As a seasoned researcher who has witnessed numerous crypto market swings, I must admit that the recent performance of Neiro (NEIRO) is nothing short of intriguing. Having closely monitored the Ichimoku Cloud and RSI indicators for countless tokens, it’s refreshing to see NEIRO break above the cloud and enter overbought territory.

Over the past day, even amidst general market turmoil, Neiro – a meme token built on the Ethereum network – demonstrated robust bullish energy.

In the past 24 hours, NEIRO (NEIRO) has seen a 15% increase, bucking the trend of subpar market performance. This upward movement is a continuation of the significant 36% jump it experienced on October 6, which overshadowed its 9.23% decline from the day before.

On October 7, the positive trend persisted as NEIRO saw a significant surge of 24.51%. This morning, an extra boost of 2.42% has further propelled NEIRO to the leading position in the list of top gainers.

NEIRO experienced a 15.3% increase within the last 24 hours, currently priced at $0.001678 as we speak. The market value of this cryptocurrency now stands at an impressive $714 million, with daily trading volumes amounting to a substantial $1.17 billion.

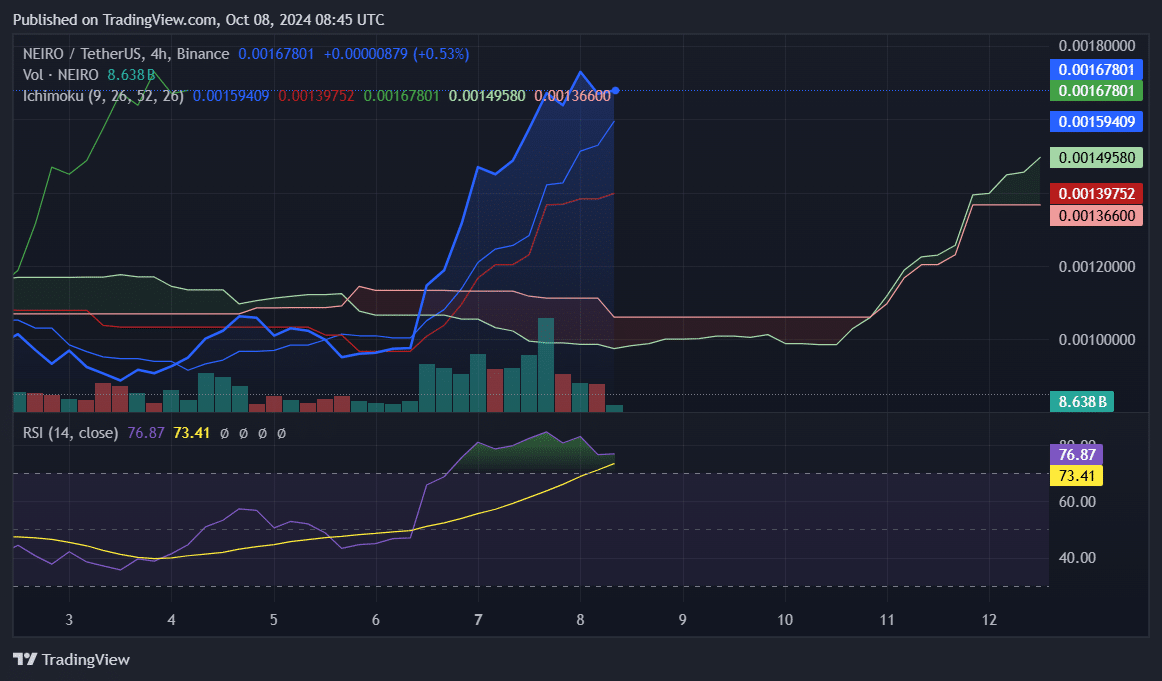

According to the four-hour chart analysis, NEIRO has moved beyond the Ichimoku Cloud, suggesting that its upward trend might persist. Importantly, the Ichimoku Cloud’s supporting lines appear robust as the price surge occurs.

Presently, the Baseline stands at $0.001397, which is significantly lower than NEIRO‘s present value. This indicates that the asset has established a robust support level or higher bottom price.

In the meantime, the key support level at $0.001495 for Leading Span A suggests a strong foundation provided by the cloud. This indicates that there might be more upward momentum if this support remains intact. If the price maintains around these levels without dipping below the cloud, the token could potentially experience even larger increases.

As a researcher, I’m observing that the Relative Strength Index (RSI) for NEIRO currently stands at 77.55, indicating that the token is overbought. This is further supported by the high buying pressure, evident from the Signal Line sitting at 73.46. While this bullish trend suggests continued growth, it also hints at an impending correction as the token may be becoming overextended.

It might be wise for investors to watch for a possible correction, considering the indications of being overbought as shown by the RSI. A dip near the baseline approximately at $0.001397 could offer a chance for investors wanting to reinvest in the market.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-08 13:03