As someone who has been closely following and trading cryptocurrencies since their early days, I must admit that the current state of Ethereum is a bit concerning. Over the years, I’ve seen it rise from an ambitious project to a dominant player in the crypto market. However, its recent performance compared to other altcoins like Solana and meme coins has been underwhelming, especially considering its larger market capitalization.

On Friday, November 22nd, Bitcoin (BTC) surged closer to its $100,000 goal, causing Ethereum (ETH) to break a three-year support level against it. For almost four months now, ETH has encountered persistent resistance at the $3,500 mark, while rival cryptocurrencies reached new highs during this cycle.

Table of Contents

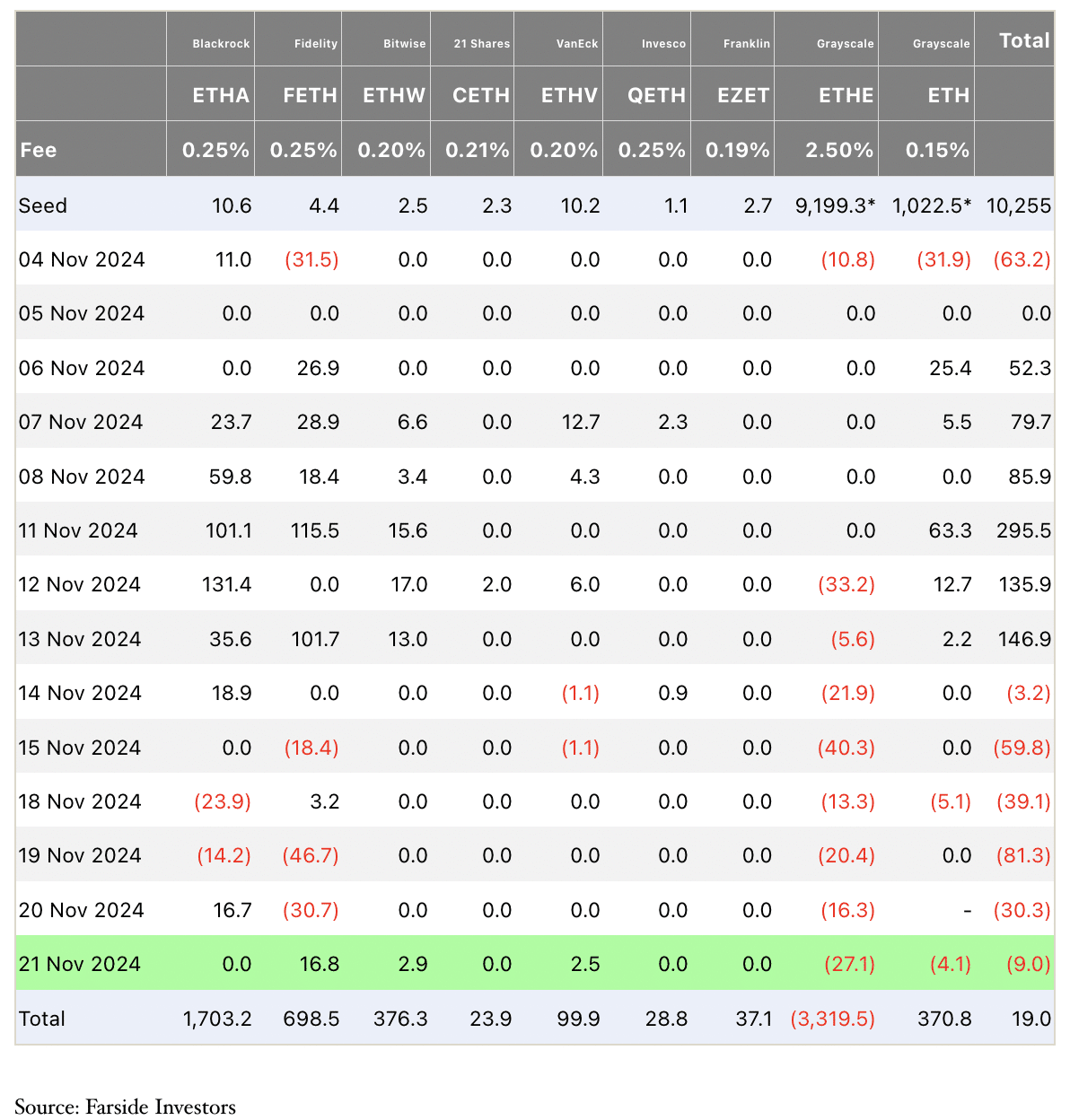

Ethereum loses favour with institutional investors, ETF performance lacklustre

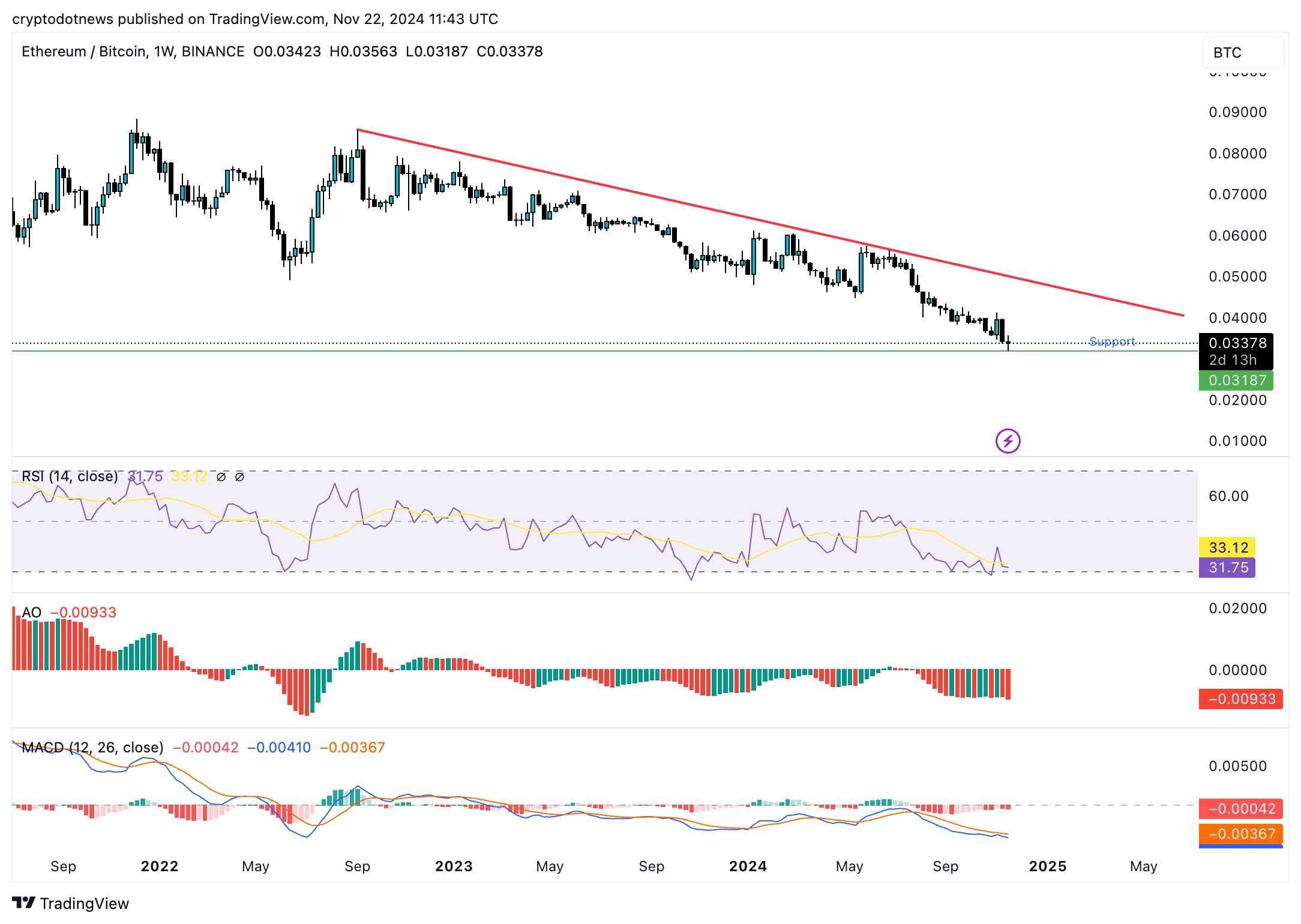

On Friday, November 22nd, Ethereum reached a low of 0.03187 relative to Bitcoin. As Bitcoin moved closer to its $100,000 goal, the price of Ethereum dipped below the support level it had held for almost three years since 2021.

The drop in Ethereum’s value relative to Bitcoin may be due to a combination of several influencing factors such as diminished interest from institutional investors, waning enthusiasm from individual investors, and the movement of resources towards Layer 2 and Layer 3 scaled projects, plus some other contributing elements.

In simpler terms, the success of the Ethereum Spot ETF indicates that institutions haven’t been keen on investing in Ethereum like they have with Bitcoin, as evidenced by the superior performance of the Bitcoin Spot ETF.

Over the past six days, data from Farside Investors UK indicates that Ethereum-based ETFs have seen net outflows or decreases in investments. Conversely, Bitcoin Spot ETFs are still drawing significant amounts of money from institutional investors.

According to Turr Demeester, who serves as Editor-in-Chief at Adamant Research, he suggested to Forbes that Ethereum could potentially be experiencing a prolonged decline, indicating a change in market trends and reduced pace of institutional adoption.

