As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market rallies and corrections. However, the recent surge in Dogecoin (DOGE) has caught my attention due to its sheer magnitude and speed.

Over a span of merely three days, Dogecoin has surged more than 50%, indicating a strong upward trend. However, it seems this meme coin’s price surge may continue further, as analysis based on various factors like on-chain and technical data, and derivatives market information suggests that Dogecoin could potentially reach its October 2021 high once again.

Table of Contents

Dogecoin hits three-year peak, gears for 18% gains

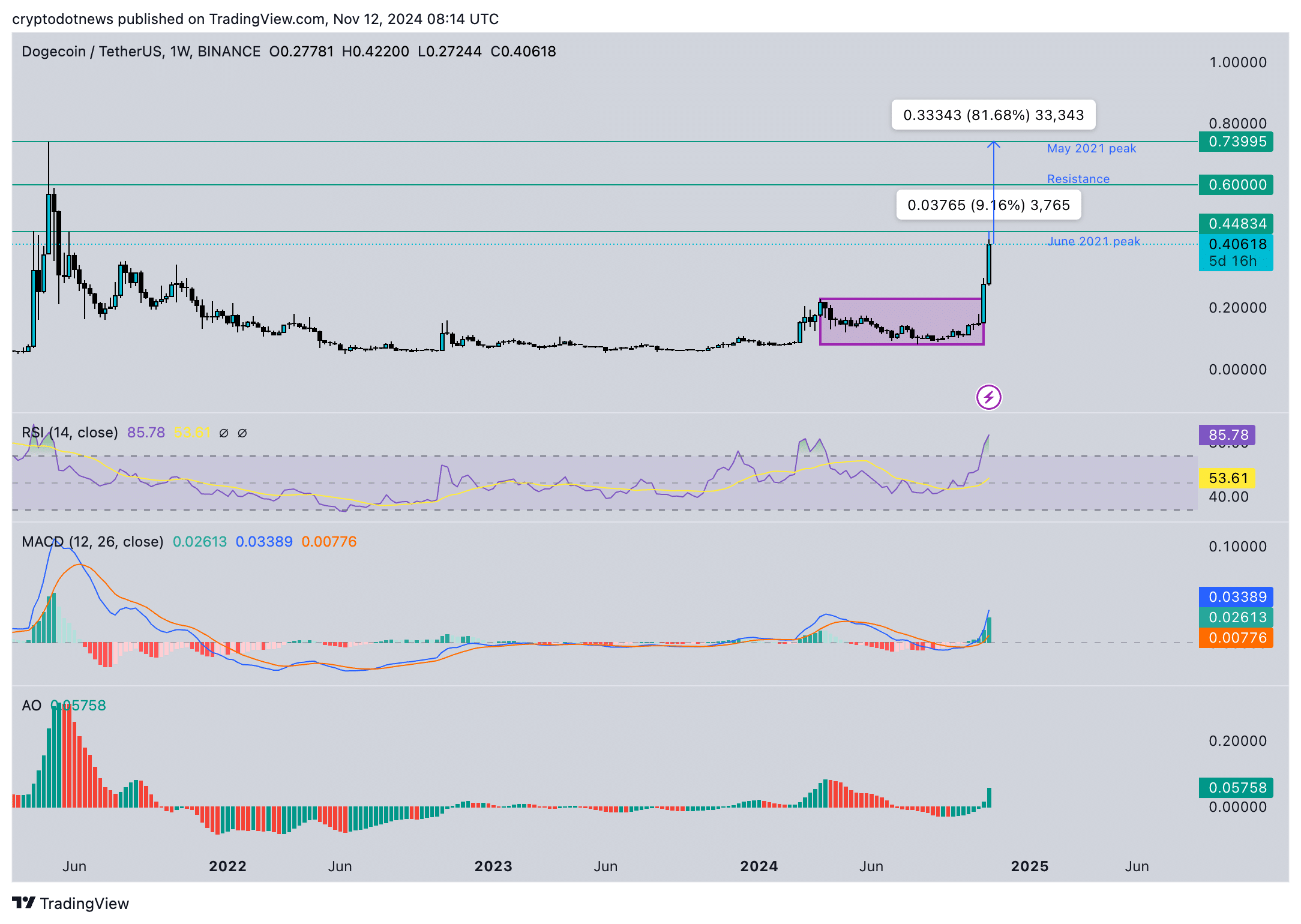

As an analyst, I’ve observed an impressive surge in Dogecoin (DOGE), reaching a peak of $0.42200 on November 12 – a level not seen in almost three years. Given the technical analysis, it appears that the meme coin is poised for additional growth, with the uptrend showing signs of persistence.

DOGE consecutively formed higher highs and higher lows since October 3.

