Over the past weekend, I observed a steady climb in the value of Bitcoin, culminating in a peak of approximately $98,300. This surge followed a significant point of support being established at around $91,405. As an analyst, these price movements are intriguing and suggest potential for further growth.

Over the past six days, the cryptocurrency with the highest market value has experienced an upward trend, aligning with persistent buying and selling activities.

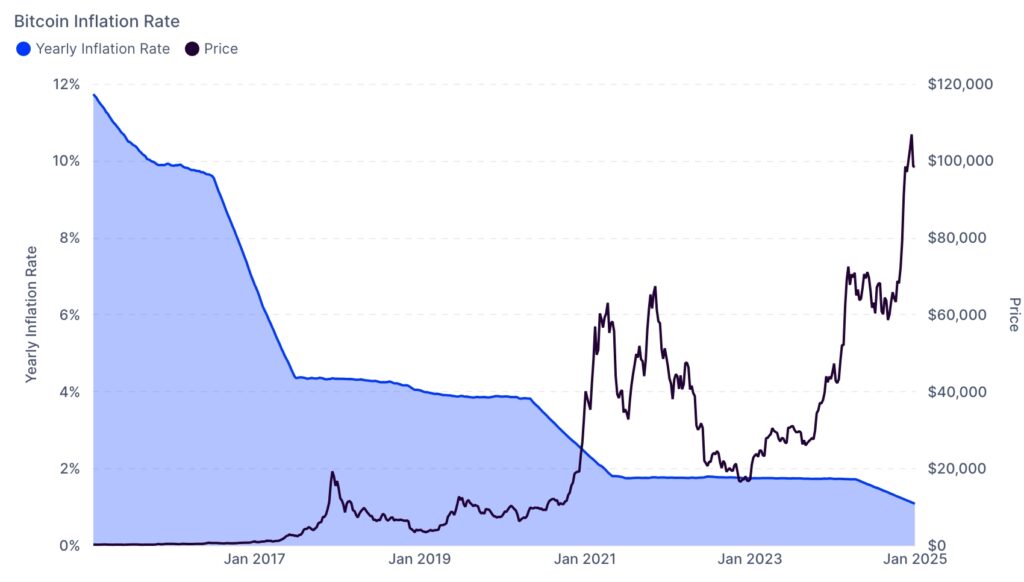

From a production perspective, the mining challenge and processing speed (hash rate) have peaked at all-time highs since the last halving in April. This rise has caused the coin’s inflation rate to drop significantly, sitting currently at 1.11%, which is far less than the U.S. consumer price index rate of 2.7%.

Compared to 2016, it’s now even lower than 12%, and the quantity of Bitcoin (BTC) kept in exchanges is still on a downward trend.

Conversely, demand is growing steadily due to the increasing investment in Exchange-Traded Funds (ETFs). Currently, these funds collectively hold more than $128 billion in assets, with BlackRock’s iShares Core U.S. Aggregate Bond ETF (IBIT) holding approximately $54 billion.

As a crypto investor, I’m excited to see MicroStrategy’s relentless purchase strategy. Currently, they hold more than 450 coins, and based on Polymarket user predictions, it seems they might own over half a million coins by March.

