As a seasoned crypto investor with over a decade of experience navigating the volatile waters of digital currencies, I can’t help but feel both exhilarated and cautious about the recent developments surrounding Bitcoin and the U.S government. The prospect of a strategic Bitcoin reserve under Trump’s administration is undeniably intriguing, especially considering Senator Cynthia Lummis’ optimism and David Bailey’s active advocacy for such a move.

During the initial 100 days of President Trump’s term, the Senate plans to expedite the approval of a Bitcoin reserve law, as the Republican party deliberates on cryptocurrency regulations.

Table of Contents

U.S. Senator Cynthia Lummis seems hopeful that the initiative to establish a strategic Bitcoin (BTC) reserve may come into effect shortly following Donald Trump’s swearing-in ceremony.

If we have the backing of the public, I’m confident that with bipartisan cooperation, we can accomplish this task within the first 100 days. This move could significantly improve our country’s fiscal stability. Let’s ensure America’s financial health by adopting the Bitcoin Act!

Senator Cynthia Lummis

Lummis’s post addressed a proposal made by David Bailey, CEO of BTC Inc., who has been offering counsel to President Trump regarding cryptocurrency matters. Earlier, Bailey had suggested that it would be feasible to establish this kind of reserve in a swift manner under the new administration.

“The Bitcoin and Crypto industry’s policy wishlist is long and pressing… but the Strategic Bitcoin Reserve is the #1 most urgent and transformational policy on President Trump’s agenda. The downstream effects change everything. We must get it done in the first 100 days.”

David Bailey, BTC Inc. CEO

Bailey proposed expanding Bitcoin’s use within government initiatives, suggesting that if Robert F. Kennedy Jr. were named Secretary of Health and Human Services, and took charge of the Social Security program, there might be conversations about distributing 5-10% of Social Security benefits as Bitcoin, with these funds being held in a strategic reserve.

What is known about the Bitcoin reserve project?

During a rally for his re-election campaign in July 2024, President Trump declared plans to establish a Bitcoin reserve within the United States. Prior to this announcement, news outlets hinted at Senator Cynthia Lummis drafting a bill aimed at creating a Bitcoin reserve, known as the BITCOIN Act of 2024.

The act proposes creating a network of decentralized vaults nationwide to securely store Bitcoin reserves. The U.S. Treasury Department is supposed to have 200,000 BTC annually for five years, and the U.S. reserves would eventually amount to one million BTC. It is also assumed that Bitcoin reserves will be stored for at least 20 years.

You can acquire cryptocurrencies using other assets you own, like gold certificates, according to the authorities. Senator Lummis suggests offsetting the cost of buying cryptocurrency by reassessing its value instead.

Furthermore, the plan includes setting up a confirmation process for the reserve, ensuring the accessibility of funds and gathering all present Bitcoin held by the U.S. government into a fresh reserve.

Bitcoin reserves to make the U.S. new crypto haven

Experts from CoinShares propose that establishing strategic Bitcoins reserves could spark increased attention and investment from institutions and governments, potentially fueling faster growth and elevating Bitcoin’s worth to unprecedented levels, as suggested by their predictions.

Generally speaking, numerous individuals in the cryptocurrency sphere believe that the U.S.’s support for Bitcoin could greatly boost its appeal as an investment. To illustrate, Anthony Pompliano, head of Pomp Investments, is certain that this move will trigger a sense of fear of missing out (FOMO) within the market.

Lummis’ suggestion suggests that the speed at which Bitcoin is being bought might exceed the expense of mining it. If this occurs, a shortage of cryptocurrency may emerge within the market, potentially boosting its value as well.

Trump’s rally is in full swing. Or just a rally?

