As a seasoned analyst with over two decades of experience in the financial markets, I find myself intrigued by the current state of Near Protocol (NEAR) and its token. The bear market has taken its toll on NEAR, but I can’t help but feel optimistic about Michael van de Poppe’s prediction of a potential 225% increase from the current level.

The Near Protocol token continues to be affected by a significant downtrend in the market, having dropped approximately 50% from its peak value this year.

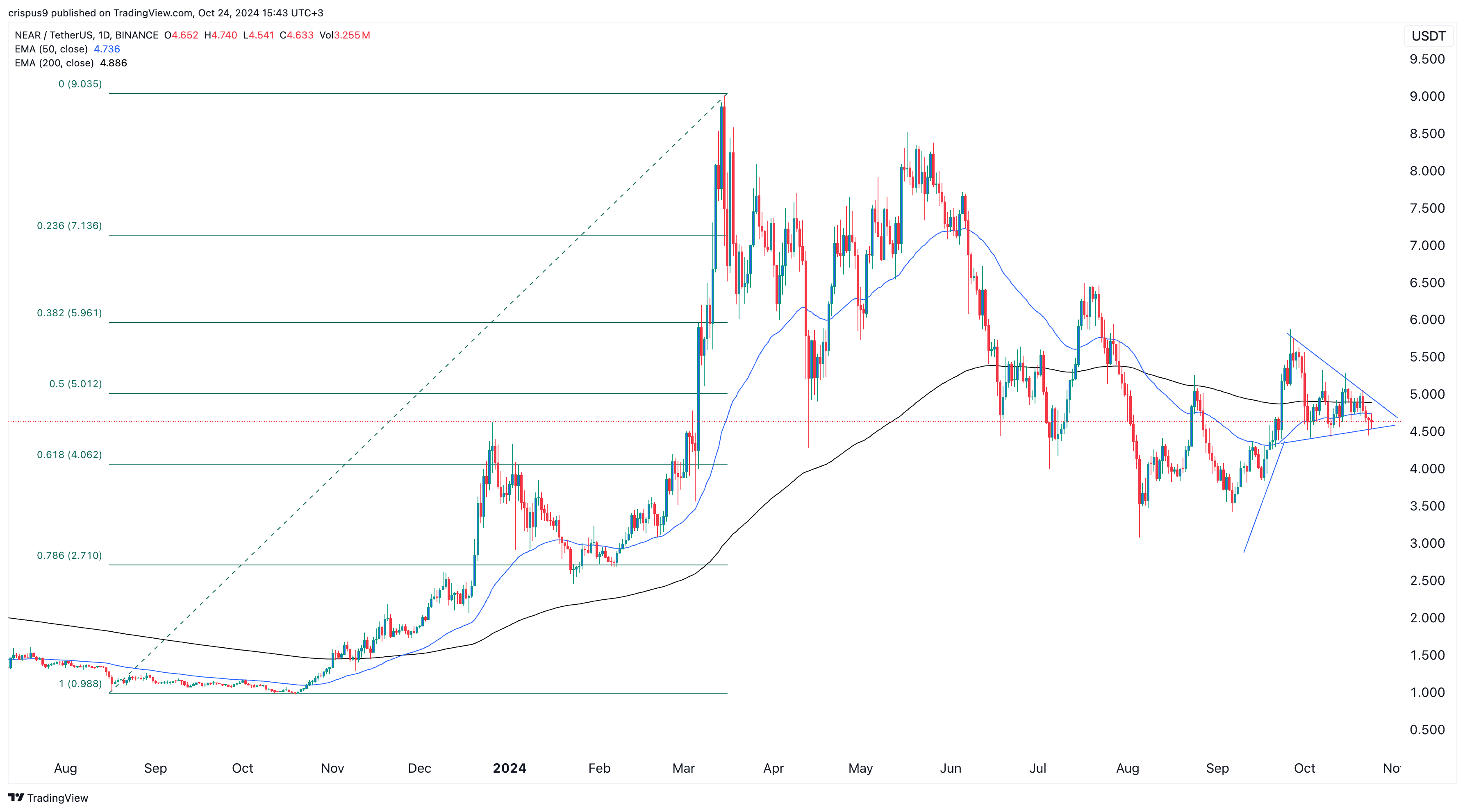

On October 24th, the price of NEAR stood at approximately $4.62, with Bitcoin (BTC) and many other altcoins experiencing a general downtrend.

Nonetheless, well-known crypto analyst Michael van de Poppe, boasting over 700,000 followers on X, anticipates a rebound soon, with potential movement within $10 and $15. If it reaches the upper limit of his forecast, this would equate to a significant 225% surge from its current price point.

The markets are preparing for a significant surge higher, with $NEAR serving as a noteworthy illustration. After testing its former consolidation zone, it has begun a gradual upward climb. The upcoming goal in this upward trend could be between $10 and $15.

— Michaël van de Poppe (@CryptoMichNL) October 24, 2024

This year, the Near Protocol, a blockchain network employing sharding technology for faster performance, has faced challenges and hasn’t kept pace with some of the more recently developed networks in terms of performance.

As a researcher delving into the realm of Decentralized Finance (DeFi), I’ve been monitoring the total value locked within this dynamic industry. According to DeFi Llama’s latest data, the current figure stands at approximately $231 million—a decrease from the year-to-date peak of $323 million. The dominant players in this ecosystem are Burrow, LiNEAR Protocol, Meta Pool Near, and Ref Finance.

Compared to newer layer-1 and layer-2 networks like Base Blockchain, Sui, and Arbitrum, Near’s TVL (Total Value Locked) is noticeably smaller. For instance, Base Blockchain, introduced in 2023 by Coinbase, has already amassed approximately $2.43 billion in assets. In a similar vein, Sui has garnered around $1.01 billion, while Arbitrum holds close to $2.34 billion.

In the realm of Decentralized Exchanges (DEX), Near Protocol currently holds a modest market share when compared to platforms such as Mint, Injective, and Blast. The DEX networks within its ecosystem processed transactions amounting to $26.3 million, indicating a relatively smaller scale.

The strong showing of this performance can be attributed in part to the absence of a meme coin ecosystem in Near Protocol, allowing Solana (SOL) to rise and take the position as the most significant DEX blockchain this year.

Positively, Near consistently processes a large volume of transactions weekly. Recent data from Dune Analytics indicates that over the past seven days, it handled approximately 49.2 million transactions. Moreover, the number of active addresses increased by around 11% to about 11.55 million during this same period.

Near token is nearing a key level

The daily graph indicates that the Near Protocol token has been stable in the past few days, forming a symmetrical triangle shape that’s about to merge. This triangle was developed during an upward trend, suggesting it could be interpreted as a bullish flag pattern on a chart. A flag is a commonly used continuation indicator.

NEAR could potentially experience further price increases due to it forming an upside-favoring inverted head and shoulders pattern. For this growth to materialize, NEAR should surpass two key levels: the 50% Fibonacci retracement level at approximately $5.012 and the 200-day moving average situated around $4.88.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-10-24 16:08