As a seasoned analyst with over two decades of experience in the financial markets, I’ve seen my fair share of market fluctuations and trends. The current surge in Stellar Lumens (XLM) is indeed impressive, but it’s important to remember that every rising tide must ebb eventually.

Over the past three weeks, Stellar Lumens has made a robust resurgence, hitting its highest point since early 2021.

The price of Stellar (XLM) surged to $0.3052 due to the continuous rise in the cryptocurrency market and the anxiety of not being left behind.

The increase in Ripple‘s value has occurred during the same period as the Ripple price surge, which propelled Ripple to a high of $1.5, its highest since May 31. This upswing is believed to be due to investors expecting that the Securities and Exchange Commission will conclude its legal action against Ripple Labs.

Ripple and Stellar share significant commonalities: both systems were developed with the intention of revolutionizing the financial transactions sector. Ripple focuses on streamlining international money transfers for institutions, whereas Stellar concentrates on fostering seamless person-to-person payment solutions.

Moreover, Gavin Wood, the creator of Stellar, was initially part of Ripple’s founding team. Previously, the value of XLM (Stellar) and XRP (Ripple) have often moved together. Investors are speculating that some companies may submit applications for a combined Stellar and Ripple ETF in 2025.

Technicals point to a Stellar Lumens reversal

The outlook for XLM price is bullish during the ongoing crypto rally. However, there is a risk of a harsh reversal in the next few days.

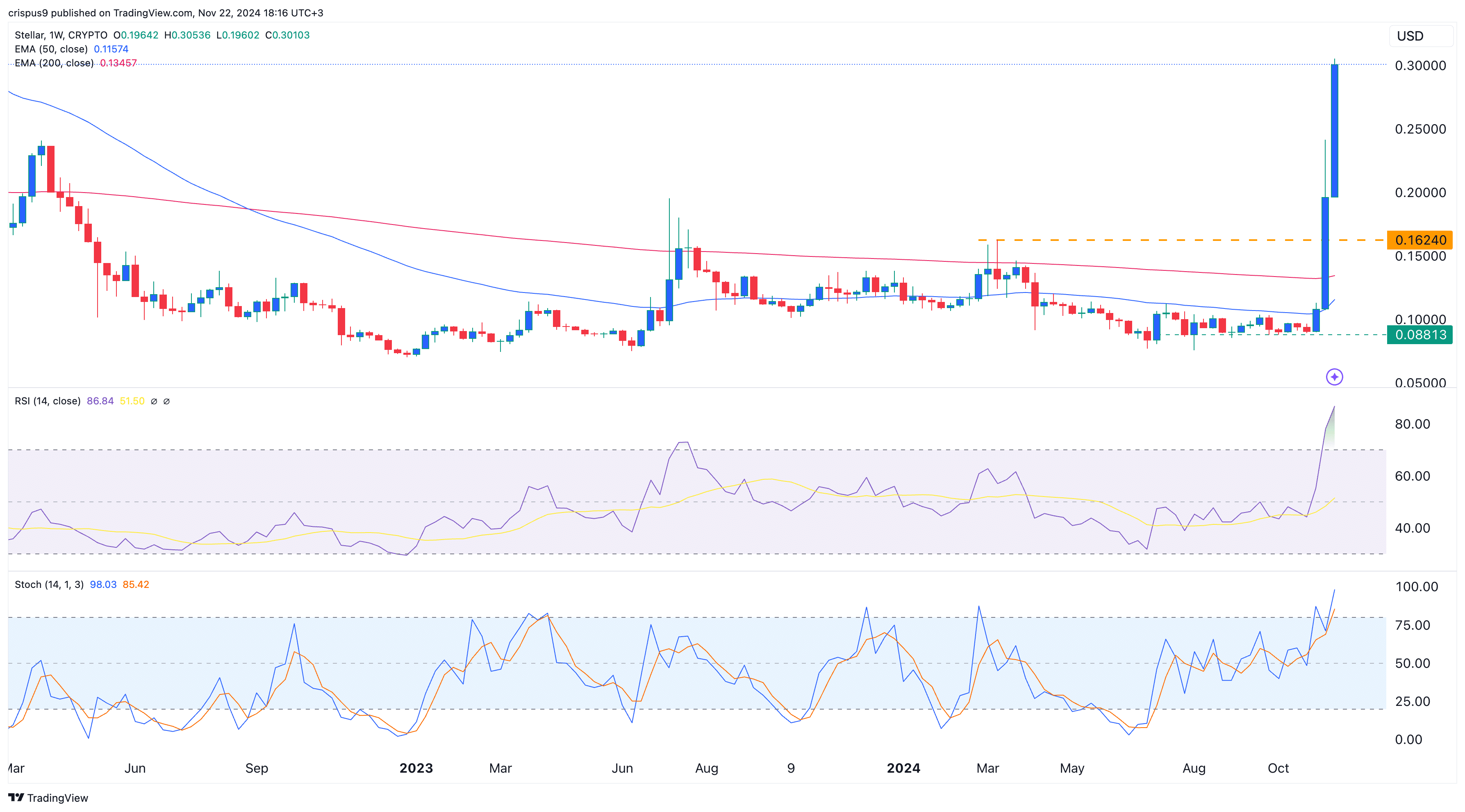

Initially, it’s possible that Stellar’s price might decrease because of mean reversion, which is a theory suggesting assets frequently revert to their historical norms. In Stellar’s instance, its price surged 142% above both its 50-week and 200-week Exponential Moving Averages during the upward trend.

Consequently, if there’s a tendency for the coin to return to its average values, there’s a potential danger it might fall towards those levels instead.

The price of XLM could suddenly drop due to being heavily overbought. This is suggested by the Relative Strength Index reaching 83 and the Stochastic Oscillator lines nearing 100. High readings on these oscillators indicate strong momentum, but such high levels often signal a forthcoming steep decline.

After surging past the significant resistance level at $0.1624, which was its peak from July 2023 last week, Stellar’s price might retrace this move and create a break-and-retest pattern. Typically, financial assets return to test critical support levels before continuing a bullish trend. Consequently, it is expected that XLM could dip back down to $0.1624 before resuming its upward trajectory.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- EUR CNY PREDICTION

- Brent Oil Forecast

- Hero Tale best builds – One for melee, one for ranged characters

- Capcom has revealed the full Monster Hunter Wilds version 1.011 update patch notes

2024-11-22 18:58