As a seasoned crypto enthusiast with a knack for deciphering market trends, I find myself constantly juggling the intricate dance between fundamentals and sentiment in this ever-evolving digital landscape. With my eyes glued to charts, news feeds, and the pulse of global markets, I’ve seen my fair share of bull runs and bear markets.

As Bitcoin nears the $100,000 mark, one might wonder if market manipulators are cashing in on profits or if this could signal the start of another significant price surge.

Table of Contents

BTC cools off

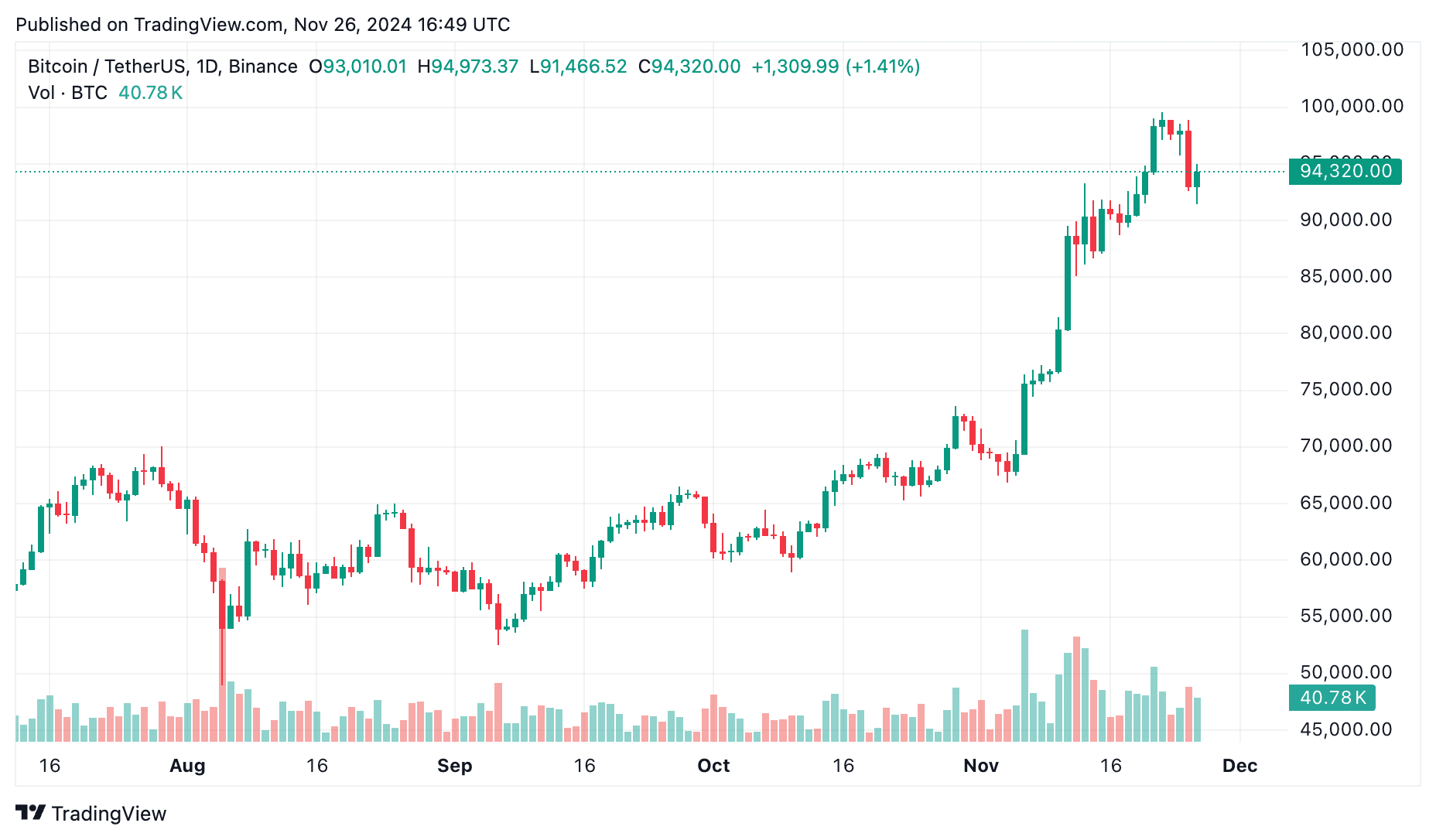

Over the past period, Bitcoin (BTC) has experienced an exhilarating surge, yet it appears that the celebration has temporarily paused. Just shy of reaching the $100,000 threshold, the most significant cryptocurrency in terms of market capitalization is experiencing a lull.

