As a seasoned researcher with a decade of experience in the ever-evolving crypto market, I find myself cautiously optimistic amidst the current volatility. The surge in liquidations and the entry of major players like Bitcoin and Ethereum into the overbought zone is reminiscent of a rollercoaster ride that we’ve all grown accustomed to.

As a crypto investor, I’m navigating through a turbulent market right now, where sudden liquidations are becoming more frequent. Currently, both Bitcoin and Ethereum seem to be overbought, meaning they’ve been bought more than usual or rapidly in a short period of time. This could potentially lead to price corrections or even a bearish trend if the selling pressure increases. It’s essential to keep a close eye on market movements and adjust strategies accordingly.

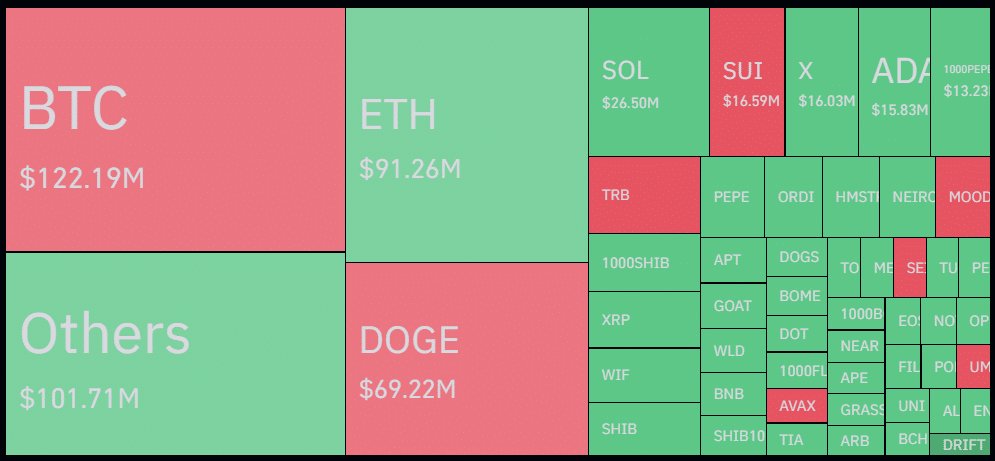

Based on information from Coinglass, the overall crypto liquidations surged by approximately 70% within the last 24 hours, amounting to a staggering $650 million. This includes $366 million in long positions and $284 million in short positions.

In simpler terms, only some cryptocurrencies like Bitcoin experienced increased short selling (short liquidations), while most others have been experiencing extended buying (long liquidations). This could indicate a possible market-wide cooling off period, as the crypto market appears to be heating up too much due to its high volatility.

Approximately $122.1 million worth of Bitcoin positions were closed out, including $37.5 million long positions and $84.6 million short positions, according to data from Coinglass. This significant liquidation was primarily triggered by Bitcoin reaching a new record high of $81,858 and boasting a market capitalization of over $1.6 trillion today.

Contrastingly, Ethereum (ETH) recorded approximately $91.2 million in liquidations during the last 24 hours – $56.7 million for long positions and $34.5 million for short positions, as reported by Coinglass. This top altcoin has initiated a descending trend following its three-month peak at $3,241.

As a researcher delving into cryptocurrency transactions, I’ve noticed that approximately 59% of the total liquidations amounting to about $262 million occurred on Binance, the premier platform by trading volume in the crypto sphere. These liquidations primarily involved long positions.

According to Coinglass, the cumulative crypto open interest has increased by 1.13% within the last day, now standing at approximately $91.9 billion. Moreover, the global cryptocurrency market capitalization hit a three-year peak of $2.9 trillion, with a trading volume surpassing $300 billion.

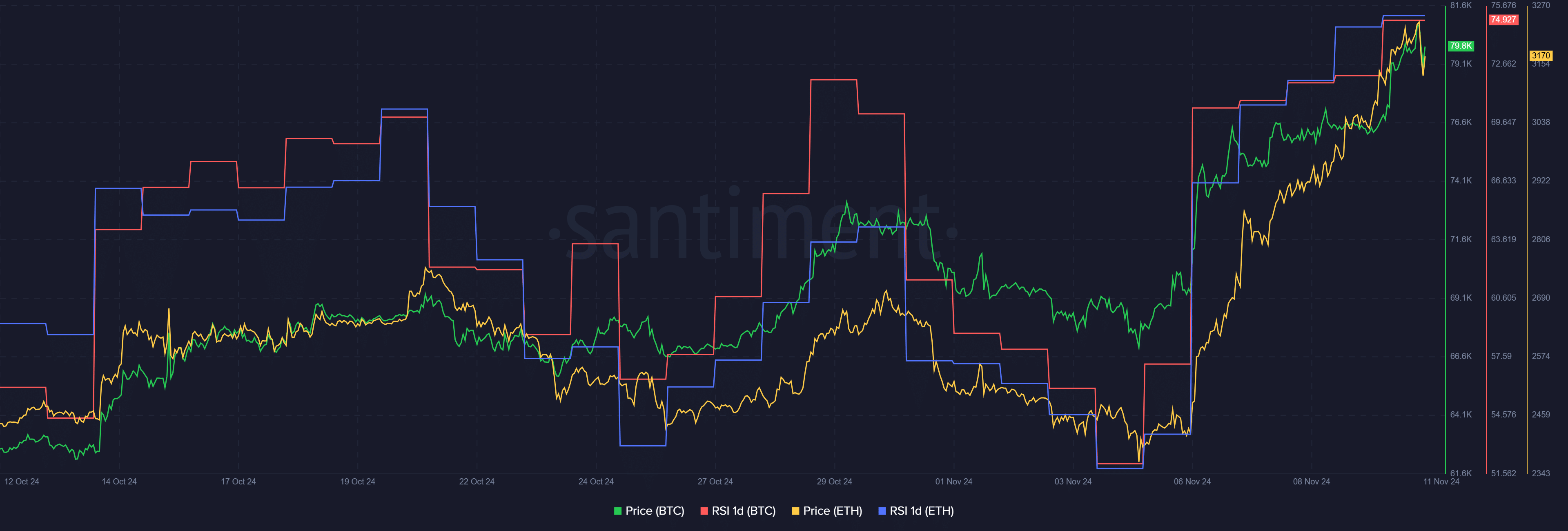

Bitcoin, Ethereum RSIs rising

Reaching $80,000, Bitcoin entered the overbought territory with a Relative Strength Index (RSI) at 75. Such high readings often occur following a swift price increase, which could signal an increased likelihood of temporary selling by investors seeking short-term profits.

As a researcher observing the cryptocurrency market, I’ve noticed an intriguing parallel between Ethereum’s recent progress and its previous instances: when the price breached the $3,200 mark, it echoed past movements. Currently, the Relative Strength Index (RSI) of ETH stands at 74, indicating a strong bullish momentum.

In simple terms over the last day, the most significant digital currency other than Bitcoin dropped by 1%, currently valued at approximately $3,150. A significant factor contributing to this could be the initiation of lengthy sales due to positions being closed out.

In simpler terms, there might be significant price fluctuations ahead as we approach the next big move, because of rising investor participation, increased demand for settlements, and a higher number of trades being made.

As a crypto investor, I find myself in agreement with Cameron Winklevoss, Gemini’s co-founder, who suggests that the current bull run may not have been primarily fueled by retail investors. Conversely, Ki Young Ju, CEO of CryptoQuant, warns that the futures market might be showing signs of overheating, which could potentially indicate a bearish trend in 2025.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-11 12:32