As a seasoned crypto investor with over two decades of market experience under my belt, I must say that the recent surge of Bitcoin ETFs surpassing gold ETFs in assets under management is nothing short of remarkable. I remember when Bitcoin was just a blip on the radar and gold ETFs were the reigning kings of the market. To see the tables turn so dramatically, with Bitcoin ETFs amassing over $129 billion in just 11 months, is truly a testament to the resilience and potential of this digital asset class.

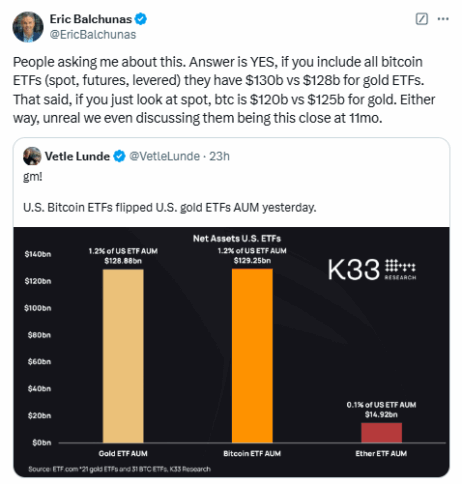

For the first time ever, the collective value managed in Bitcoin-based exchange-traded funds (ETFs) has outpaced that of gold ETFs, reaching $129 billion on December 16, 2024, as reported by K33 Research and Bloomberg analyst Eric Balchunas. This milestone surpasses the $128 billion in assets held by gold ETFs.

The current period is exceptionally favorable for Bitcoin, as Bitcoin ETFs were only introduced eleven months ago, while gold ETFs have been around for over two decades in the market. The rapid expansion of Bitcoin ETFs indicates a growing interest among institutional investors in cryptocurrencies and an overall positive outlook towards Bitcoin’s future prospects.

Leading the way among asset holders is the BlackRock’s iShares Bitcoin Trust (IBIT), currently managing close to $60 billion worth of assets. This year alone, it has outpaced BlackRock’s gold ETF, iShares Gold Trust (IAU).

Although Bitcoin ETFs have now exceeded gold in total Assets Under Management (AUM) overall, when focusing on spot ETFs exclusively, gold holds a slight advantage with an estimated value of approximately $125 billion compared to Bitcoin’s roughly $120 billion. This difference is quite minimal considering the impressive growth Bitcoin has experienced in such a short timeframe.

Investors are capitalizing on the surge of the “dollar devaluation tactic,” a popular investing approach. This strategy is based on growing apprehension about global economic instability, rising inflation rates, and fears over escalating government debt. In response, investors are turning to secure assets like Bitcoin and gold.

Due to recent events, the value of Bitcoin has risen significantly, causing the Bitcoin-to-gold ratio to reach an all-time peak.

By the year 2024, Bitcoin ETFs in the U.S. have amassed over 500,000 Bitcoins, which is approximately 2.5% of the total circulating supply. Currently, this makes them the largest known Bitcoin holder globally, surpassing the renowned Satoshi Nakamoto wallet. It’s clear that U.S.-based Bitcoin ETFs control a significant portion, around 1.1 million Bitcoins, in today’s market.

Experts like James Seyffart from Bloomberg predict that the introduction of a Bitcoin and Ethereum blend ETF might not occur until 2025, when a flood of new cryptocurrency exchange-traded funds (ETFs) are anticipated to arrive on the scene. These upcoming ETFs may also encompass opportunities for Litecoin ETFs and potentially other digital coins as well.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Gold Rate Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-18 12:52