As a seasoned researcher who has witnessed numerous market cycles, I can confidently say that this week promises to be an exciting ride for crypto enthusiasts. The rollercoaster we experienced last week with Bitcoin retesting its all-time high and EIGEN sliding 17%, among others, is a clear indication of the unpredictable nature of the crypto market.

Over the course of the week, the market exhibited a turbulent pattern reminiscent of a rollercoaster, reaching a three-month high of $2.5 trillion in global crypto market capitalization midweek, only to return to $2.38 trillion by the end of the week.

Bitcoin (BTC) initiated an upward trend, climbing to challenge its previous record high in March 2024, reaching approximately $73,000. However, it subsequently experienced a significant pullback following this surge.

This week, keep an eye on some notable cryptocurrencies that have shown significant price movement:

BTC retests ATH

Bitcoin’s start to the week coincided with a bullish momentum that began on Oct. 26. By Monday, the asset had recorded three consecutive intraday gains, knocking at the $70,000 region.

On October 29th, an impressive upward trend carried Bitcoin past the barrier of $71,000 and onward to break through the challenging $73,000 threshold, marking a seven-month high. This significant milestone enabled Bitcoin to reevaluate its all-time high (ATH) achieved in March.

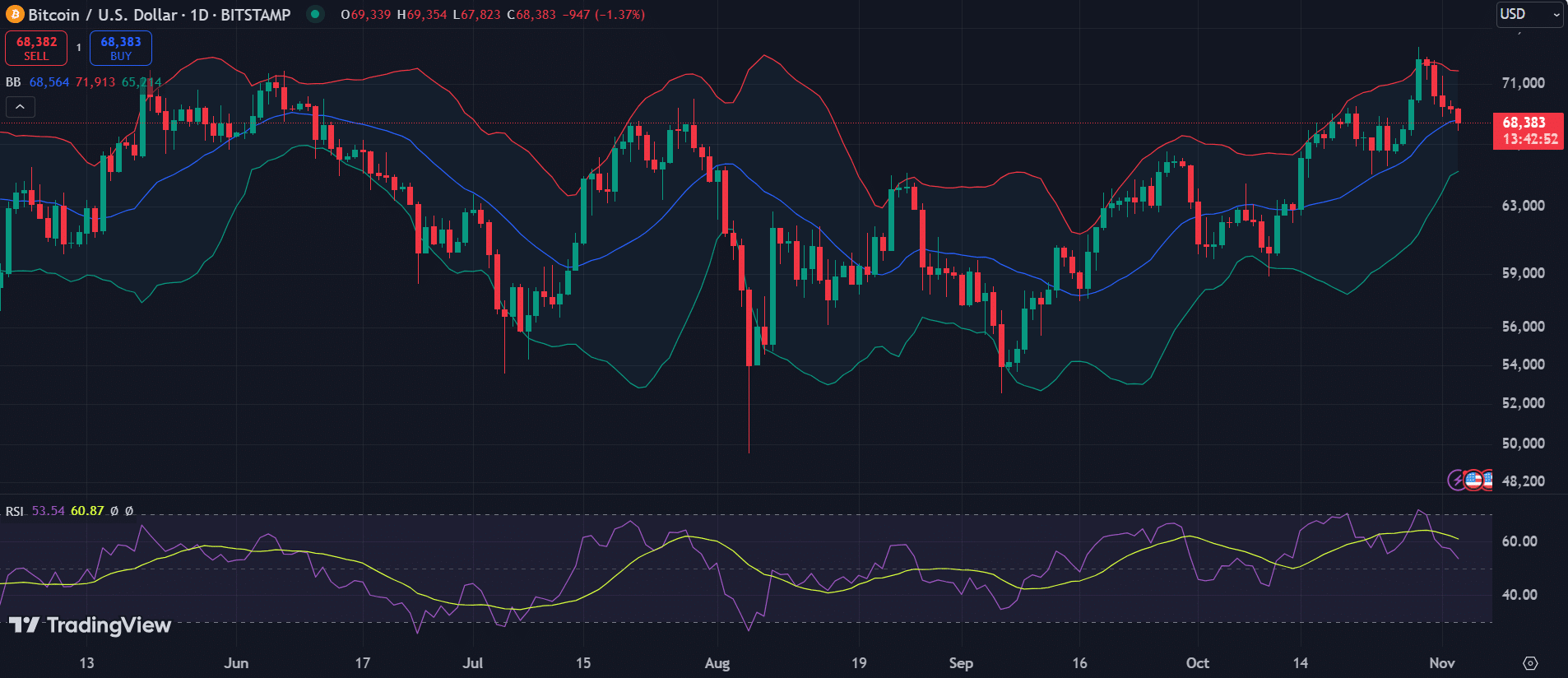

Initially, there was an upward spike in Bitcoin’s price, but this increase was followed by a significant correction. As a result, Bitcoin’s price trended negatively over the next four days. Now, the 20-day moving average at $68,564 is serving as a protective barrier against any potential further drops.

If the 20-day moving average (MA) provides weak support, Bitcoin might have to sustain itself above the lower Bollinger Band currently at $65,214 during the upcoming US presidential election this week. But if it manages to bounce back above $71,913, it could empower the bulls once more, potentially allowing them to reach a new all-time high (ATH).