The Moving Average Convergence/Divergence (MACD) indicator is a tool commonly used by traders to determine whether a cryptocurrency like Dogecoin has strong upward or downward movement. It helps identify potential overbought or oversold conditions and predict future trend changes based on this momentum analysis. When the MACD shows consistently tall green bars above the neutral line, it indicates that Dogecoin’s price may have positive underlying momentum.

The awesome oscillator is typically considered a “lagging” indicator, but it helps confirm trends and predict an upcoming impulse or movement in the token’s price. The AO on Dogecoin’s daily price chart shows that DOGE’s trend confirms the uptrend.

Dogecoin surpassed its previous high from October 2021 of $0.340000, and managed to break through the resistance level set by its August 2021 peak at $0.351700.

In June 2021, the highest point at $0.448340 serves as a significant barrier for further price increase, sitting about 9% higher than the current market value. If DOGE manages to surpass this level, the aim would be to reach the May 2021 peak of $0.739950, which represents an approximately 80% rise over $0.410940.

Based on the Relative Strength Index (RSI), there’s been a sell signal triggered on the daily price chart, with the RSI currently at 92. This suggests that Dogecoin might be “overvalued” and a potential correction could happen for this meme coin. Therefore, it’s crucial for traders to keep a close eye on this indicator when considering a long position in DOGE.

The weekly price chart confirms the trend and shows DOGE has slipped out of the range bound price action between the upper boundary of $0.228880 and lower boundary of $0.08050. The three technical indicators, MACD, AO and RSI draw similar conclusions as the daily price chart.