Currently, as of November 26th, Bitcoin is being exchanged at approximately $94,300. Compared to the previous day, this represents a decrease of about 3%. This downward trend follows Bitcoin reaching its record high of $99,655 on November 22nd.

As an analyst, I’ve noticed that the latest price fluctuations appear to align with a typical profit-taking scenario. Initially, this downward trend was somewhat mitigated by robust buying interest from Spot Bitcoin Exchange-Traded Funds (ETFs). Over the past five days, these ETFs have consistently experienced net inflows.

On the other hand, starting November 25th, there was a change in direction as ETFs experienced withdrawals amounting to $435 million, based on data from CoinGlass.

Stepping back for a moment, it’s worth noting that overall, Bitcoin’s outlook remains optimistic. Following the U.S. presidential election on November 5, when an unexpected return of Donald Trump was announced, Bitcoin has climbed by over 30%.

As the upcoming departure of SEC Chair Gary Gensler, scheduled for January 20, 2025, approaches, speculation about potential policy changes in the crypto sector is growing. This anticipation suggests a more favorable regulatory environment may be on the horizon for cryptocurrencies.

Where does the journey of Bitcoin continue? Has it reached its maximum point, or is this a temporary halt before another rise? Let’s explore and see.

What’s really happening with Bitcoin?

Amid Bitcoin’s ongoing adjustment phase, the broader storyline concerning BTC continues to be closely associated with one of its ardent advocates – MicroStrategy.

MicroStrategy, the company that transitioned into a Bitcoin investment entity under the guidance of Michael Saylor, has attracted attention once more following its substantial acquisition of 55,500 Bitcoins from November 18 to November 24.

MicroStrategy recently purchased approximately 55,500 Bitcoins for around $5.4 billion, which equates to roughly $97,862 per Bitcoin. This move has resulted in a Quarter-to-Date (QTD) yield of 35.2% and a Year-to-Date (YTD) yield of 59.3%. As of November 24, 2024, we hold about 386,700 Bitcoins that were acquired for around $21.9 billion at an average price of $56,761 per Bitcoin. $MSTR is the ticker symbol for this company.

— Michael Saylor⚡️ (@saylor) November 25, 2024

In simple terms, MicroStrategy’s recent purchase of Bitcoin for $5.4 billion, with each Bitcoin costing around $97,862, marks its largest single-week acquisition ever. This latest buying spree increases the company’s total Bitcoin holdings to approximately 386,700, which they acquired at an average price of $56,761 per token.

Over the past three Mondays since President Donald Trump’s re-election, MicroStrategy has revealed that they have purchased a total of 11.43 billion dollars in Bitcoin, with this significant amount being accumulated during just the month of November.

Accumulating Bitcoin in such an assertive manner is boosting the belief among institutions that it’s a sound long-term investment, thanks to optimism about a favorable regulatory climate for cryptocurrencies under the new administration.

Initially, these grand market acquisitions create uncertainty and turbulence in an already unstable financial environment. For instance, on November 25th, Bitcoin soared to around $98,000, but once the news of a $97,862 purchase price broke out, speculative investors swiftly responded. Consequently, Bitcoin tumbled down to approximately $92,240 within hours, leading to significant liquidations in the derivatives market.

Based on information from CoinGlass, approximately $149 million worth of Bitcoin futures contracts were closed out within the previous 24-hour period as of November 26th. The majority of these losses, around $113 million, were sustained by those who had taken long positions (bulls), while short sellers only faced liquidations totaling roughly $35 million.

Individual investors frequently view institutional purchase prices as reference points, adjusting their own bids towards these values. During times when the market is highly leveraged, small corrections can escalate into more severe sell-offs as the process of liquidation spreads.

Even though there’s some temporary volatility, the overall perspective for the future stays positive. In fact, with approximately 134,000 Bitcoins withdrawn from circulation in November alone, the company is essentially securing its liquidity, reducing the amount of Bitcoin that could potentially satisfy future demand.

Over time, this could amplify price momentum during the next surge in buying interest.

Experts shed light on BTC’s path

Bitcoin’s recent dip might seem alarming, but professionals within the cryptocurrency realm are advising tranquility – and they have a point.

As a researcher delving into the fascinating world of cryptocurrencies, I’ve been intrigued by recent insights from Santiment, a prominent on-chain analytics provider. Their findings have brought to light an intriguing pattern: the conduct of significant Bitcoin holders.

