As a seasoned researcher with years spent delving into the intricacies of global finance and emerging technologies, I find myself intrigued by the prospect of stablecoins potentially alleviating the U.S. debt crisis. It’s not every day that we come across an opportunity where the future of finance could intersect so closely with the present-day economic challenges.

In a recent article published in the Wall Street Journal, Former House Speaker Paul Ryan proposes that cryptocurrencies might help prevent a potential U.S. debt crisis. He explains that America’s escalating $35.46 trillion debt could challenge the U.S. dollar‘s role as the world’s primary reserve currency. Ryan suggests that stablecoins, which are increasingly being used to purchase U.S. government debt, might postpone this crisis.

Table of Contents

Stablecoins as a source of demand for U.S. debt

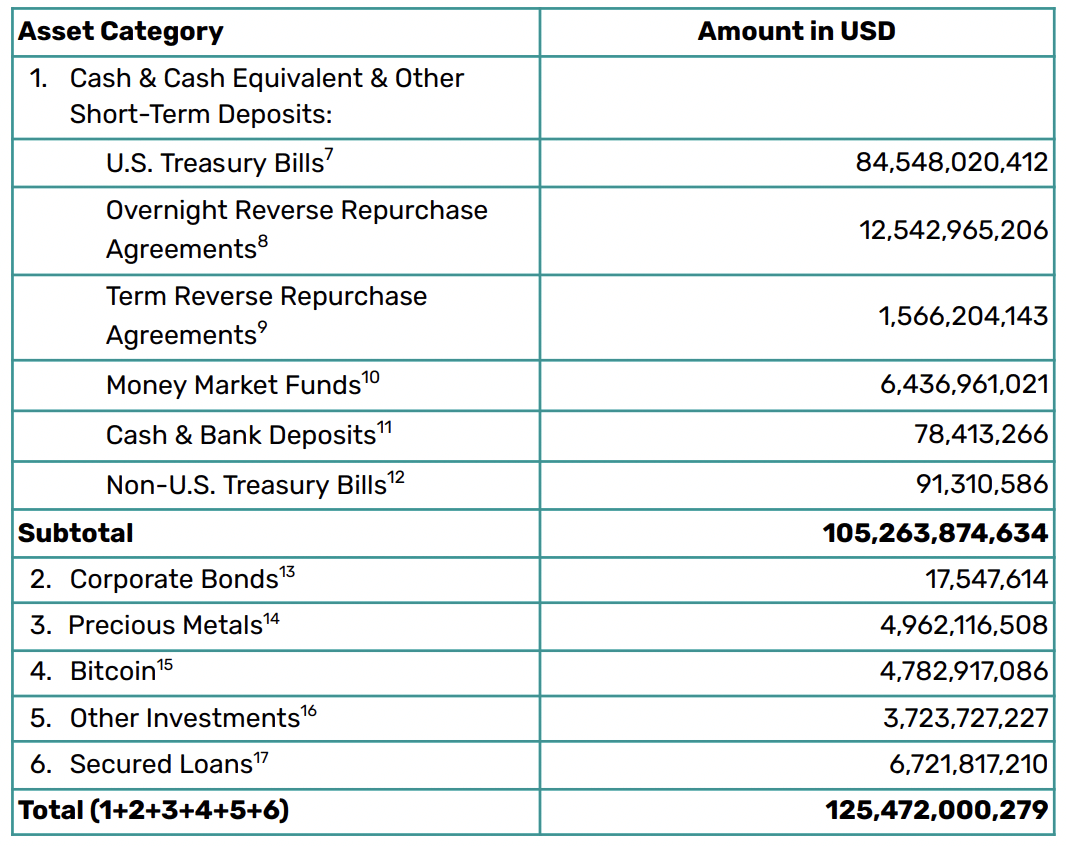

Stablecoins such as USDT (Tether) and USD Coin (USD Coin) currently have more than $95 billion invested in U.S. Treasury bonds, according to their latest financial statements. As the popularity of stablecoins increases, they are providing a bridge for traders to access traditional fiat currency and boosting cryptocurrency adoption. Over time, this consistent demand for Treasury bills could potentially lead to the absorption of more U.S. debt.

