As someone who has been closely following the cryptocurrency market since its inception, I find Bitwise’s 2025 predictions to be not only intriguing but also plausible. The potential growth of Bitcoin, stablecoins, and tokenized real-world assets could significantly reshape the financial landscape we know today.

Is it possible that by the year 2025, Bitcoin could reach a value of $200,000, cryptocurrency unicorns might make their Wall Street debut, and tokenized assets could become commonplace? Here’s a breakdown of the reasoning behind this prediction.

2024 saw a remarkable transformation in the cryptocurrency market, as significant achievements dominated the landscape all year long.

In light of current circumstances, Bitwise has presented a set of daring forecasts for the year 2025, highlighting potential future developments within the sector.

Let’s delve deeper into every prediction, understanding the underlying market circumstances, so we can evaluate their feasibility and potential impact on the industry’s future.

Table of Contents

Bitcoin’s rise fueled by ETFs and adoption

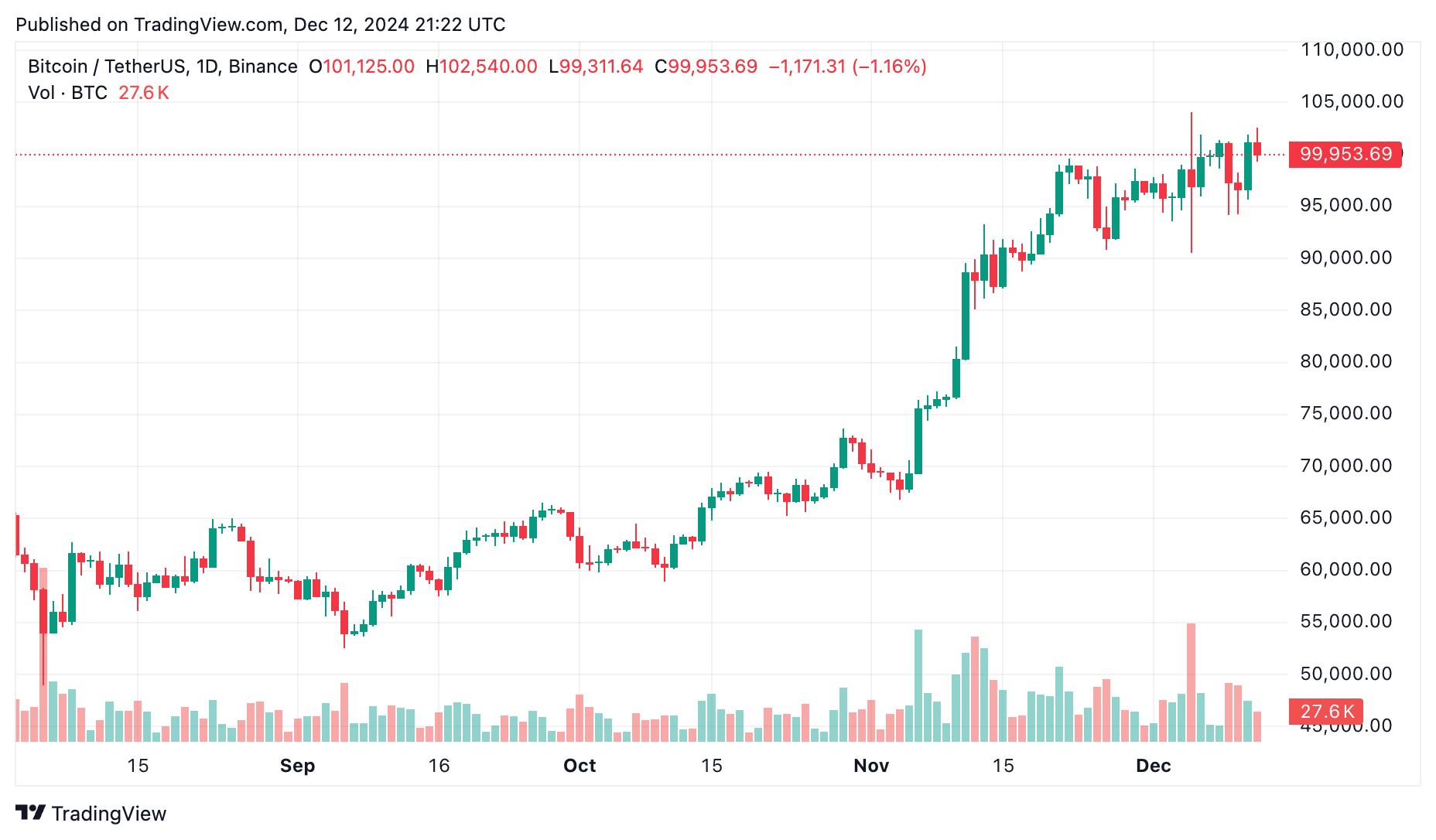

One way to rephrase the given text could be: The initial prediction is that Bitcoin (BTC) will surge past $200,000 by the year 2025. At the moment, as of December 12th, its value stands at approximately $100,500, a slight dip from its peak of $103,900 which it reached on December 5th, only a week prior.