Solana challenges Ethereum’s dominance, on-chain analysis

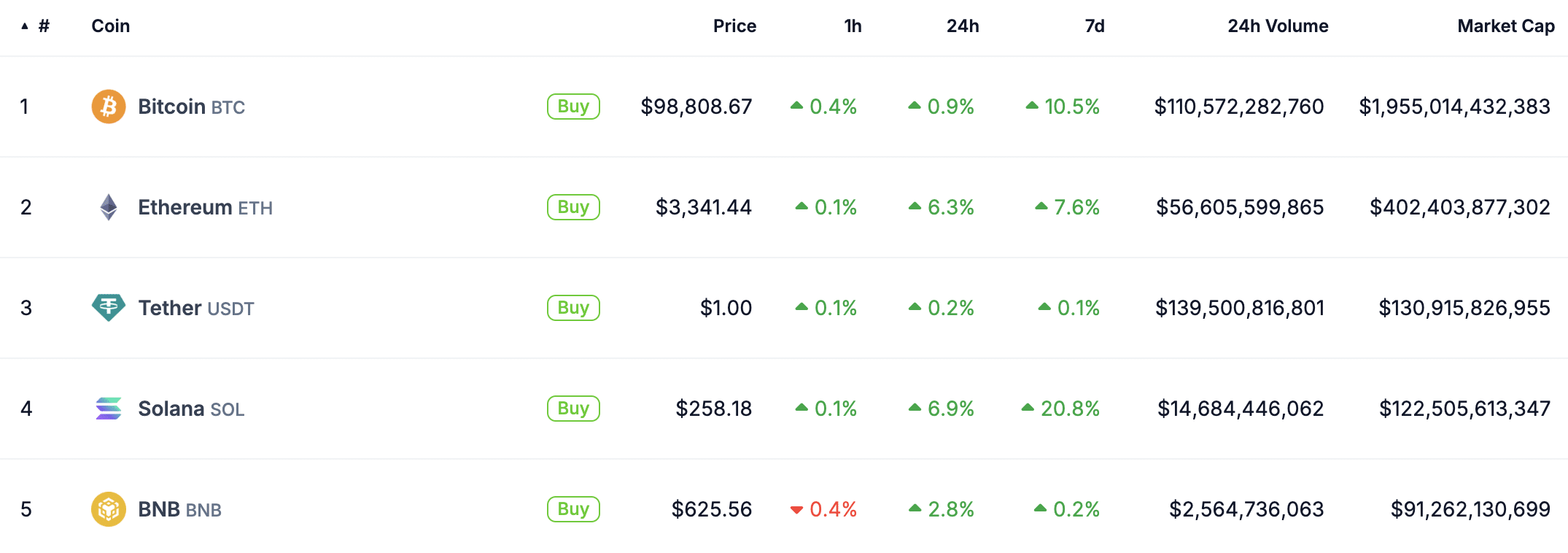

As Ethereum ETF’s performance falters, its rival Solana (SOL) poses a threat. The surge in Solana’s market capitalization and price increase has propelled SOL into the group of the top four cryptocurrencies, according to CoinGecko.

As a researcher examining blockchain data from October 2024 to November 2024, I found that Solana outperformed Ethereum significantly in terms of transaction volume, DEX activity, and protocol fees generated across decentralized exchange platforms during this period.

