As a seasoned crypto investor with a knack for spotting potential opportunities amidst market volatility, I find the recent moves by World Liberty Financial (WLFI) quite intriguing. Despite the ongoing crypto market downturn, WLFI’s strategic purchase of Ethereum at an average price of $3,651 per ETH seems to be a bold and calculated move.

In simpler terms, World Liberty Financial (WLFI), a financial venture connected to the newly elected President Donald Trump that focuses on decentralized finance, has increased its investments in Ethereum, even amidst the current slump in the cryptocurrency market.

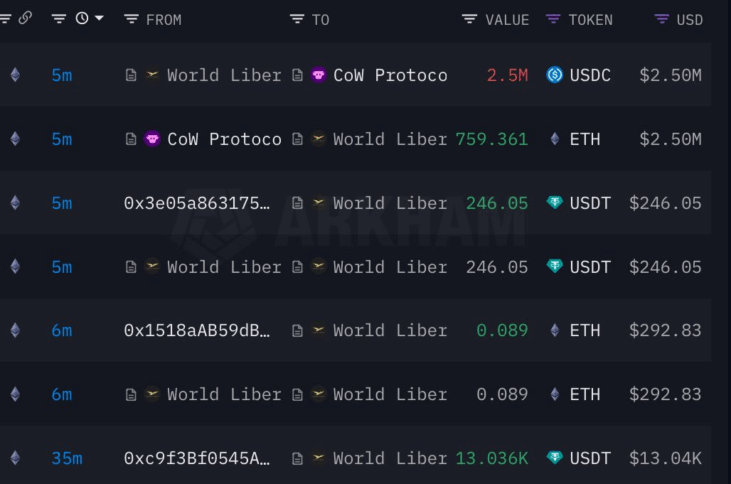

WLFI acquired an additional 759 Ether (ETH), with an average purchase price of approximately $3,651 per ETH. This transaction amounted to roughly $2.5 million. The initiative has been actively buying Ether since December, utilizing USD Coin (USDC) for these transactions.

Currently, WLFI’s Ethereum holdings amount to approximately 16,362 Ether, which equates to around $54.62 million. However, the fluctuations in the Ethereum market have impacted the total Ether returns negatively.

WLFI has spent $35 million on Ethereum, with an average purchase price of $3,651 per ETH. Despite the recent drop in crypto prices, its Ethereum losses have decreased to $3.4 million from earlier estimates.

According to information from Etherscan, the project made an Ethereum purchase of approximately 1,481 ETH in just one day, demonstrating their habit of acquiring during market fluctuations.

In this transaction, Ethereum was bought at an average cost of $3,374.79 each, accumulating a total of more than 9,500 Ether for the month. Additionally, as Coinbase declared they would cease trading in cbBTC, the project exchanged approximately $10.4 million worth of cbBTC for Wrapped Bitcoin.

As a crypto investor, I’m proud to be part of WLFI’s portfolio which currently boasts a substantial holding. We’ve got 103.15 Wrapped Bitcoins (WBTC) valued at approximately $9.83 million, 6,137 AAVE tokens worth around $1.84 million, and an impressive 78,387 Chainlink (LINK) tokens adding up to about $1.75 million. Furthermore, the project also includes smaller investments in tokens such as ENA valued at $740,000 and ONDO worth approximately $230,000.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-21 01:08