This dip represents a decrease of 3.5%, occurring after a general market adjustment that followed a remarkable bull market trend earlier in the year.

Initially, Bitcoin surpassed its prior record peak of $73,000 in March, triggering an optimistic surge that peaked in November following the election of Donald Trump as the 47th President of the United States.

His administration’s perceived pro-crypto stance has injected fresh confidence into the market. While the recent pullback may have tempered the frenzy, the overarching bullish sentiment remains intact.

Bolstering this positivity is the rapid expansion of Bitcoin ETFs, with Bitwise forecasting an increase in investments next year (2025) that could surpass the inflow seen in 2024.

Starting from January this year, the introduction of spot Bitcoin ETFs has led to a remarkable accumulation of managed assets, now standing at approximately $113 billion, as confirmed by CoinGlass on December 12th.

Among various digital asset funds, BlackRock’s iShares Bitcoin Trust (IBIT) is leading the way, attracting the majority of investments. In the last week alone, an unprecedented $3.85 billion was invested in these funds, with BlackRock accounting for approximately $2.6 billion of that total.

Bitwise’s third projection aligns strongly with the initial two, predicting that the count of nations possessing Bitcoin could nearly double by 2025. The notion of sovereign nations amassing Bitcoin isn’t novel, but it is gaining momentum as governments become aware of its potential as a valuable reserve asset.

At present, eight countries have Bitcoin in their possession. The United States is in the front with approximately 207,000 Bitcoins, which equates to over $20.6 billion at current values. China comes in second with about 194,000 Bitcoins, valued at around $19.3 billion.

As an analyst, I’d rephrase it as follows: Among other significant holders, I am part of a group that includes the United Kingdom, Ukraine, Bhutan, and El Salvador. Our individual Bitcoin holdings vary from a few thousand to tens of thousands. Collectively, our nations control approximately 2.52% of the total Bitcoin supply, which equates to around 529,558 BTC out of the 21 million coins in circulation.

Should the tally of nations adopting Bitcoin truly double, it might lead to a significant transformation in global political tactics, as Bitcoin potentially takes on a role as an innovative form of reserve currency.

Coinbase and MicroStrategy’s market potential

As an analyst, I’m projecting that the value of Coinbase (COIN) shares could surpass $700 per share by 2025, based on Bitwise’s latest forecasts. At present, the stock is trading at around $313, having already achieved a 100% year-to-date growth.

In terms of historical prices, Coinbase peaked at $429.54 on its initial release on April 13, 2021, but hit a low of $31.55 on January 5, 2023.

From its all-time low to today’s price, the stock has surged by over 900%, showing a dramatic turnaround. However, achieving the predicted $700 mark would require an additional 120% increase.

Another fascinating prediction centers on Coinbase’s potential entry into the S&P 500 and MicroStrategy’s potential inclusion in the Nasdaq-100.

Joining the S&P 500 for Coinbase implies it has grown into a top-tier company, similar to those recognized as blue-chip stocks. These are firms that hold a significant market value (over $18 billion) and satisfy certain earnings requirements.

Despite experiencing fluctuations following its Initial Public Offering (IPO), Coinbase demonstrated resilience with its robust comeback in 2023 and steady progress in 2024, positioning it as a potential inclusion in the index due to its solid performance.

Instead of being just a business software company, MicroStrategy has now become a trailblazer in the corporate Bitcoin sector, significantly enhancing its market standing. This transformation has led to a remarkable surge in its stock price by approximately 500% this year, currently trading at around $411 (though it previously reached $543 as its 52-week high).

There’s been a lot of excitement about MicroStrategy potentially joining both the Nasdaq-100 and the S&P 500. As Bloomberg ETF analyst Eric Balchunas suggests, the company appears to be a strong contender for the Nasdaq-100, with an announcement likely coming soon.

It appears that Moderna ($MSTR) may join the SPDR S&P 500 Trust ETF ($QQQ) on December 23, following an announcement on December 13. This is symbolic for Moderna, as it suggests its increasing prominence. According to @JSeyff’s predictions, if added, Moderna would represent approximately 0.47% of the ETF’s total holdings, making it the 40th largest holding. There are around $550 billion worth of ETFs that track this index. It’s likely that Moderna will be included in the S&P 500 next year.

— Eric Balchunas (@EricBalchunas) December 10, 2024

Nevertheless, getting included in the S&P 500 might be harder because of tougher requirements and the index committee’s careful selection process.

2025 may see at least five cryptocurrency billion-dollar companies (crypto unicorns) making their public debut in the U.S., given that there are approximately 30 such firms currently active within the country, including notable ones like Ripple (XRP), OpenSea, and Chainalysis. The pool of potential Initial Public Offerings (IPOs) appears to be substantial.

An increase in Initial Public Offerings (IPOs) for cryptocurrency projects wouldn’t just create fresh avenues for investing, but it would also indicate the industry’s evolution – moving from a specialized niche towards becoming more mainstream.