❓ Should we be alarmed that Bitcoin started the week by slightly dipping below $95K? It seems that whales and sharks are not panicking. In fact, wallets holding at least 10 BTC have added an additional 63,922 coins (equivalent to $6.06B) in November alone. As they continue to move their…

— Santiment (@santimentfeed) November 25, 2024

In contrast to Bitcoin’s drop in value below $95,000 this week, wallets containing at least 10 Bitcoins have been actively accumulating, amassing over 63,922 bitcoins just in the month of November. This amounts to a staggering worth of approximately $6.06 billion.

According to Santiment, the growth in these wallets’ holdings could potentially make any decline they experience relatively brief.

During the dramatic rise in 2021, the CEO of CryptoQuant, Ki Young Ju, noted that significant drops of around 30% were frequent events.

In even the steepest upward trend, such as a parabolic bull run, Bitcoin can experience drops of up to 30%. During the price surge from $17,000 to $64,000 in 2021, such corrections were common.

— Ki Young Ju (@ki_young_ju) November 26, 2024

According to him, these price decreases were simply a regular aspect of the Bitcoin value exploration journey that propelled its value from $17,000 to $64,000 within a short span of time. In his words, “We’re experiencing a bullish trend.

Enhancing the optimistic outlook is crypto analyst Michaël van de Poppe, who underscores a significant distinction between this cycle and previous ones: the marked decrease in Bitcoin holdings kept on exchanges.

As a crypto investor, I’ve noticed a significant shift from past cycles – the amount of Bitcoin (BTC) held on exchanges has dramatically dwindled and continues to do so. This trend indicates an upcoming supply shock due to the massive influx of liquidity. Based on this pattern, I firmly believe that we’ll reach heights far beyond our expectations during this cycle.

— Michaël van de Poppe (@CryptoMichNL) November 25, 2024

This decrease in circulating Bitcoin (BTC) indicates an increasing trend of investors storing their BTC long term, thereby limiting the amount readily available for trading. Van de Poppe interprets this phenomenon as foreshadowing a “supply shortage,” potentially amplified as more liquidity enters the market.

Given the current trend where demand exceeds the available supply, it seems possible that Bitcoin might reach higher levels than we currently anticipate, as suggested by his prediction: “During this cycle, we will climb significantly beyond what everyone now expects.

What to expect next?

Regarding Bitcoin, the current concern revolves around investor actions and economic influences. While larger investors and long-term holders continue to purchase available coins, short-term fluctuations in price continue due to adjustments being made by speculative traders.

The market seems to be in a delicate situation, potentially trending towards either a period of stabilization around $90,000 to $95,000, or a more significant drop to the $85,000 mark. This could be due to issues with liquidity and the arrangement of derivatives.

In spite of these conditions, the underlying factors – like dwindling reserve levels and persistent accumulation – suggest that any drops are likely to meet substantial purchasing demand.

This situation could lead to a possible recuperation should demand suddenly surge, particularly during the holiday period when there’s usually an uptick in retail investment activities.

In other words, investors of altcoins need to be careful. A decrease in Bitcoin’s influence may indicate potential opportunities for altcoins, but a significant drop in Bitcoin’s value could drag the whole market down, which seems to be happening now.

Adding to the uncertainty in the markets is the increased political risks. The intensifying Russia-Ukraine tension and growing instability in the Middle East could potentially trigger market disruptions, increasing investors’ cautiousness.

These advancements might briefly cause a dip in cryptocurrency optimism, especially for alternative coins, as investors tend to shift towards more secure investments during such times.

In light of the current situation, everyone is eagerly awaiting the Federal Reserve’s meeting in December, as its decisions could significantly impact various financial markets, including cryptocurrencies.

At the moment, it’s estimated that there is a 52% chance the Federal Reserve may lower interest rates by 0.25%, which would result in rates falling to a range of 4.25% to 4.5%.

As a researcher, I’m exploring the potential implications of this proposed reduction. If it indeed comes to fruition, it seems that it could serve as a catalyst for Bitcoin and the wider cryptocurrency market. This is because it might lessen the cost of borrowing and enhance liquidity, which could propel further growth in these markets.

Therefore, the short-term direction of Bitcoin is likely influenced by a delicate equilibrium between stockpiling and general market feeling. Remember to trade prudently and never risk more capital than you are willing to potentially lose.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-11-26 20:17