Despite Ethereum experiencing an increase in its value on Thursday and Friday this week, it faces resistance around the $3,500 mark. If it fails to surpass this level, there may be doubts about additional growth potential for the cryptocurrency.

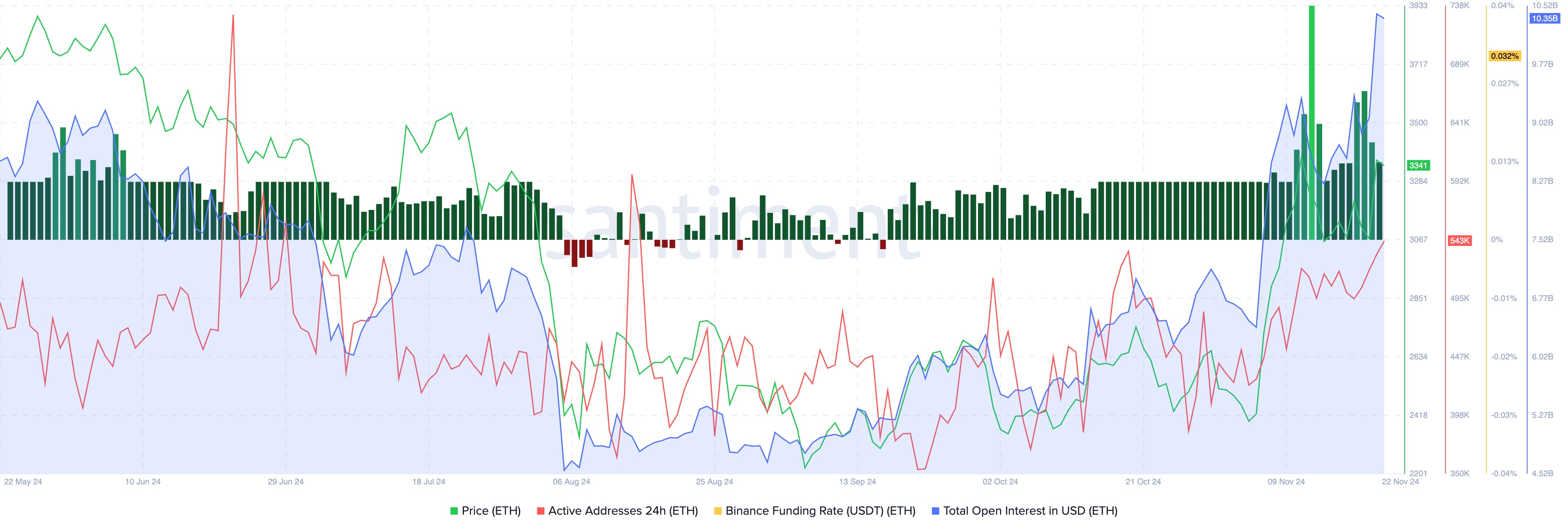

The data from on-chain analysis is ambiguous. Although the number of active addresses is still significantly lower than it was in mid-August 2024, the funding rate on Binance has stayed favorable since mid-September 2024.