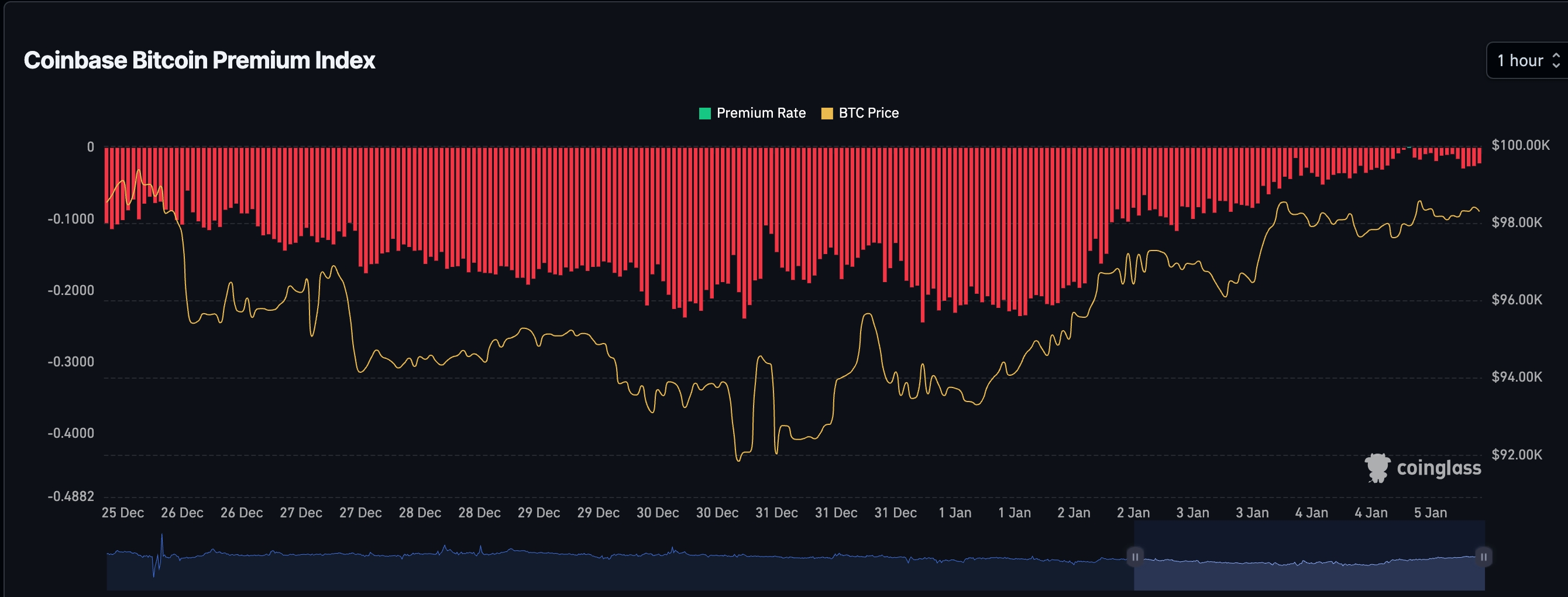

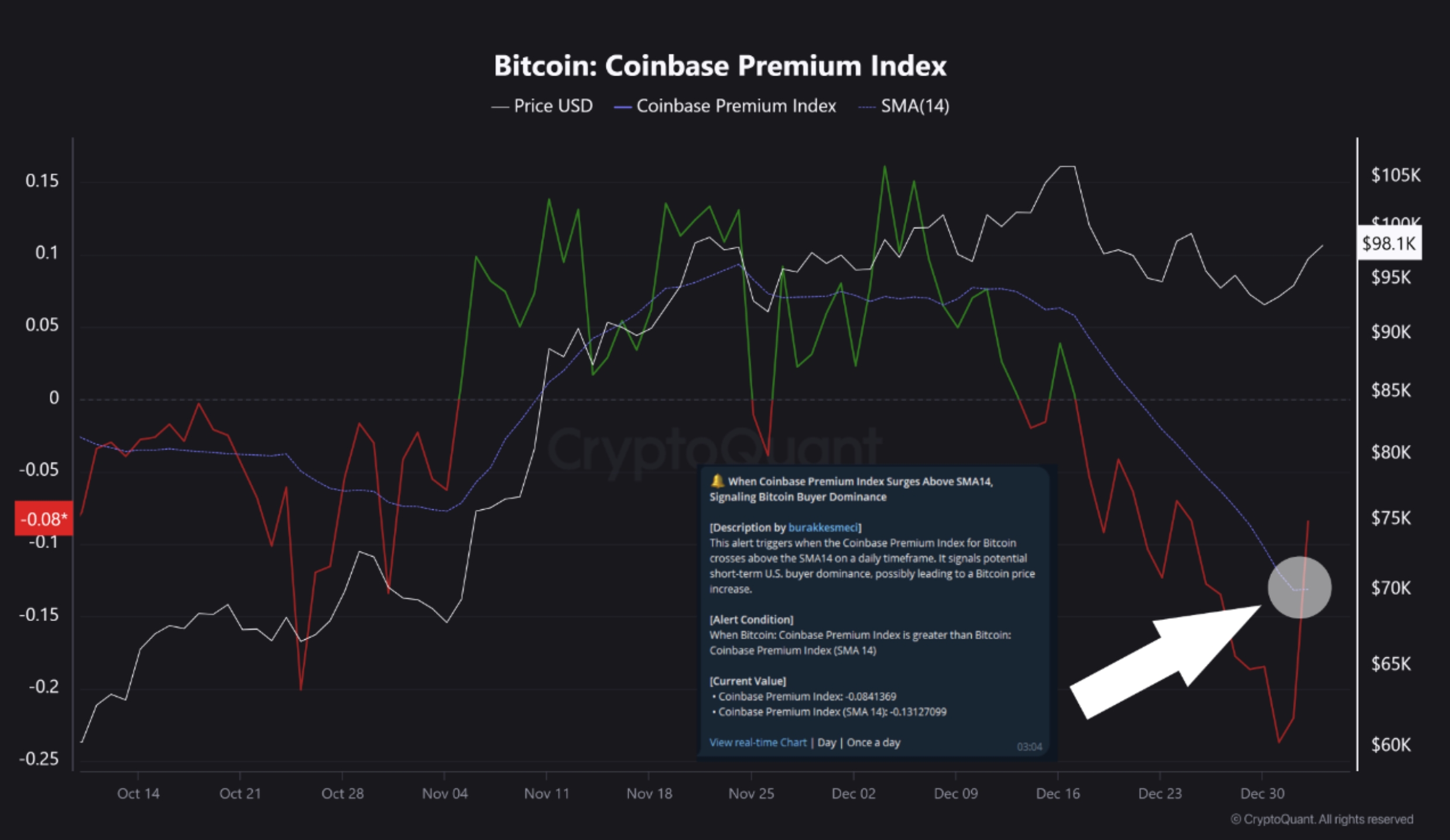

Evidence suggests a rise in Bitcoin purchases among U.S. investors, as indicated by their increased ETF investments. Furthermore, data indicates that the Coinbase Premium Index, which had dropped significantly in December, is now rebounding.

According to CoinGlass, it has moved to minus 0.021, up from minus 0.24 in December.

According to CryptoQuant, the index has risen above its 14-day moving average following a 26-day period, which is typically a bullish signal suggesting potential price growth.

As a crypto investor, I closely monitor the Coinbase Premium Index because it offers valuable insights into buying trends among American investors, including institutional ones. Given that Coinbase is the go-to exchange in the U.S., when this index increases, it’s a potential sign that a substantial chunk of our nation’s capital could be accumulating, which might influence the broader market dynamics.

Furthermore, Bitcoin is set to encounter other significant triggers, such as the inauguration of President-elect Donald Trump and the forthcoming FTX distributions worth an estimated $16 billion.

It’s possible that a few beneficiaries of these resources might decide to put their money into Bitcoin and other virtual currencies. Furthermore, as crypto.news shared last week, Bitcoin’s MVRV ratio remains relatively low—an indicator suggesting it may be underpriced.

Bitcoin price analysis

Over the recent days, the daily graph indicates a recovery in BTC’s price. It has experienced an upward trend for the last six consecutive days, consistently staying above its 50-day moving average.

Bitcoin has received significant backing at the crucial support level of $91,400, a point it has repeatedly been unable to drop below since December.

As a researcher analyzing market trends, it appears that there’s a strong possibility of continued growth, with bulls aiming for the record high of $108,000. If we manage to surpass this level, it could signal further increases, potentially reaching the 38.2% Fibonacci Retracement point around $114,000.

