As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I’ve learned to expect the unexpected in this wild west of digital assets. The recent crash in meme coin prices on Thursday was a stark reminder that even the most volatile coins can’t escape the broader market sentiment.

On Thursday, I observed a significant drop in meme coin prices, effectively wiping out the majority of the progress we had seen during the Santa Claus rally that occurred on Christmas Eve.

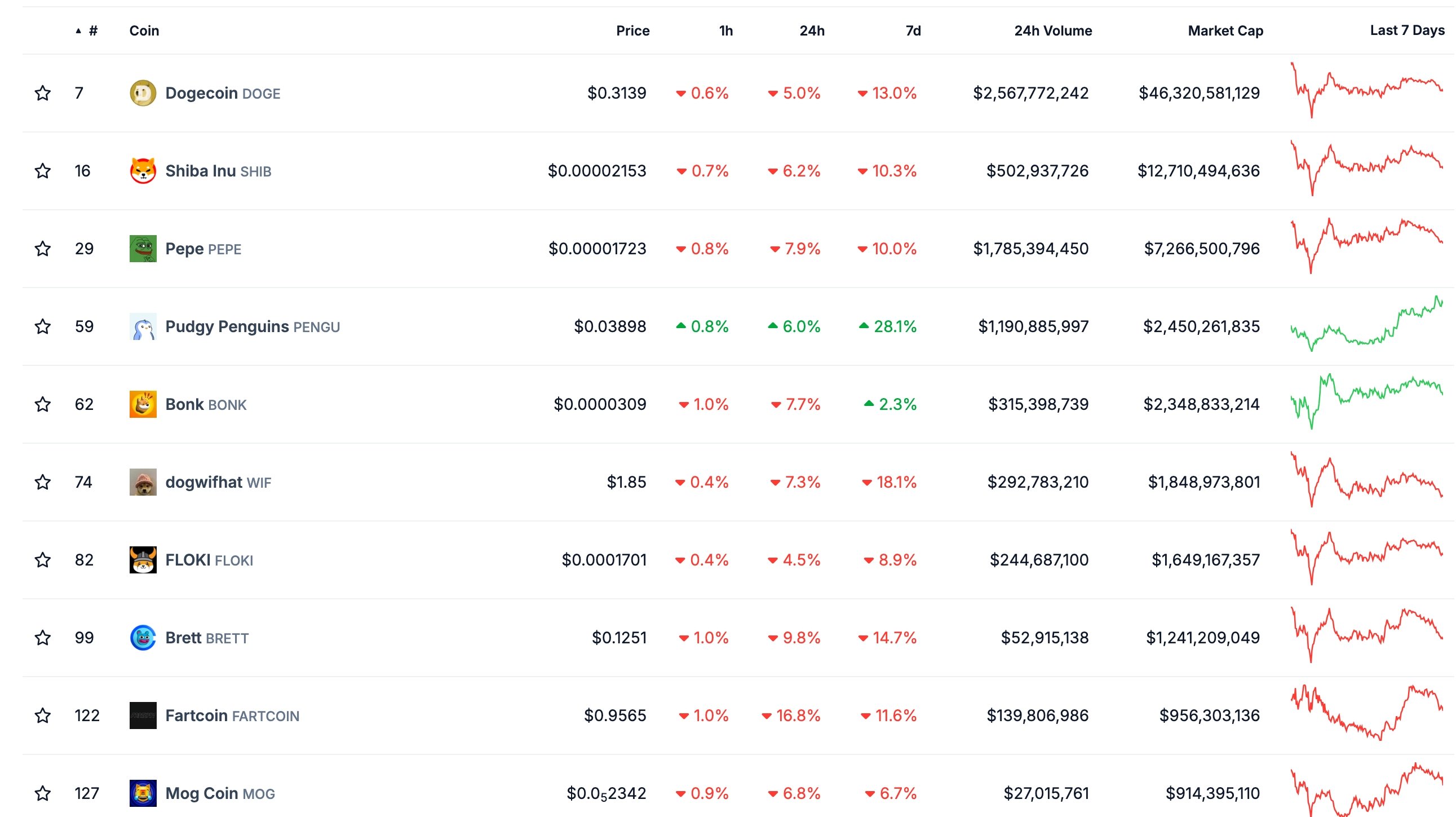

Among the leading meme tokens in the Solana network, Fartcoin (FARTCOIN) experienced a significant decline of approximately 16.8%, which places it among the coins with the most substantial price drops.

Floki (FLOKI) retreated by 4.5%, while Shiba Inu (SHIB) plummeted by 6.5%. Other top laggards in the meme coin industry were Brett, Mog Coin, and Popcat (POPCAT).

PENGU was the only major meme coin in the green, rising by 6% as total sales jumped by 127% in the last 24 hours to $6.1 million.

Meme tokens retreated due to a general risk-averse mood in the cryptocurrency sector, causing most tokens to decrease in value. Bitcoin dipped to approximately $95,000, and the combined market value of all coins dropped to about $3.32 trillion. Notably, meme coins and other altcoins, particularly those known for their volatility, tend to plummet when Bitcoin’s performance is poor.

During the Christmas break, the prices of meme coins, other alternative cryptocurrencies, and even Bitcoin experienced a dip due to a decrease in liquidity within the crypto market. It appears that the majority of investors and traders are enjoying their holidays, leading to reduced trading volume across most cryptocurrencies. On Thursday, Bitcoin saw its lowest 24-hour trading volume since November 3rd, amounting to $33.96 million.

As a crypto investor, I’ve noticed that other meme coins have been experiencing lower trading volumes recently. For instance, Floki’s 24-hour volume dipped to $238 million, marking its lowest point in over a month. Similarly, Fartcoin saw a volume of $187 million, while Shiba Inu had a higher volume of $576 million. It’s essential to remember that when trading volumes are low, cryptocurrency prices can experience significant fluctuations in either direction, which could potentially impact my investments.

The prices of meme coins are decreasing as investors cash out their gains, having seen significant increases throughout the year. For instance, Floki reached a high of $0.0002885 in November, which was double its lowest point in August, while Shiba Inu peaked at $0.000033.

Furthermore, there remains apprehension regarding the Federal Reserve, indicating a projected two increases in interest rates by 2025, which leans towards a more aggressive stance. This shift has caused bond yields to increase, with the 10-year reaching 4.63%, the 30-year and 5-year hitting 4.8% and 4.50% respectively. Typically, when bond yields go up, cryptocurrency prices and stock markets tend to decrease.

Read More

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- USD CNY PREDICTION

- USD JPY PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Gold Rate Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-26 18:00