As a seasoned crypto investor with over a decade of experience navigating the volatile and rapidly evolving landscape of digital assets, I find myself increasingly intrigued by the ongoing saga between Coinbase and U.S. regulators. The latest move by Coinbase to file two Freedom of Information Act (FOIA) requests against American regulatory bodies is a testament to their relentless pursuit of clarity in an industry that has been shrouded in ambiguity for far too long.

Coinbase has submitted two Freedom of Information Act (FOIA) requests against American regulators.

The cryptocurrency trading platform has requested for the unveiling of papers concerning the legal action taken against crypto businesses by American banks, according to Paul Grewal, Coinbase’s Chief Legal Officer.

“We submitted two additional Freedom of Information Act (FOIA) petitions as part of our ongoing quest for transparency regarding regulatory agencies’ handling of digital assets. In essence, if the government remains stubborn, Coinbase will persist in its pursuit.

The Federal Deposit Insurance Corporation (FDIC) advises banks to cap deposits from cryptocurrency companies at a maximum of 15% of their overall deposits. Meanwhile, Coinbase has submitted another Freedom of Information Act (FOIA) request to uncover how regulatory bodies have addressed similar inquiries.

It appears the FDIC implemented these restrictions without first gathering public feedback, deviating from the typical procedure for U.S. banking regulators. Grewal pointed out that the newly submitted Freedom of Information Act (FOIA) requests have no connection to earlier ones, which are currently embroiled in federal court cases and date back over a year.

They are distinct from the documents we submitted through FOIA, which are currently involved in ongoing federal lawsuits.

In the United States, the Freedom of Information Act (FOIA) grants the ability to ask for access to documents and data kept by federal authorities. This encompasses government files concerning financial dealings as well as rules governing cryptocurrencies.

What is known about the Coinbase lawsuit string

For several years now, Coinbase has been urging the U.S. Securities and Exchange Commission (SEC) to establish clear guidelines for the industry. In July 2022, they submitted a request to the Commission for such rules. By April 2023, the company took the matter to court.

According to Gary Gensler, chairman of the SEC, the arguments put forward by Coinbase are not valid. He maintains that the current regulations are applicable to the crypto industry. Previously, in March, Coinbase requested the appellate court to persuade the regulator to establish specific rules for the sector.

In June 2023, the Securities and Exchange Commission accused Coinbase of breaking securities laws by offering staking on Ethereum (ETH). To clarify whether Ethereum is considered a security or a commodity by the regulatory body, Coinbase asked for relevant documents.

It is claimed that Coinbase, though under the jurisdiction of securities regulations, has allegedly combined and illegally performed trading, brokerage, dealing, and settlement services.

Gary Gensler, SEC Chair

After this matter, Coinbase took legal action against both the Securities and Exchange Commission (SEC) and the Federal Deposit Insurance Corporation (FDIC), as they declined to provide clarity on the regulation of the cryptocurrency industry.

Regulatory bodies have employed various strategies in an attempt to restrict the growth of the digital asset sector. The Securities and Exchange Commission (SECGov) asserts broad power, yet fails to offer any guidelines, let alone clear or logical ones. Meanwhile, the FDICgov has been putting pressure on financial institutions to reduce their involvement…

— paulgrewal.eth (@iampaulgrewal) June 27, 2024

The business submitted a Freedom of Information Act (FOIA) application to the relevant authorities, primarily seeking documents related to the Ethereum 2.0 probe and the concluded SEC matters involving Enigma MPC and Ether Delta.

Nevertheless, Coinbase found its efforts unavailing, leading them to petition for a judicial review to reverse the SEC’s ruling. The plea contended that the regulatory body is lacking in providing clear directives, thereby making adherence to the existing U.S. laws challenging.

Eugene Scalia, a lawyer for Coinbase, worried that the SEC’s lack of clarity in its conduct left the exchange “without a clear path to compliance”.

“I leave this court understanding the SEC’s views on this topic even less than when I entered.”

Eugene Scalia, Coinbase’s lawyer

The panel agreed that the Securities and Exchange Commission (SEC) has the ability to prioritize its rule-making, but expressed doubts about why cryptocurrency regulation hasn’t been given more focus. This case is connected to a larger conflict between the SEC and the cryptocurrency sector, as the regulatory body continues to argue that most crypto tokens should be classified as securities under their jurisdiction.

Crypto firms like Coinbase are contesting this stance, suggesting that the digital currency field is currently unclear from a legal perspective and advocating for fresh laws to govern these electronic monies.

Crypto’s growing influence in the U.S.

In my role as a dedicated researcher exploring the realm of cryptocurrency, I’ve taken an active part in Coinbase’s latest endeavor, titled “Stand With Crypto.” This initiative encompasses the establishment of a Political Action Committee (PAC), marking our commitment to advocating for improved regulatory frameworks that foster growth and security within our industry.

