As a seasoned researcher with over two decades of experience in financial markets and cryptocurrencies, I find myself intrigued by the recent developments in Bitcoin exchange-traded funds (ETFs) and their correlation with global macroeconomic events.

This week, United States-based Bitcoin exchange-traded funds experienced withdrawals exceeding $300 million, driven by international economic developments that fueled apprehension about the near-term trend.

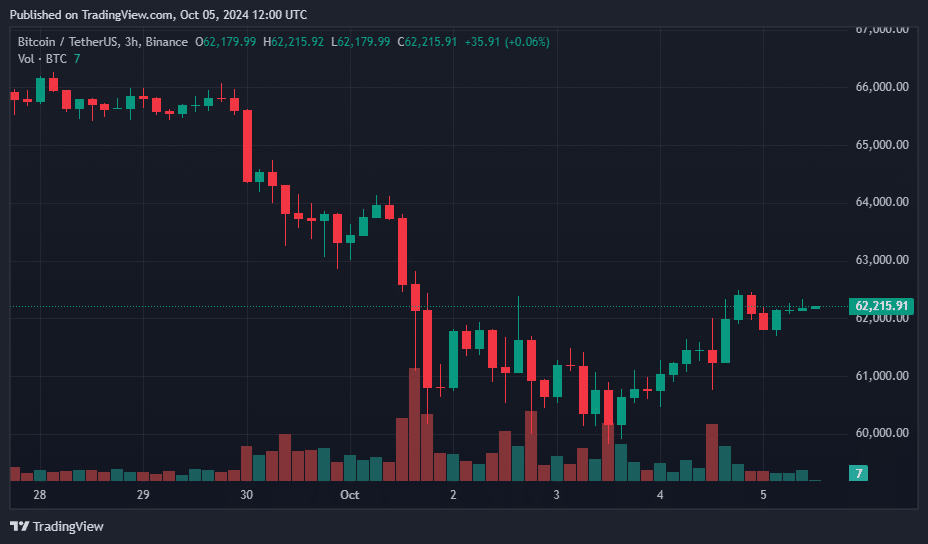

Following the September’s historically bearish close, accumulating approximately $1.1 billion in inflows, around $388.4 million was withdrawn from Bitcoin ETF funds between October 1st and October 3rd. This withdrawal coincided with the escalating Iran-Israel conflict, causing Bitcoin’s price to reach a weekly low of $60,047.

On October 4th, stronger-than-anticipated U.S. employment figures eased market concerns slightly, enabling Bitcoin to regain the $62,000 mark. Meanwhile, ETF investments recorded an inflow of approximately $25.59 million.

However, this recovery wasn’t enough to fully offset the impact of the three-day outflow streak.

For three weeks starting from September 13th, there were continuous deposits totaling approximately $1.91 billion into Bitcoin ETFs. However, this current week saw withdrawals, causing these funds to finish the first week of October with a net loss of around $301.54 million, as reported by SoSoValue data.

Highlighting yesterday’s market activity, Bitwise’s BITB experienced the highest influx of funds, whereas seven out of twelve Bitcoin Exchange-Traded Funds, such as BlackRock’s IBIT, showed no changes.

-

Bitwise’s BITB led with inflows of $15.29 million.

Fidelity’s FBTC, $13.63 million.

ARK and 21Shares’ ARKB saw its first inflow this week, bringing in $5.29 million.

VanEck’s BTCW, $5.29 million.

Grayscale’s GBTC recorded outflows of $13.91.

Analysts point to key levels

In addition to the ETF market, there was also a significant amount of selling pressure originating from Bitcoin miners. As reported by crypto analyst Ali, these miners have disposed of roughly $143 million in Bitcoin (BTC) since September 29.

#Bitcoin miners have sold 2,364 $BTC in the past six days, worth around $143 million! — Ali (@ali_charts) October 4, 2024

According to Ali’s recent post on X, it’s possible that the pace of buying and selling could accelerate due to the fact that the current market price for Bitcoin is lower than the average purchase price for short-term holders, which is now approximately $63,000.

The given price is the typical amount spent by short-term Bitcoin investors. When the market falls beneath this figure, those owners become more likely to sell in order to limit their potential losses, which might lead to a chain reaction of additional sales and increased downward pressure on the market.

In this case, Ali suggested that investors should keep an eye on the $63,000 point as a crucial milestone for Bitcoin’s progress, surpassing which could help prevent any additional losses.

Alternatively, Crypto expert Immortal suggests a more immediate goal of around $64,000. He notes that if Bitcoin surpasses this critical resistance point, it might be an indication of a robust bullish trend commencing.

Looking ahead over an extended period, experts continue to express optimism, referencing Bitcoin’s traditionally strong fourth quarter performance and anticipation of potential U.S. interest rate reductions. This positive outlook suggests that Bitcoin’s price might reach around $72,000 in the long run, notwithstanding any short-term market fluctuations.

As I’m typing this, Bitcoin stood slightly above $62,200, representing a decline of more than 5% over the last seven days.

currently, the market mood seems to be improving as the Fear and Greed Index is moving towards neutral, climbing from 41 to 49, according to information provided by Alternative.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

2024-10-05 18:04