Crypto’s path into 401(k) plans

Bitwise’s next prediction for 2025 revolves around the U.S. Department of Labor potentially relaxing its current guidance against including crypto in 401(k) retirement plans.

To fully grasp the possible repercussions, it’s crucial to initially examine the existing situation and the reasons behind the heated debate surrounding cryptocurrencies in retirement plans.

Currently, the Labor Department is taking a careful approach regarding cryptocurrency in retirement plans. Back in March 2022, they released a notice, advising managers (fiduciaries) to be extremely vigilant when considering crypto investments within 401(k) options.

The Department of Labor expressed worries over the speculative characteristics of digital currencies, their high price fluctuations, unclear regulations, and potential threats of fraud and theft.

The agency contends that these elements render digital assets inappropriate for the majority of retirement investors, as they have extended investment timelines and a relatively low tolerance for risk.

In most cases, crypto assets have not been incorporated into 401(k) plans. Even when attempts have been made to integrate them, like Fidelity’s addition of a Bitcoin option for their 401(k) plans in 2022, these moves have sparked instant criticism.

The Department of Labor advised Fidelity and comparable product providers to maintain adherence to their fiduciary responsibilities, implicitly suggesting that a wider implementation may not be favored.

Because employers are cautious about taking on possible legal risks, there’s been a relatively small representation of cryptocurrencies in retirement investment plans.

If the forecast for lax regulations on cryptocurrencies in 2025 proves accurate, it would represent a significant change in policy. This change might primarily stem from an increasing desire for crypto acceptance among upcoming workforces who view digital currencies as a valid investment category.

Research repeatedly indicates that young investors from the millennial and Gen Z generations consider cryptocurrencies as essential elements in their long-term financial planning. For instance, a Charles Schwab survey conducted in 2023 revealed that about 47% of millennials currently possess crypto assets, while 45% are keen on adding it to their retirement funds if provided the opportunity.

As a crypto investor, I can’t help but feel the ripples of excitement when considering the potential market impact of this change. The Investment Company Institute reports that as of December 2023, U.S. 401(k) plans were holding an astounding $7.7 trillion in assets. If even a tiny fraction of these funds were to flow into the crypto market, it would bring a massive influx of liquidity and undeniably legitimize this space further.

Stablecoins and tokenized assets

In simpler terms, Bitwise anticipates some daring projections about the stablecoin market and the area involving tokens representing real-world assets by 2025.

In simple terms, it’s projected that the value of stablecoin assets could potentially double, reaching approximately $800 billion, which is significantly higher than their current market value of around $207 billion (as observed on December 12).

In this particular market, USDT (Tether) holds a substantial lead, accounting for around 67.6% of the total share. This strong position is supported by its impressive market capitalization of about $140 billion.

Compared to USDT’s market capitalization, which stands at approximately $126 billion, its main rival, USD Coin (USDC), trails significantly with a market cap of $41 billion. This means USDC is about 3.4 times smaller.

Stablecoins are frequently used as trading pairs on exchanges, providing a bridge between crypto assets and fiat currencies. Moreover, their role in facilitating cross-border transactions has also gained attention, particularly in regions with limited access to traditional banking services.

As a researcher delving into the realm of tokenized real-world assets, I’m projecting that this market could surge to a staggering $50 billion by the year 2025. Interestingly, a report published by Binance in September 2024 revealed an unprecedented peak in the total value of these tokenized assets, surpassing $12 billion – it’s important to note that this figure excludes stablecoins.

The value of digital assets directly tied to real-world items has hit an unprecedented peak.

In our latest analysis, we delve into this surge, identify primary categories of these assets, and offer a tech-infused journey through some of the most intriguing platforms shaping the landscape.

Dive in below 🔽

— Binance Research (@BinanceResearch) September 13, 2024

Representation of Wide Assets (RWAs) signify digital counterparts of tangible and intangible assets like property, securities, goods, and artwork. Through the process of tokenization, these assets can be broken down into smaller parts, making them easier for numerous investors to acquire.

Important areas within the Real Asset World (RWA) involve securitized U.S. Treasury bonds, personal loans, mortgages, and property, while newer sectors like carbon offsets and land rights above buildings are growing in popularity.

Already, conventional asset managers are turning these illiquid assets such as properties and artwork into digital tokens, making it possible for investors to expand the diversity of their investments in areas that were once hard to access or expensive.

By 2030, a McKinsey study predicts that the value of the tokenized market might reach an impressive $2 trillion, driven by rising interest in clarity, convenience, and shared ownership within the financial sector.

The road ahead

The crypto market’s future seems promising, as Bitwise anticipates significant transformations by 2025. It’s possible that Bitcoin may reach unprecedented peaks, stablecoins might double their worth, and tokenized real-world assets could emerge as the next groundbreaking trend. However, these developments hinge on the expansion of the market, regulatory adaptations, and technological advancements.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-12-13 02:25