As a seasoned crypto investor with a knack for spotting trends and patterns, I find myself intrigued by the current state of Litecoin (LTC). With over 78% of its addresses held by long-term investors, it’s clear that this coin is more than just a passing fad. The resilience shown during market fluctuations mirrors my own experience as an investor – buy low, sell high, and hold on tight.

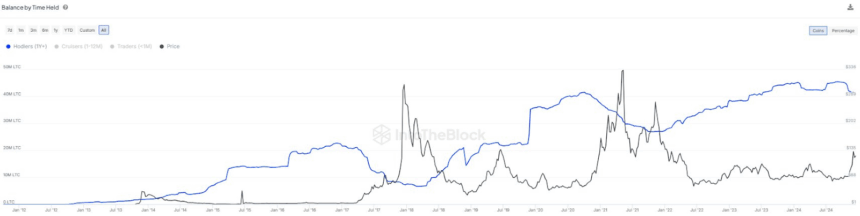

As an analyst, I’ve recently observed that a significant portion, approximately 78%, of Litecoin (LTC) wallets fall into the category of long-term holders or “hodlers” – individuals who tend to keep their coins for extended periods.

These investors typically purchase assets at lower prices and offload them at higher ones. This strategy, which is commonly associated with large-scale investors, remains consistent over time, particularly during periods of significant price increases.

In contrast to previous market cycles, fewer long-term holdings have declined this year, suggesting that many investors are maintaining their positions. It appears they are choosing to wait for increased prices instead of selling at the current moment.

Currently, I find myself observing a pattern in Litecoin’s price action that mirrors its behavior during late 2020. Back then, after the U.S. elections, Litecoin’s value steadily rose from approximately $60 to over $160 at the start of 2021, suggesting a similar trend might be unfolding now.

In the closing stretch of 2024, there was another hike in price, similar to what we saw before. If this pattern persists, experts predict that Litecoin could climb up to $200 by the beginning of 2025. The coin’s recent spike in trading activity and optimistic buy signals suggest that investor attention towards it is growing.

Long-term investors usually keep a calm approach, whereas short-term traders frequently adapt their strategies according to fluctuating market circumstances, particularly when seeking immediate profits in the volatile crypto marketplace.

Despite experiencing both ups and downs, most Litecoin investors remain steadfast in their positions, anticipating higher rewards in the future. Notably, Litecoin’s past trends suggest it tends to fluctuate in cycles, particularly during election years.

2020 saw an increase in value following the U.S. elections, and this year it appears as though a recovery is underway. Additionally, more investment companies are showing interest, with Canary Funds submitting an application for a Litecoin Exchange-Traded Fund (ETF).

It’s widely thought among many that Litecoin could experience a significant price surge, as its potential value is believed to exceed $200 in the near future by quite a few individuals.

Currently, LTC has dropped approximately 8% to $97 due to Federal Reserve Chairman Jerome Powell’s statement that the Fed will not purchase or keep Bitcoin. This announcement triggered a wave of selling in the market, causing it to turn red.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2024-12-20 21:56