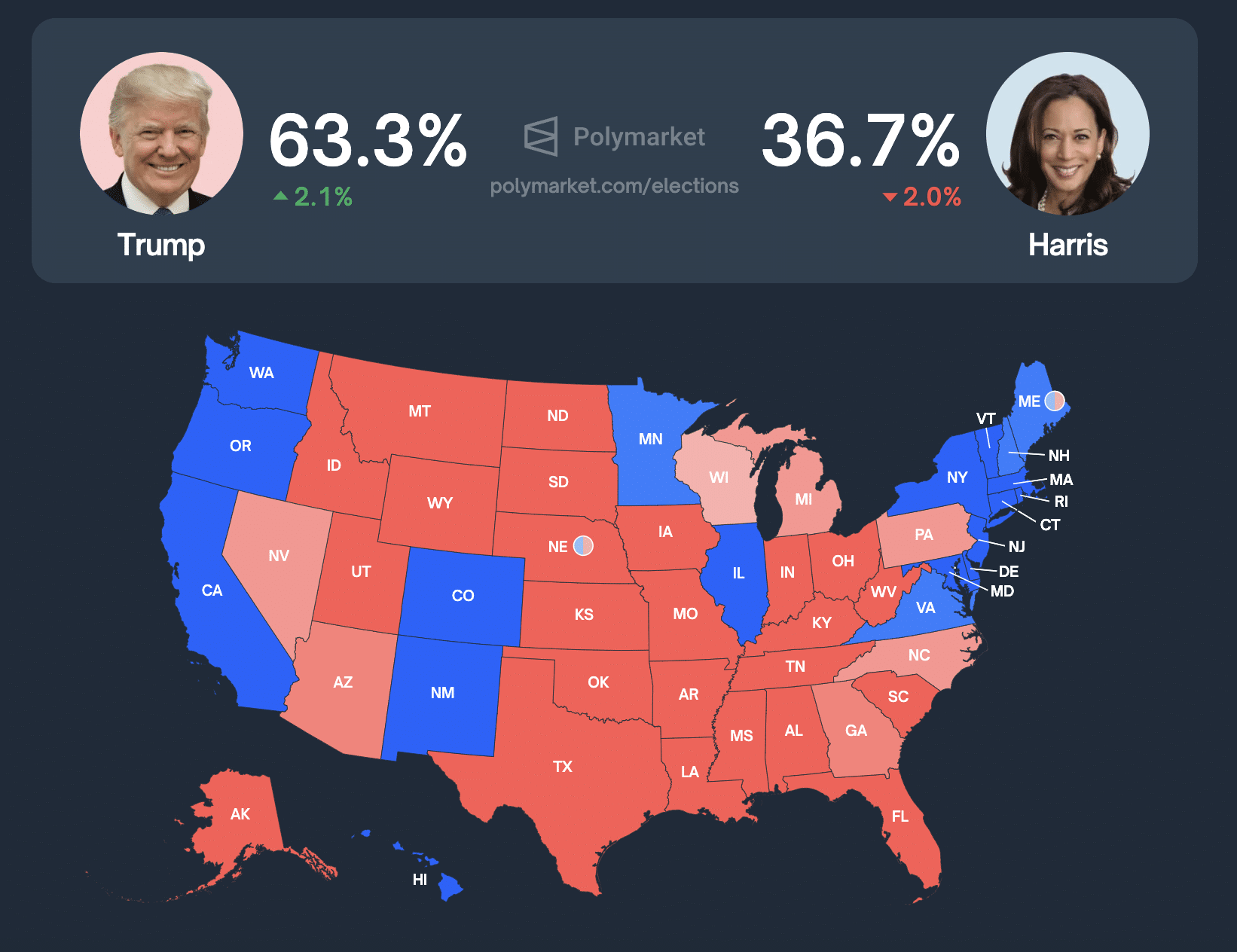

In November, the U.S. elections will feature a clash between Republican candidate Donald Trump, who aims to revitalize cryptocurrency, and Democratic candidate Kamala Harris, whose stance on digital currencies is more positive than President Joe Biden’s, yet less progressive than Trump’s. Crypto advocates view this election as potentially pivotal for the industry, and they are prepared to provide financial backing to their chosen candidates.

In this current election cycle, as reported by CNBC, cryptocurrency companies account for approximately half of all corporate contributions. The total amount of cryptocurrency donations towards the U.S. presidential election has surpassed close to $200 million.

Crypto expert James Delmore underscores the fact that California continues to be a hub for the cryptocurrency sector due to an abundance of blockchain businesses. He also highlights the importance of the political climate in the state for shaping future laws and regulations in this domain.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

2024-10-22 20:17