As a seasoned crypto investor with a keen eye for on-chain data and market trends, I find the recent Ethereum (ETH) price action intriguing. The significant increase in large holder inflows suggests that whales are accumulating ETH at these levels, which is usually a bullish sign. However, the simultaneous increase in exchange inflows indicates that some investors are aiming for short-term profits, a trend I’ve seen play out many times before.

As an analyst, I observed a significant accumulation of Ethereum by whale investors when the price soared beyond $2,600, even with a concurrent uptick in exchange inflows. This unusual behavior presents a blend of optimistic and cautious indicators.

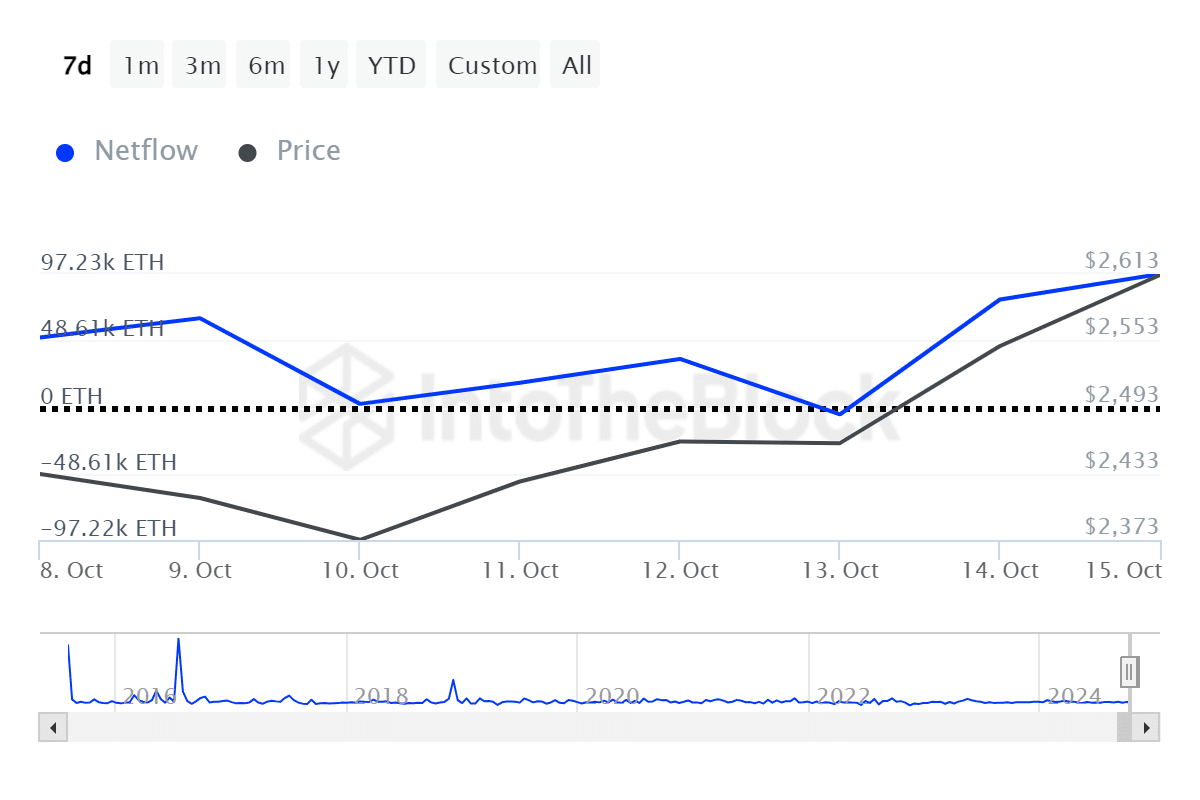

Based on information from IntoTheBlock, the number of Ethereum (ETH) held by large investors increased significantly over the last week, with a net inflow of approximately 97,220 ETH, or around $254 million, being recorded on October 15 at current market prices.

An increase in an asset’s whale net flow shows accumulation and vice versa, per ITB.

Yesterday, the direction of Ethereum exchange net flows reversed from an outflow of 5,700 ETH on October 13th to an inflow of 15,000 ETH. This change suggests that investors are seeking quick gains.

On-chain data shows that ETH registered an exchange net inflow of $8.88 million over the past week.

Given that the price of ETH initially increased from around 2,400 and then went beyond $2,600 after a fortnight of downward compression, this rise can be seen as typical.

As an analyst, I observed a significant drop in profits between 2:00 PM and 3:00 PM UTC on Tuesday, as Ethereum swiftly fell from its local peak of $2,685 to $2,540. In just one hour, the ETH market cap decreased by approximately $16.6 billion.

As a crypto investor, I’m observing that Ethereum (ETH) is currently holding steady above the $2,600 level at this very moment. This significant cryptocurrency boasts a massive market capitalization of around $313 billion, with daily trading volumes amounting to approximately $22 billion.

As a crypto investor, I’ve noticed that Ethereum seems to be missing a robust driver to sustain its bullish trend. The performance of U.S.-based Ethereum exchange-traded funds hasn’t been impressive either. On October 15 alone, these investment products experienced a net outflow of approximately $12.7 million, while Bitcoin ETFs saw a net inflow worth $371 million instead.

According to an article published by Crypto News, Monochrome Asset Management, a company based in Australia, introduced the nation’s initial spot Ethereum Exchange Traded Fund (ETF) on Tuesday. At this time, the fund’s total net asset value stands at approximately $272,908.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-10-16 11:13