Derivatives traders are bullish on DOGE

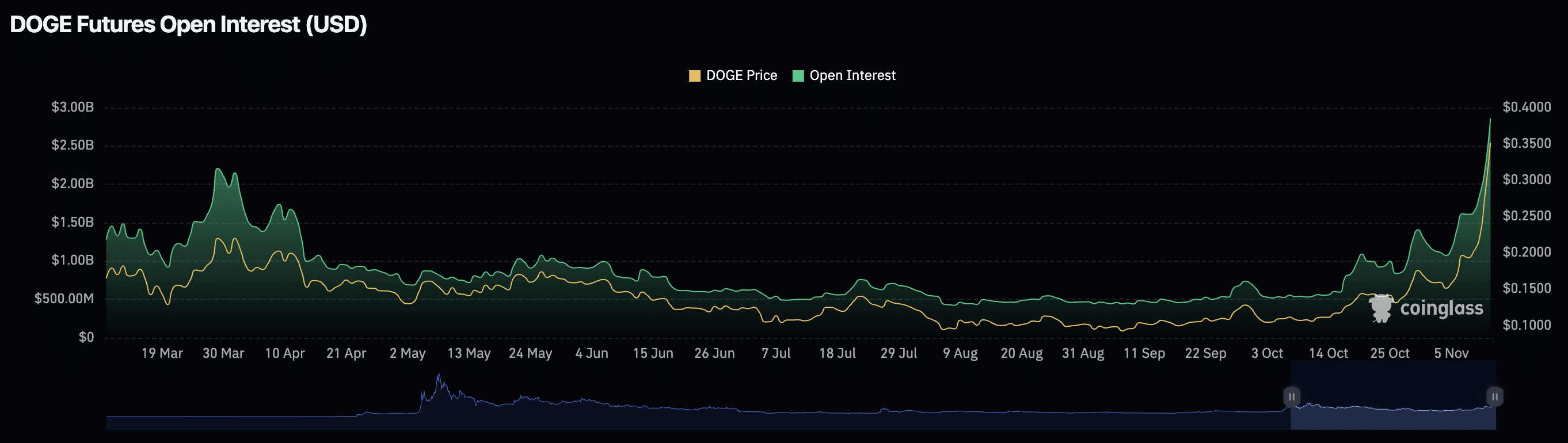

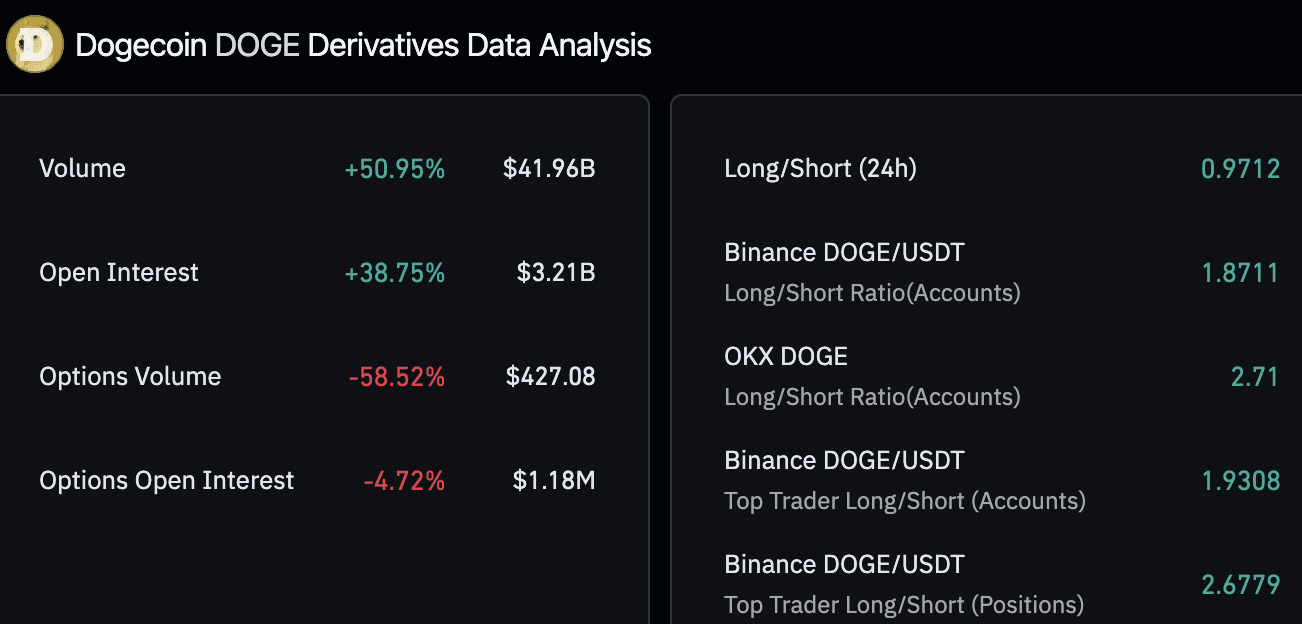

On Tuesday, November 12, there was a significant surge in the total number of open positions for Dogecoin, reaching an impressive $2.86 billion – the highest it’s been in almost three years! According to Coinglass data, this increase came after a 38% jump in open interest over the past day.

Generally speaking, when there’s an upward trend in open interest for a token, it often suggests that investors anticipate its price will rise. A recent analysis of derivatives data indicates that traders on platforms such as Binance and OKX are optimistic about the Dogecoin (DOGE) price increasing, given that the long/short ratio is greater than 1.

A ratio greater than 1 suggests that more traders are placing bets on DOGE’s price rise, implying a bullish sentiment among derivatives traders towards the meme coin. This increased optimism might lead to an continued upward trend for DOGE in the near future.