As a crypto investor, I’ve noticed that over the years, China, traditionally a major buyer of American debt and the second-largest holder of treasury bills after Japan, has been gradually reducing its exposure. From a staggering $1.27 trillion in 2013, China’s holdings have dropped significantly to less than $1 trillion since April 2022. This decrease is not without reason; geopolitical tensions and shifting trade policies between our nations seem to be the primary factors driving this change.

By having stablecoin issuers buy treasury bills, there’s a decrease in reliance on conventional purchasers. This shift helps address worries about a decline in traditional buyers’ holdings due to geopolitical unrest and the changing political landscape following the U.S. presidential election.

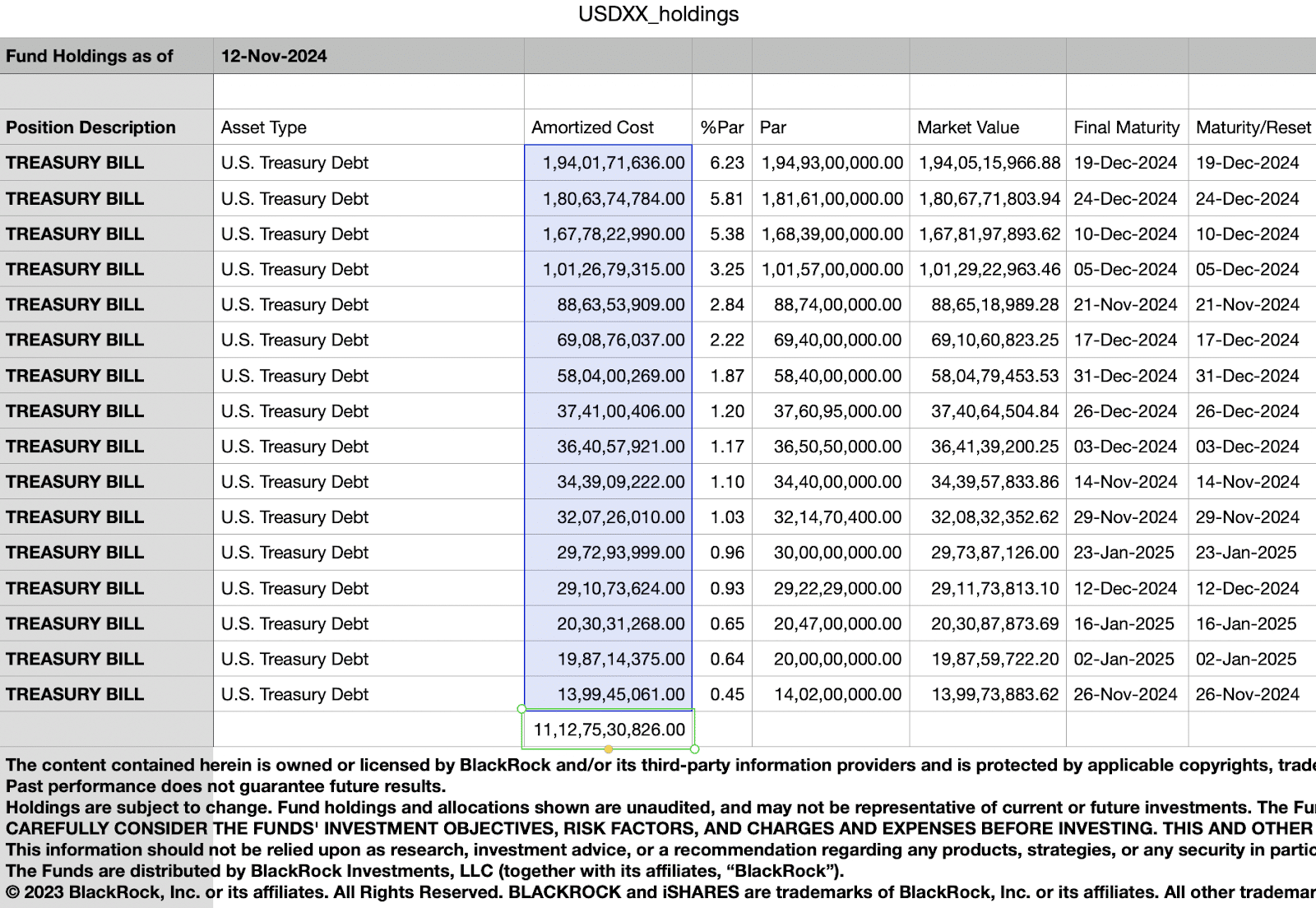

According to Tether’s October 31, 2024 report, the stablecoin issuer has a total of $84.548 billion invested in U.S. government bonds. Meanwhile, Circle’s November 12 report, based on data from BlackRock, indicates that they have $11.127 billion in treasury bills.

Ryan understands that the position of the US dollar as a worldwide reserve currency might be threatened by decreasing overseas demand, potentially leading to increased borrowing costs for the U.S. and a weakening of its economic power.

As an analyst, I find myself considering stablecoins as a possible solution to maintain stability amidst the current unrest. These digital currencies, designed to minimize volatility, might serve as a temporary anchor while more comprehensive strategies are developed to address the underlying crisis.

Hoover Institution report suggests the U.S. should lead the digital currency space

As a financial analyst, I often ponder over the potential implications of integrating stablecoins into our existing financial infrastructure. One point of contention that frequently arises is the potential loss of control in imposing sanctions and regulating global fund flows. This concern stems from the decentralized nature of many stablecoin systems, which might make it challenging for authorities to enforce restrictions when necessary.