As a researcher delving into Ethereum futures, I’ve noticed a surge in open interest, reaching an impressive $10.35 billion, as indicated by Santiment data. This increase signifies growing enthusiasm and demand among derivatives traders, lending credence to a bullish outlook for the altcoin. With the recent uptick in Ether’s price and the potential for it to break through the resistance at $3,500, we might expect further upward momentum if this altcoin succeeds in its attempt.

Bitcoin leads cryptos with digital gold narrative

For approximately the last ten years, Ethereum and Bitcoin have been frequently discussed by financial analysts and traders alike. While Bitcoin has assumed the role of a “digital gold” or a currency used to protect against geopolitical turmoil and unexpected market events, Ethereum is grappling with scalability concerns.

The scalability challenges faced by Ethereum led to the development of Layer 2 and Layer 3 protocols, and these solutions have provided impressive returns for investors in 2024. Unfortunately, interest and engagement with the main chain has been dwindling among market players.

Institutional interest grew towards the digital gold narrative, as various countries considered adding Bitcoin to their financial reserves. Meanwhile, Ethereum continues to strive towards becoming a globally accessible “decentralized computing” platform.

Although Ethereum currently boasts a greater market value compared to Bank of America, it’s worth noting that in the present market trend, Ethereum hasn’t outperformed meme coins or other cryptos such as Solana, as of November 22.

Ethereum future expectations and technical analysis

In simpler terms, the value of ETH relative to BTC has dropped close to a nearly three-year minimum, reaching an important support point, as illustrated in the accompanying graph. This decrease is substantial, and the trend for this pair has been descending since September of 2023.

Technical indicators such as the Relative Strength Index (RSI) and momentum indicators suggest a pessimistic outlook. With an RSI reading of 31, it’s almost in the “oversold” region below 30. This often creates a buy signal for investors, indicating that the asset is underpriced and could be a favorable moment for those on the sidelines to invest.

If the recovery from the support level doesn’t occur, there might be a continued drop in the ETH/BTC pair over the coming weeks of 2024, as it potentially slides downward.

