As a seasoned researcher who has closely followed the crypto market for years, I find myself deeply concerned about the ongoing saga between Binance and WazirX. The recent comments by Changpeng Zhao (CZ) have only added fuel to the fire, leaving users in a state of uncertainty and frustration.

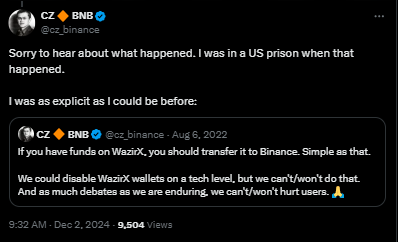

Approximately four months following the $2000 crore WazirX hack incident, Binance‘s founder Changpeng Zhao publicly commented on Monday, essentially telling the 4.4 million affected users, “I warned you.” The relationship between Binance and WazirX, which was intended to be sealed through an acquisition deal in 2022, has since been strained.

In a series of tweets, Cz has reiterated earlier statements that underscore ongoing disagreements about WazirX’s administration and accusations that Binance froze approximately $17 million in user assets.

Users are pushing for tangible changes from CZ, expressing a strong need for action – particularly in response to the hacking incident involving WazirX earlier this year.

In a tweet, well-known cryptocurrency figure Aditya Singh voiced his discontent about Nischal and WazirX asserting that Binance has immobilized approximately $17 million worth of user assets. These funds are currently inaccessible.

He requests further explanation about this from CZ, asking, “Would be greatly appreciated if you or Binance could provide more clarity on this matter.

The controversy stems from an unresolved acquisition deal between Binance and WazirX’s parent company, Zanmai Labs. While Binance insists it never completed the acquisition due to unfulfilled obligations, WazirX maintains that Binance’s involvement created ambiguity, deepening the rift.

The ongoing disagreement over who owns WazirX has added another layer of complexity to the aftermath of the platform’s hack, during which more than half of customers’ assets were stolen and laundered.

Amidst ongoing regulatory scrutiny and accusations, such as claims of FEMA violations by Indian authorities, users find themselves without guidance. CZ’s public statements may be abundant, but they have yet to address the issue of recovering funds. Indian crypto enthusiasts fear that this dispute could further erode trust in an already fragile market, potentially impacting investor confidence.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-12-02 10:12