On the other hand, creating a head and shoulders pattern can be quite uncertain, potentially resulting in a downward break below the level of $91,400, indicating a bearish trend.

Analyst’s bearish take

According to analyst Jacob King from WhaleWire, there might be indicators pointing towards a possible downturn or a ‘bear’ trend in the Bitcoin and wider cryptocurrency market.

On a recent social media update, the monarch emphasized various advancements such as MicroStrategy scaling back on its Bitcoin buying spree, El Salvador possibly moving away from crypto-centric policies, and BlackRock disposing of substantial amounts of Bitcoin assets.

As an analyst, I find myself reflecting on recent trends in Bitcoin (BTC). MicroStrategy’s ongoing Bitcoin purchases appear to be diminishing, potentially indicating increased risk. Simultaneously, El Salvador is reportedly reconsidering its BTC adoption policies, which could have significant implications. Furthermore, BlackRock, a major player, is observed offloading record-breaking amounts of BTC. Additionally, Tether’s lack of new minting over the past 20 days has led to Bitcoin stagnation. These developments collectively paint a picture that might suggest a potential shift in the Bitcoin landscape.

— Jacob King (@JacobKinge) January 3, 2025

King has accused MicroStrategy’s approach as a massive scheme that is not long-term viable. Moreover, he noted that Tether (USDT) stopped creating new coins for more than 20 days, which aligns with the cryptocurrency’s recent price plateau.

In a cautionary tone, King described the current state as a “peaceful period preceding a turbulent one,” implying that a decline in the cryptocurrency market could coincide with a significant drop in the stock market. He advised investors to carefully evaluate their potential risks.

At last check Sunday, BTC was trading at $98,035.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-01-05 20:26