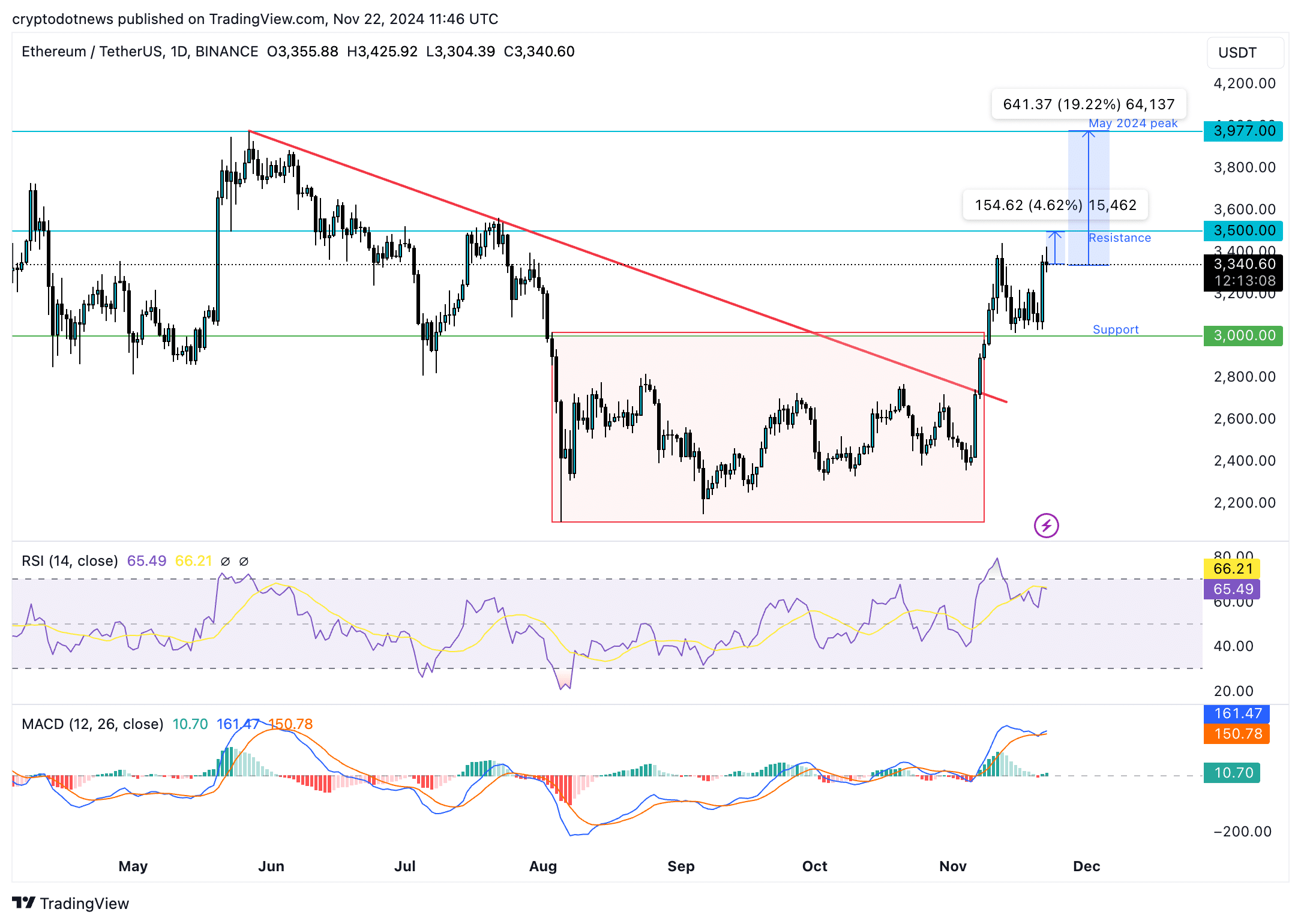

The ETH to USDT daily graph indicates a promising trend for Ethereum. If Ethereum continues its bullish run, it might surge toward the $3,500 barrier and potentially reach the May 2024 high of $3,977.

1) Ethereum is almost within touching distance of $3,500, and if it continues to grow, it could potentially reach the high from May 2024 at $3,977 – a nearly 20% increase. The Relative Strength Index (RSI) currently stands at 65, which is significantly lower than the overvalued range above 70, suggesting Ethereum still has room to grow. The positive green bars on the Moving Average Convergence Divergence (MACD) indicator also indicate a high probability of further gains for Ethereum.

The current upward trajectory of Ethereum suggests a promising outlook, with a strong possibility that it might surpass the significant $4,000 mark in the near future if its steady growth continues unabated.

A potential adjustment could lead Ethereum to evaluate its support at approximately $3,000 – a crucial level of backing for this cryptocurrency throughout 2024. If it continues to drop, Ethereum may find its backup at the lower boundary of the range around $2,111, as suggested by the daily price chart.

Strategic considerations

On Macroaxis.com, it’s reported that Ethereum shares a robust relationship with Bitcoin, with a correlation coefficient of 0.91. This means that when Bitcoin’s price increases substantially, we might expect similar growth in Ethereum’s value as well. It’s anticipated that this upward trend could be reflected in the price of Ethereum.

Although Ethereum trails behind other cryptocurrencies, a potential correction in Bitcoin might intensify the difficulties Ethereum encounters as it tries to surmount resistance at $3,500. Keep an eye on the volume and open interest of options in Ethereum before increasing your ETH holdings.

Read More

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- Capcom has revealed the full Monster Hunter Wilds version 1.011 update patch notes

2024-11-22 18:30