As a researcher exploring the realm of digital currencies, I’ve come to appreciate the unique attributes of dollar-backed stablecoins. These innovative monetary instruments are issued on open, permissionless blockchains, reflecting the American values of liberty and transparency that set them apart from China’s digital financial infrastructure.

The Hoover Institution’s study, “Digital Currencies: Navigating a Crucial Juncture for the U.S., China, and Global Finance,” underscores the strategic advantage China holds in being the first to introduce its central bank digital currency, and discusses how this could influence global norms and guidelines for digital money.

The report doesn’t propose establishing a digital dollar; instead, it underscores the immediate requirement for policymakers to establish guidelines to combat the escalating Chinese impact. A smoother shift toward the U.S.’s digital economy could be facilitated by stablecoins, but drafting regulations and setting up infrastructure for this transition will take time to ensure its success.

The document outlines the various stages involved, such as collaborating with G7 countries and other democratic allies to establish a worldwide digital finance framework that strengthens, instead of undermines, privacy, responsibility, safety, and legal order.

By establishing the appropriate legal foundation and guidelines, stablecoins might help the U.S. reassert its global financial dominance.

Could Bitcoin solve the U.S. national debt problem?

In July 2024, U.S. Senator Cynthia Lummis presented the Bitcoin Act. She proposed establishing a national Bitcoin reserve containing approximately 1 million Bitcoin tokens. This reserve would function as a valuable asset to enhance the financial strength of the United States.

According to Sen. Lummis’ assertion, the US could erase its debt within 20 years by cashing in on Bitcoin sales. However, considering the current national debt of $35.46 trillion and Bitcoin’s market cap at $1.739 trillion, it appears that this scenario is less probable.

To eliminate the national debt using a million Bitcoin tokens, each token would need to be worth approximately $35.46 million, given that there are only 21 million Bitcoins in circulation and its market cap already surpasses that of silver (as of November 15). However, it’s unlikely for the Bitcoin market capitalization to expand at a rate faster than the combined value of assets like gold, silver, and stocks.

