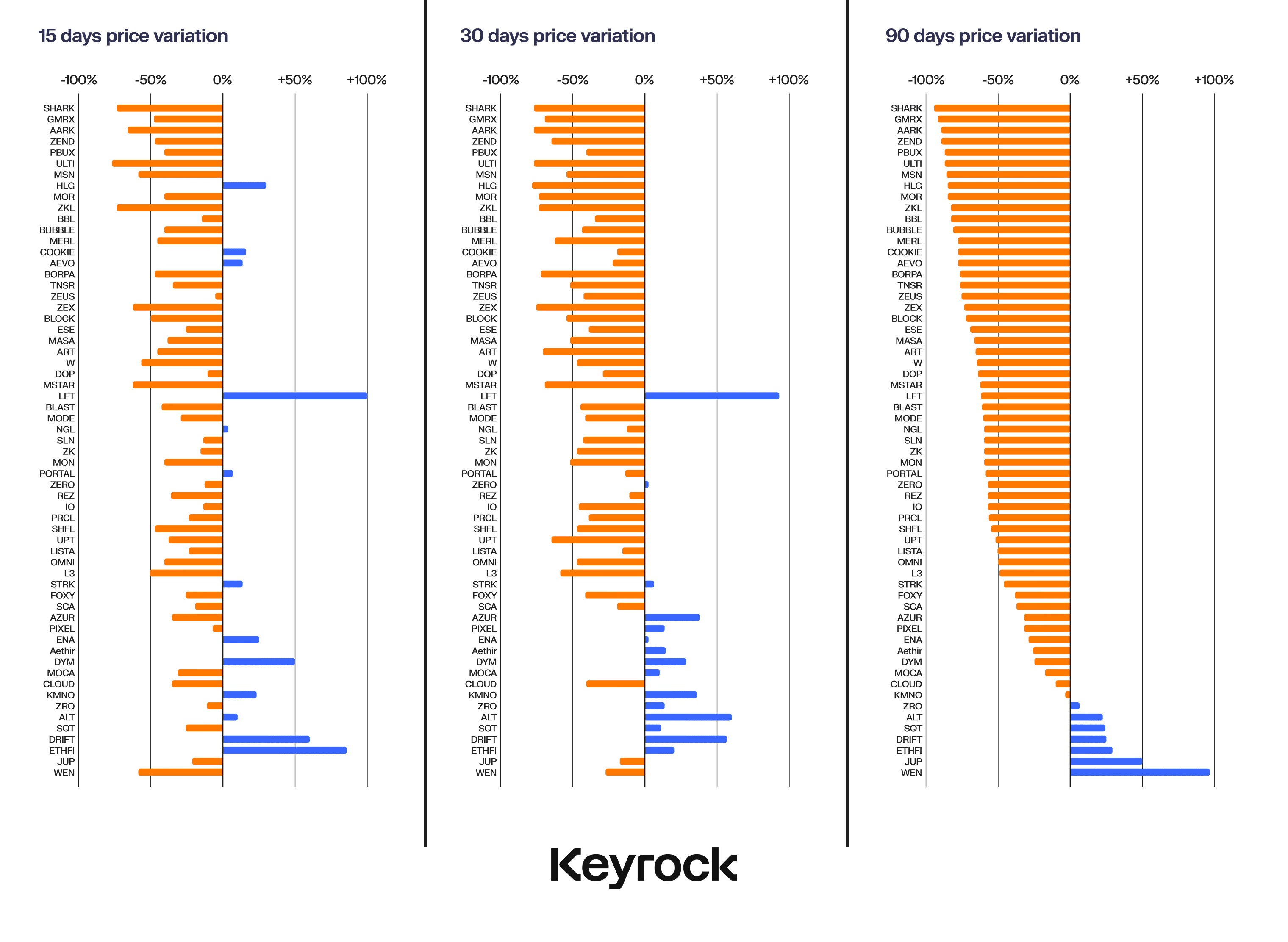

For example, KeyRock experts analyzed 62 airdrops in six blockchains since the beginning of 2024. The data showed that 88.7% of the tokens demonstrated a significant price decline within 90 days after the distribution. Only a few of them showed sustainability.

From my perspective as an analyst, it appears that smaller airdrops have demonstrated remarkable short-term resilience. This could be attributed to the minimal selling pressure experienced during the initial token distribution phase. Yet, when considering the long-term outlook, these tokens have consistently declined over a three-month period.

Additionally, since Telegram gaming is relatively new, it remains uncertain if the interest in these games will endure, causing some investors to hesitate. This uncertainty, in turn, often leads users to offload their tokens, thereby potentially lowering their value.

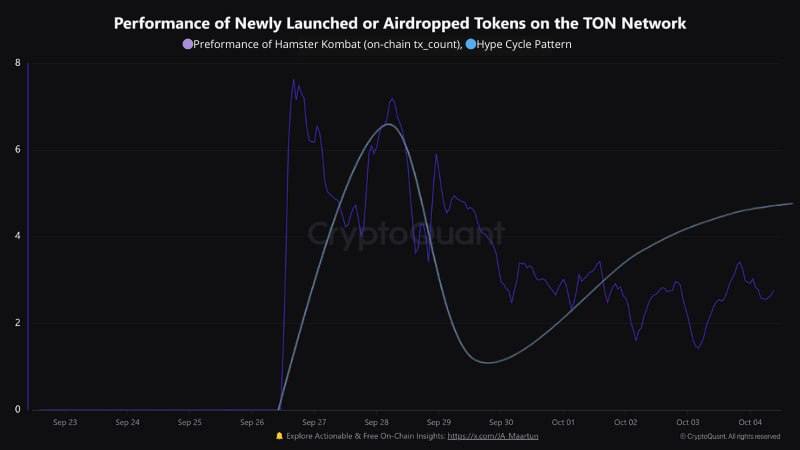

According to Maartunn’s analysis for crypto.news, tokens introduced within the TON system frequently adhere to a standard pattern of excitement or buzz.

At first, it’s common for people to have overly optimistic short-term forecasts, whereas their long-term predictions may fall short.

Maartunn, CryptoQuant analyst

He also visualized the number of Hamster Token transactions relative to all TON transactions. The trend line illustrates the classic hype cycle model.

Among the newer cryptocurrencies on the market, Hamster Kombat has gained significant popularity. Yet, it’s important to note that numerous meme coins might not be sustainable in the long run. Only those backed by solid foundations and robust networks are likely to thrive.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-10-04 20:50