As a seasoned analyst with over a decade of experience in the volatile world of financial markets, I have seen my fair share of market turbulence and recovery cycles. The recent crypto market dip, followed by a stabilization, is a classic example of the rollercoaster ride that is cryptocurrency trading.

After a significant drop on October 22nd, the digital currency market appears to be recovering and cooling down, as indicated by the decrease in liquidation activity.

Based on figures from CoinGecko, the worldwide cryptocurrency market experienced a drop in value of approximately $57 billion yesterday, resulting in a total market cap of around $2.44 trillion. This decrease occurred after the market had reached a three-month peak of $2.498 trillion the day prior.

The global market cap faced a 2.5% decline in the past 24 hours again, wiping another $7 billion.

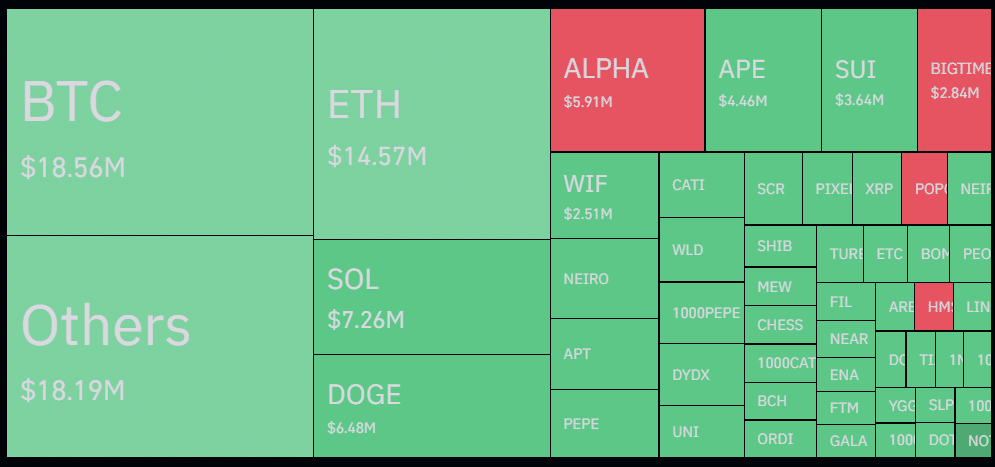

Over the last 24 hours, as the selloff on Tuesday appears to be subsiding, crypto liquidations have dropped by around 40%, amounting to approximately $121 million, according to data from Coinglass. Given the broader market downturn, it’s worth noting that about 75% of these liquidations, equivalent to around $91 million, were long positions.

Currently, Bitcoin (BTC) dominates with approximately $18.5 million in liquidations – including $11 million long positions and $7.5 million short positions – as its price dipped below the $67,000 threshold. At the moment of writing this, BTC is trading at $66,800, representing a one-week low.

The majority of Ethereum (ETH) liquidations, amounting to around 77%, were from long positions, indicating a high long-short ratio. Yet, ETH remains above the significant level of $2,600, defying the bearish outlook surrounding it.

On Binance, the leading cryptocurrency exchange by trade volume, the biggest liquidation order for about 690,000 dollars in the SOL/USDT pair was executed.

Based on a report from crypto.news, exchange-traded funds (ETFs) that deal with buying Bitcoin spot markets in the U.S. experienced their initial day of withdrawals as the overall market feeling turned negative. These investment products collectively saw a net withdrawal of approximately $79.1 million, primarily driven by Ark and 21Share’s ARKB fund, which withdrew a significant amount of $134.7 million.

ETH ETFs, on the other hand, witnessed a net inflow of $11.9 million amid market uncertainty.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-10-23 12:14