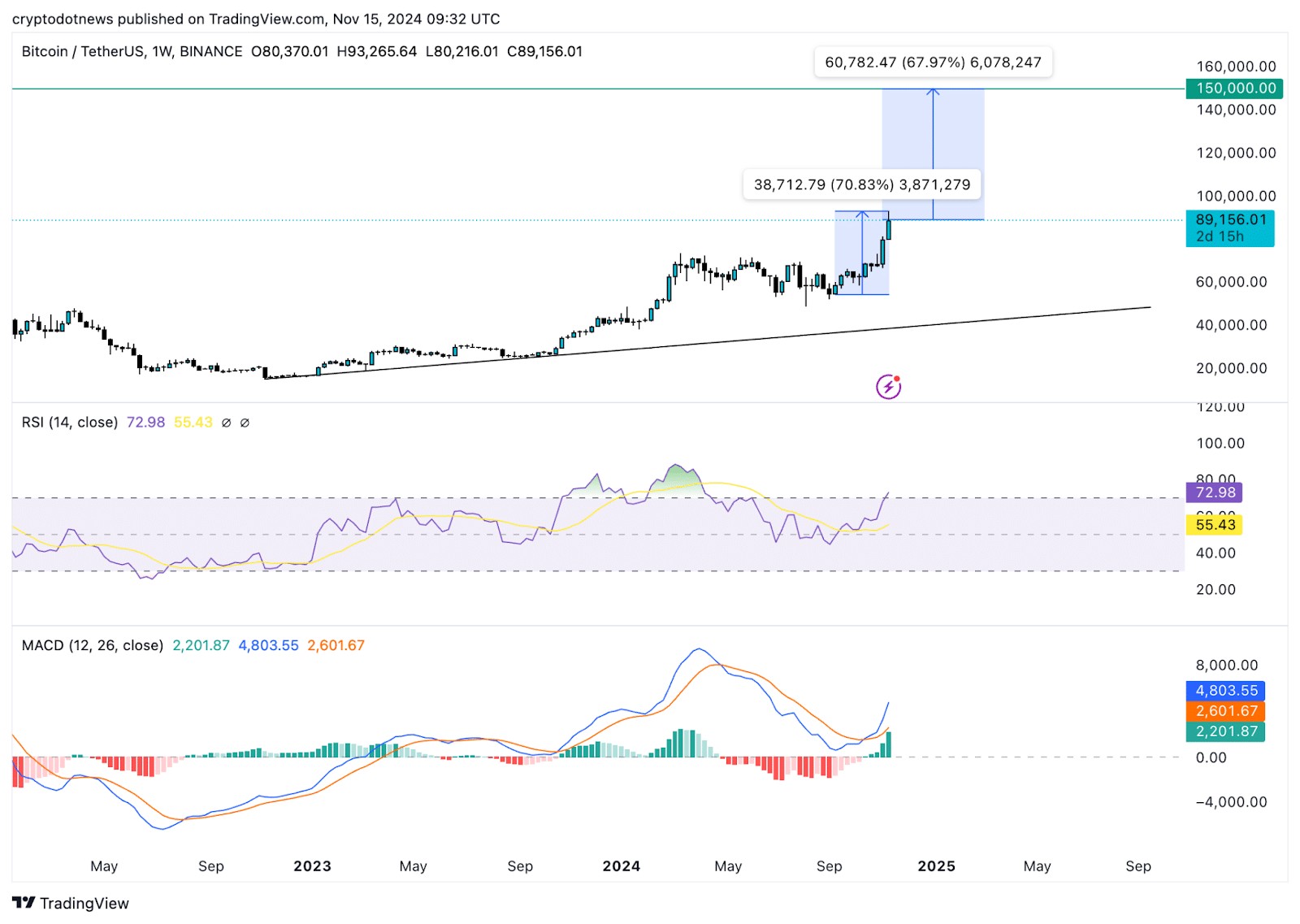

On November 13th, the surge of Bitcoin up to $93,265 has boosted investors’ faith in its potential to reach $100,000 before the end of the year. Over the period between September and November 13th, Bitcoin experienced a significant increase of approximately 70%. If this growth continues at a similar pace, it could potentially drive Bitcoin towards a target price of around $150,000.

The technical analysis of Bitcoin’s weekly price graph indicates a growing optimistic trend in Bitcoin prices. Specifically, the Moving Average Convergence Divergence (MACD) is displaying positive signals by presenting green bars above the median line.

Investors should exercise caution while entering a long position in Bitcoin, as its Relative Strength Index stands at 72, suggesting the cryptocurrency may be overpriced. Historically, such high RSI values often indicate a sell signal or a potential correction for the digital token.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-15 15:14