On-chain indicators show whales making moves in DOGE

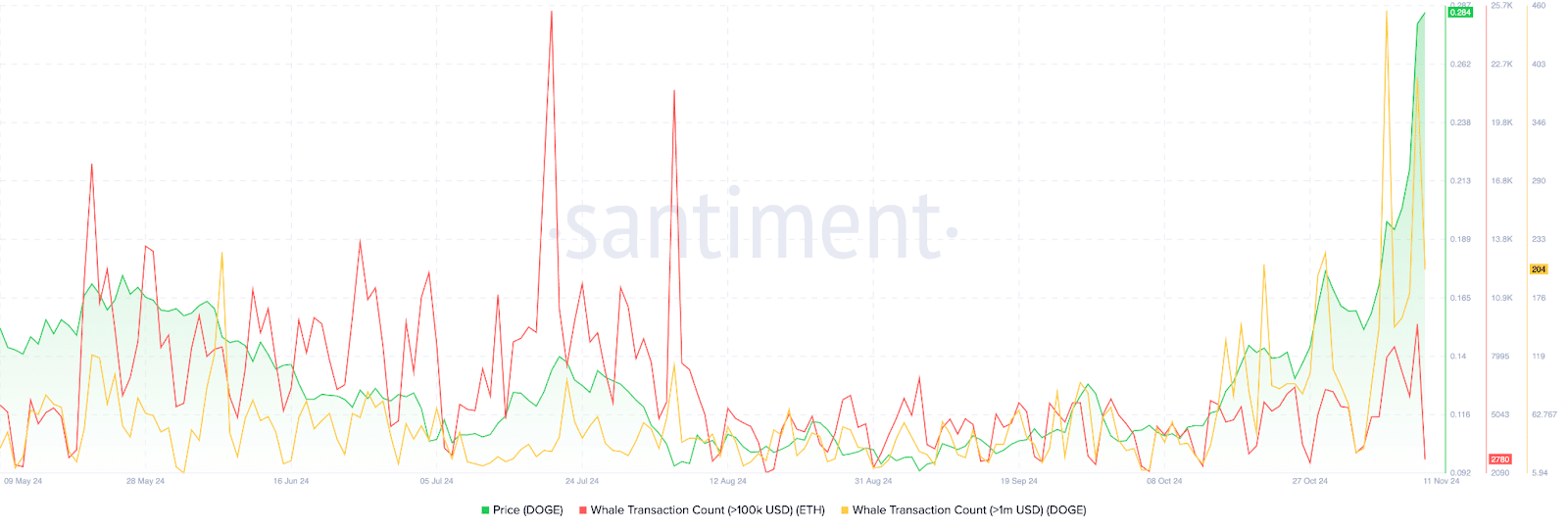

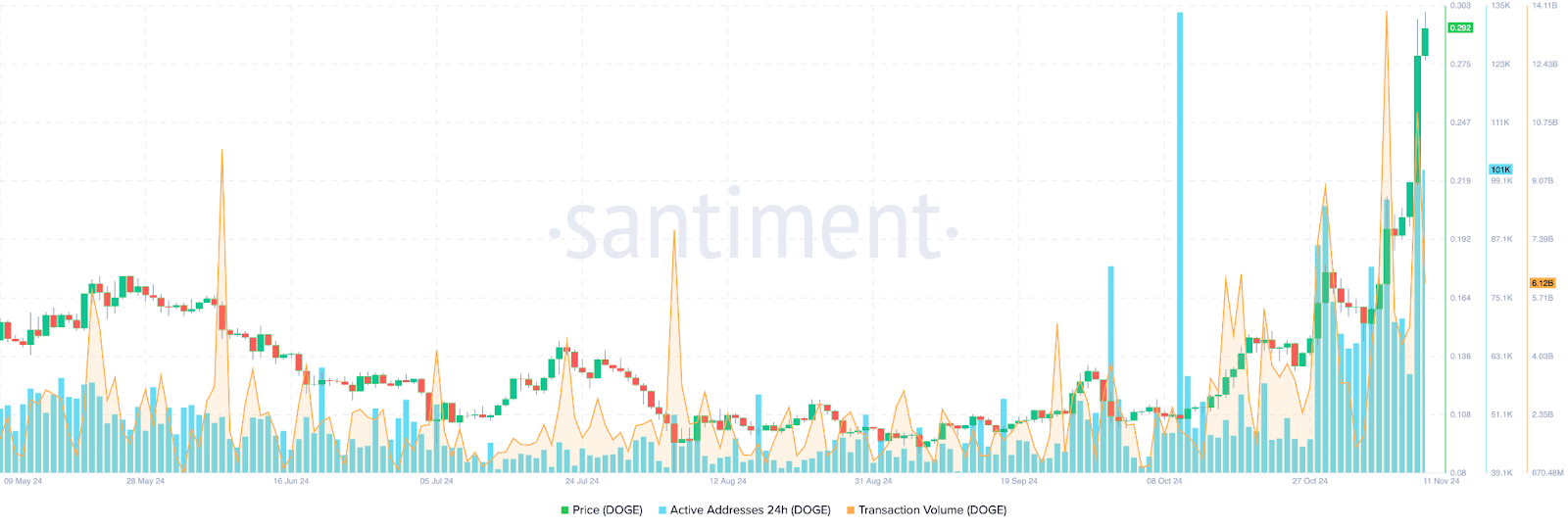

On November 6th and 10th, I noticed a significant rise in my Dogecoin-related transactions, which might be why these dates stand out as notable spikes in my whale transaction count chart, according to data from Santiment.

A rise in whale-related transactions often suggests significant transfers of meme coins, which may be whales stockpiling or moving funds between exchange accounts.

According to the Santiment graph, it appears that significant increases in whale activities correspond with the peak prices of Dogecoin in specific locations.

The count of active addresses is an on-chain metric that helps identify the relevance of a token among crypto traders. Active address count noted a spike on November 6 and 10, alongside a spike in transaction volume. Similar spikes correspond to local price tops for Dogecoin, as seen in the Santiment chart below.

Strategic considerations

As a researcher, I conducted an examination of Dogecoin’s on-chain analysis and technical aspects during a time when Bitcoin reached a unprecedented peak of $89,940 on November 12, 2024. Data sourced from Macroaxis.com revealed a significant correlation between Dogecoin and Bitcoin, with a coefficient of 0.94. This high correlation suggests that any potential correction in Bitcoin might have a detrimental effect on Dogecoin’s performance.

The increase in Dogecoin’s price is probably impacted by Bitcoin’s price movements, the overall condition of the cryptocurrency market, and the performance of other meme coins within the market, along with various other factors that influence market dynamics.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-11-12 16:05