As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles, but the current Bitcoin rally is truly remarkable. Having closely followed the cryptocurrency since its early days, it’s fascinating to see how it has evolved from a niche asset to a mainstream investment option.

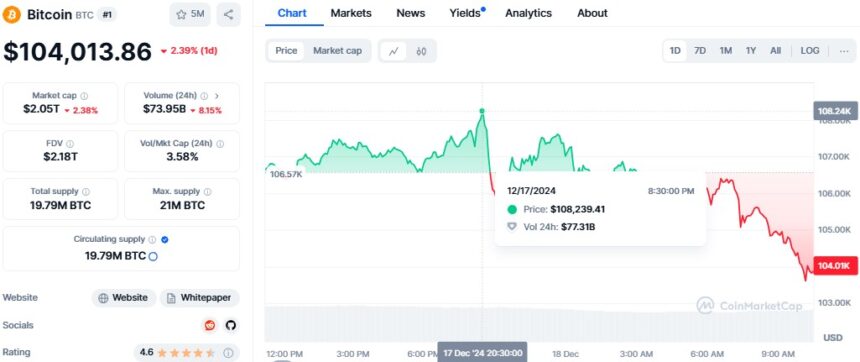

On Tuesday, Bitcoin peaked at a record-breaking $108,239, but then momentarily halted its progress and dropped to $104,013 by Wednesday midday in Singapore. This slight dip didn’t deter the overall worth of digital assets, which almost reached an impressive $4 trillion during the surge, indicating robust investor enthusiasm.

There’s a growing sense of optimism among traders, particularly due to President-elect Donald Trump’s backing of cryptocurrencies. His pledge to enact supportive regulations and potentially set up a national Bitcoin reserve has ignited market excitement.

Moreover, the anticipation of MicroStrategy joining the Nasdaq 100 Index is fueling optimism, as it’s believed that this move might result in increased share prices, considering the firm’s emphasis on Bitcoin-related investments.

It’s generally anticipated that the Federal Reserve will lower interest rates by a quarter-point in the near future. However, predictions about next year’s situation are clouded due to strong U.S. economic development and possible inflation concerns stemming from President Trump’s policies.

K33 Research experts predict that the Federal Reserve’s last monetary policy decision in 2024 might trigger market fluctuations. However, they believe the upward trend for Bitcoin could persist during the festive period.

Since Trump’s win in the presidential election, Bitcoin has experienced a substantial increase of more than 55%. Even amidst its volatile nature and absence of conventional value assessment, investors have been attracted to Bitcoin investment funds.

As a researcher, I’ve noticed a notable surge of attention towards Bitcoin hitting the $120,000 mark on Deribit options exchange. However, much like analyst Tony Sycamore from IG Australia warns, investing in Bitcoin at its present levels might come with certain risks that should be carefully considered.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-18 09:41