EIGEN slides 17%

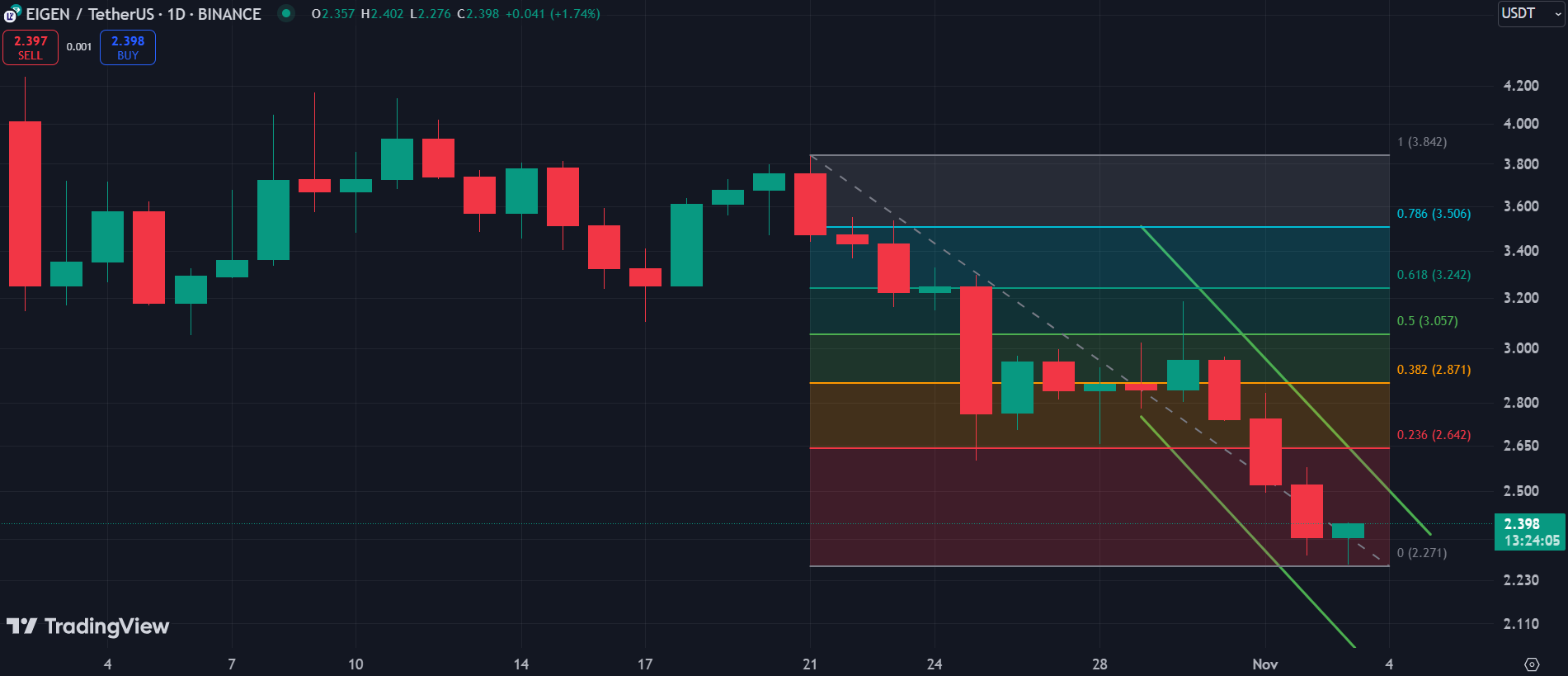

Although most markets experienced modest growth during the previous week, EigenLayer’s native token (EIGEN) ended up losing 17% over the same period following an initial increase.

EIGEN has been making efforts to regain its initial high of $4 since it was first listed on October 1. The asset had climbed as high as $4.90 on Binance, but subsequently corrected. Since then, it’s been in a phase of consolidation, with the past week adding more downward pressure.

In my analysis as an analyst, I’ve observed that EIGEN experienced significant drops over a three-day span mid-week, forming a downward trend channel in its price action. To reverse this trend and regain momentum, it is crucial for EigenLayer to surpass the 23.6% Fibonacci retracement level at $2.642 by the end of this week.

KAS faces uncertainty

Last week, the price trajectory of Kaspa (KAS) navigated through market turbulence, deviating from the overall trend in the broader market. Despite some positive movements near the end of the week, Kaspa ended up with a 4.4% decrease in its closing value.

Throughout last week, the value of this token underwent ups and downs, but it never surpassed the key level of $0.2592. This pattern suggests a dominant bearish trend, as the -DI (negative directional indicator) with a reading of 31.1 significantly outperformed the +DI (positive directional indicator) at 13.3.

To propel KAS forward this week, it needs to surpass a key resistance point and reclaim the peak price from late October at $0.1311.

If Kaspa manages to go beyond its current level, it will encounter significant resistance around $0.1492 for the first time. This area could act as a launchpad for Kaspa to regain the psychological milestones of $0.15 and $0.16. A second notable barrier lies at $0.1636.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-03 15:46