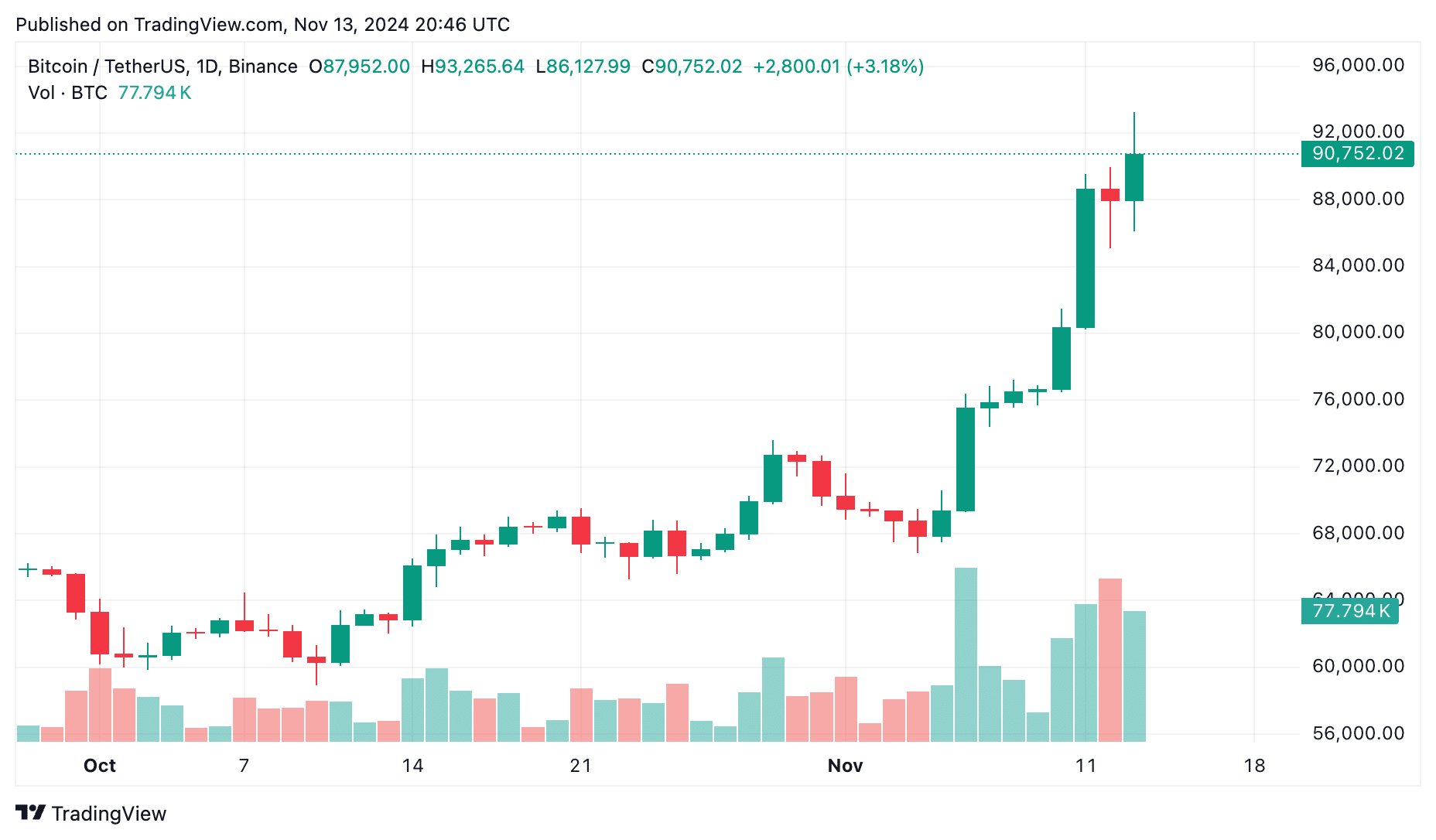

Generally speaking, Lummis’ statements align with the trends observed in Bitcoin and the broader cryptocurrency market following the U.S. elections. In the last seven days alone, Bitcoin has consistently set new record highs.

Over the past seven days, the overall value of the cryptocurrency market has surged by a substantial 25%, breaking through the $3 trillion mark. Simultaneously, the price of Bitcoin has experienced an impressive growth of 23.8%, repeatedly setting new record highs and soaring to approximately $93,000.

