As a seasoned researcher with over two decades of experience in financial markets, I have witnessed countless cycles and trends that have shaped the world of finance. The current bullish trend of Bitcoin is undoubtedly one for the books, and while ETFs play a significant role, they are not the sole drivers of this momentum.

According to Ryan Lee, who serves as the head analyst at Bitget Research, it’s clear that Bitcoin exchange-traded funds significantly boost demand for Bitcoin, but there are several elements fueling its ongoing growth.

Beginning from January 2024, the introduction of Bitcoin (BTC) ETFs for trading in the U.S., has led to a significant surge in investments. These financial products have amassed a total of approximately $24 billion, with an impressive $5.4 billion flowing into them during October alone.

Nevertheless, Lee explained to Crypto.news that Exchange Traded Funds (ETFs) alone do not account for Bitcoin’s uptrend, as the cryptocurrency reached a new high at around $73,000 during a remarkable recovery period.

Political and technical factors fueling bullish sentiment

Lee emphasized that the approaching U.S. presidential election could serve as a trigger for Bitcoin’s price increase. It is worth noting that both main contenders, Donald Trump and Kamala Harris, have expressed their backing towards establishing more transparent regulations for digital currencies.

Despite Trump’s proactive attitude, Lee anticipates a more cooperative posture towards the industry from whoever wins the election. This additional reassurance has bolstered investor trust in Bitcoin.

As the election approaches, there’s a growing expectation that the upcoming administration, be it Trump’s or Harris’, could potentially take a more favorable approach towards the cryptocurrency market.

Lee added.

The main analyst from Bitget Research emphasized some technical aspects. Specifically, he pointed out a recent “golden cross” phenomenon, where Bitcoin’s 50-day moving average surpassed its 200-day moving average on October 27th. This occurrence typically indicates a bullish market direction.

Upcoming economic indicators to impact the market

Moving ahead, Lee suggested that various forthcoming economic occurrences might influence Bitcoin’s market trend until November.

He stressed that the Federal Reserve’s interest rate decision on Nov. 7 could lead to a 25-basis-point cut, potentially increasing market liquidity and benefiting crypto assets.

At present, both the U.S. Dollar Index and Treasury rates are increasing, yet if there were a reduction in interest rates, it could enhance total economic fluidity, which might stimulate cryptocurrency assets.

Lee says.

In simple terms, the open interest for Bitcoin on the CME has hit a record level, indicating strong demand for Bitcoin from the futures market. Moreover, he pointed out that consistent investments in Bitcoin ETFs might further bolster its price.

Lastly, a potential BTC acquisition by Microsoft remains on the horizon. Lee expects that if Microsoft’s board approves the purchase, it would mark a landmark event in Bitcoin’s adoption and add substantial institutional interest.

Based on the diverse elements involved, Lee anticipates that Bitcoin’s price might oscillate around the range of $66,000 to $75,000 in November. However, he cautions that the market’s instability may persist at a considerable level.

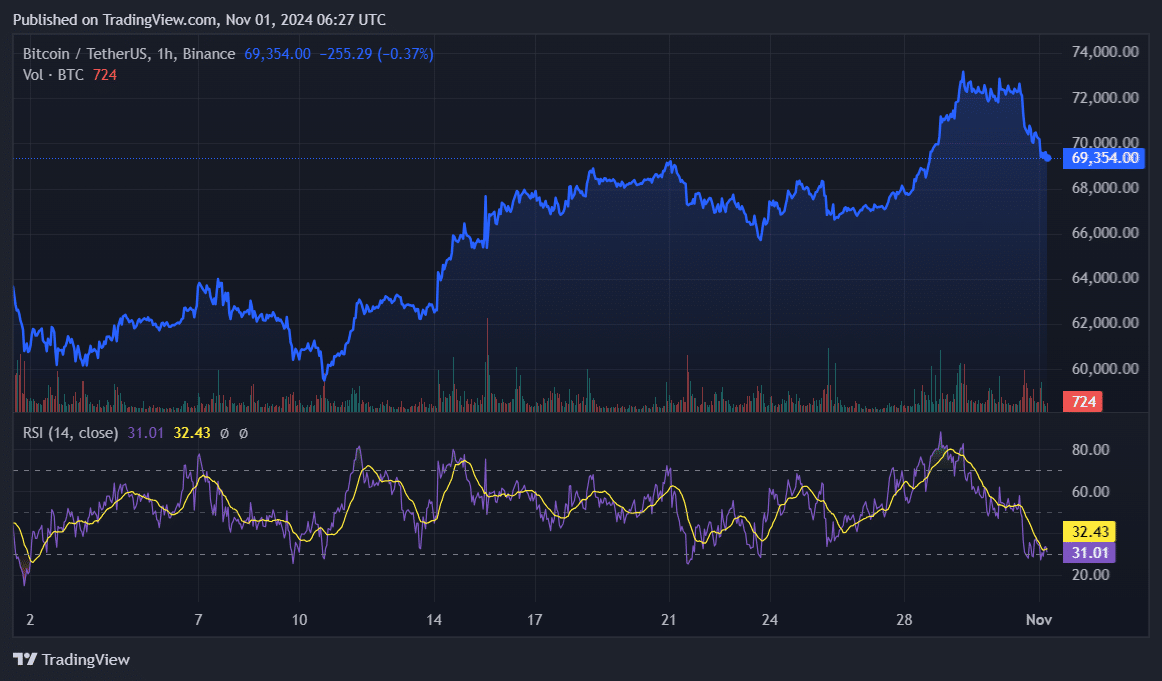

In simple terms, the value of Bitcoin dropped by approximately 4% over the past day and currently stands at around $69,350. At present, its total market value has fallen under the $1.4 trillion threshold, while its daily transaction volume amounts to roughly $45 billion.

One possible explanation for the recent drop in Bitcoin’s price might be due to its significant increases over the last week, causing it to move into an overbought state. At present, the Bitcoin Relative Strength Index is around 32, which indicates that the leading cryptocurrency could soon enter the oversold territory.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Gold Rate Forecast

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-11-01 10:21