As a seasoned crypto investor with a knack for spotting promising trends, I can confidently say that the Real-World Asset (RWA) sector has caught my attention like never before. With its staggering growth over the past week, it’s clear that this sector is not just surviving but thriving in the crypto market.

Over the last seven days, the Rapidly-Growing Assets (RGA) segment has seen a significant increase of over 20%, positioning it as one of the most vigorously expanding sectors within the cryptocurrency industry right now.

In simpler terms, the total value of assets in the real world currently stands at approximately $40.41 billion. Over the past 24 hours, these assets have been traded for a total volume of around $3.22 billion. Real-world assets (RWAs) are evolving as they move towards the next stage of innovation, serving as a connection between traditional assets such as art, commodities, and real estate, and the emerging technology of blockchain.

Last week, Avalanche (AVAX) and Chainlink (LINK) were the top performers among sector leaders, with AVAX increasing by 14.97% and LINK at 14.39%. However, MANTRA OM took center stage with a remarkable surge of 128.51% last week. Meanwhile, Maker (MKR) also saw impressive growth, rising by 15.89%, demonstrating the high level of enthusiasm and activity within communities centered around decentralized finance protocols.

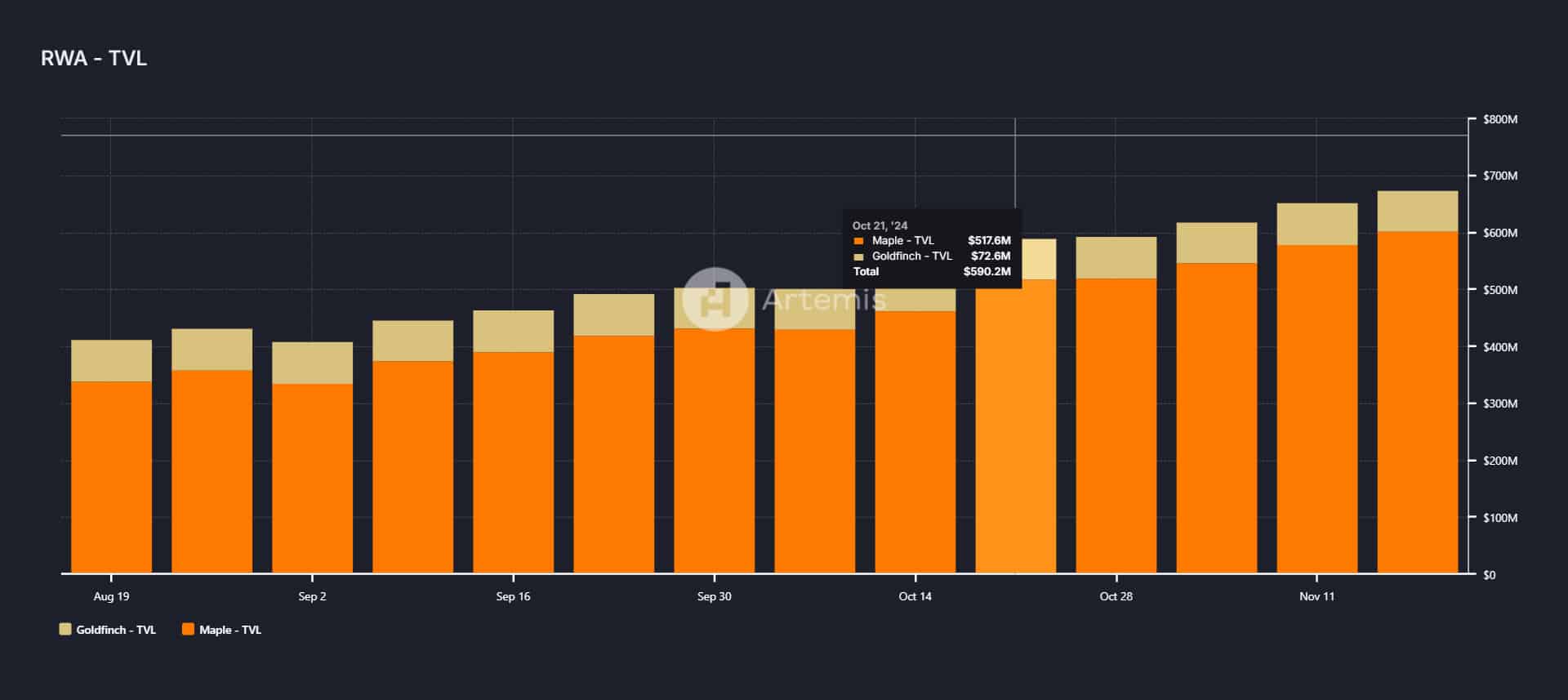

By October 21st, the combined Total Value Locked (TVL) for Maple Finance and Goldfinch, two DeFi platforms specializing in financing decentralized loans using RWA in developing markets, had increased by $517.6 million on Maple Finance and $72.6 million on Goldfinch. The current combined TVL amounts to approximately $590.2 million. This growth indicates a rising investment value and growing adoption of decentralized lending and borrowing platforms.

The rise in TVL indicates a strong adoption of RWAs for facilitating liquidity in previously infrequently traded assets. Notable participants like Maple and Goldfinch have become significant contributors to this trend, leveraging blockchain technology to channel high-quality financial resources.

David Hendricks, the CEO of Vertalo, recently discussed with Dorian Batycka about regulatory bodies like the SEC and Finra. He emphasized that these entities won’t be lenient; they will closely scrutinize the use of technology for creating investment products, as it’s reminiscent of cryptocurrencies in this aspect. However, he clarified that unlike crypto with its potential rug pulls, this is more about utilizing database technology to develop investment products and boost efficiency.

As attention shifts towards Real-World Assets (RWA) sectors, these are increasingly integrating with Decentralized Finance (DeFi), opening up fresh opportunities for financial accessibility and creativity. Those in this field, including investors and developers, are drawn by the space’s potential to reshape asset ownership models and make them more accessible to a broader market.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-11-22 14:38