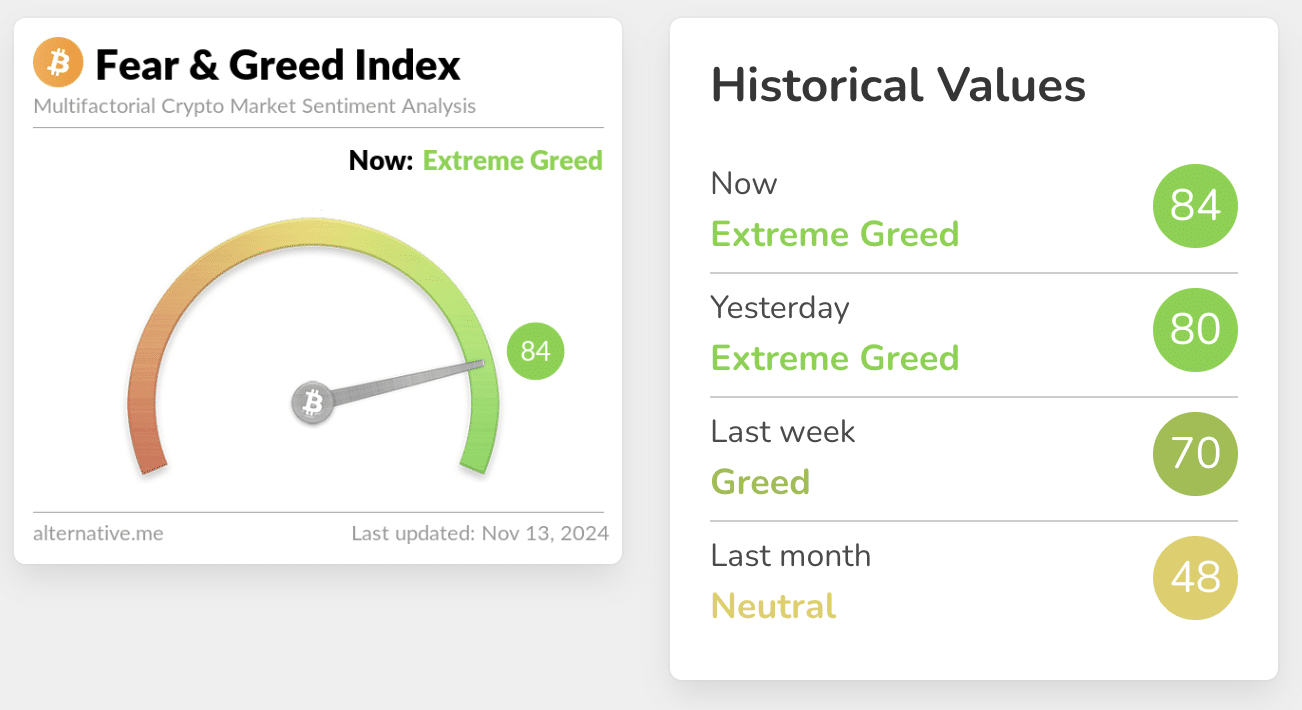

Over the past week, the gauge measuring fear and excitement in the cryptocurrency market has risen significantly, climbing from 70 to 84 on a scale of 100. This notable increase suggests that the market is currently experiencing intense greed.

However, some experts doubted that Trump’s victory was the only growth driver of the crypto market.

In essence, Jesse Myers, a co-founder at Onramp Bitcoin, stated that following the Bitcoin halving in April, these types of crypto market behaviors are typical and follow a pattern. The scarcity of coins on the market is causing an increase in price due to high demand. This situation sets off a chain reaction that could potentially lead to another market bubble.

If you’re curious about the current state of #Bitcoin…

— Jesse Myers (Croesus 🔴) (@Croesus_BTC) November 11, 2024

Myers pointed out that history tends to repeat itself following each Bitcoin halving event, suggesting we might witness a similar pattern again. The shift in US political power towards a potentially more crypto-friendly administration has only served to accelerate these developments.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Gold Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-11-14 00:02