Over the weekend, Ethereum found itself in a tense state due to significant withdrawals from its exchange-traded funds, an increase in exchange holdings, and a decrease in staking rewards.

Currently, Ethereum (ETH) is being exchanged at approximately $3,268, representing a drop from its previous peak this month of $4,104. Notably, the trend for Ethereum resembles that of Bitcoin (BTC), which has seen a decrease from its record high of $108,000 to currently trading below $95,000.

Over the past few days, there’s been a retreat for Ether as data indicates a decline in its ETF demand on Wall Street. As per SoSoValue, all Ethereum funds experienced a loss of approximately $68 million in assets on Friday, following a loss of around $159.3 million the previous day and $86 million two days prior.

Currently, these investment funds hold approximately 11.61 billion dollars’ worth of assets, which equates to about 2.96% of Ethereum’s total market value. On the other hand, Bitcoin ETFs manage around $107 billion in assets, representing around 5.2% of Bitcoin’s market cap.

Currently, as reported by CoinGlass, the amount of Ethereum held on centralized platforms has increased this year. At present, there are approximately 15.8 million Ethereum coins stored on these exchanges, representing a growth from 15.30 million on December 30th.

As an analyst, I’ve observed that an increase in exchange balances suggests that investors are shifting their tokens from their personal wallets to centralized exchange platforms. This action typically precedes the sale of these digital assets on these platforms.

It appears that recent data indicates Ethereum’s futures open interest has decreased significantly from its peak in December of $31.1 billion. This decrease suggests a drop in demand for Ethereum futures, as the daily open interest over the past five days has remained at approximately $28.4 billion, well below the December high.

From my personal perspective as a crypto investor, it’s fascinating to note that when open interest in Ethereum and other digital currencies decreases, they tend to bounce back. For instance, the surge in ETH’s price, which kick-started its recent rally, occurred in November when the interest dipped down to a staggering $14 billion.

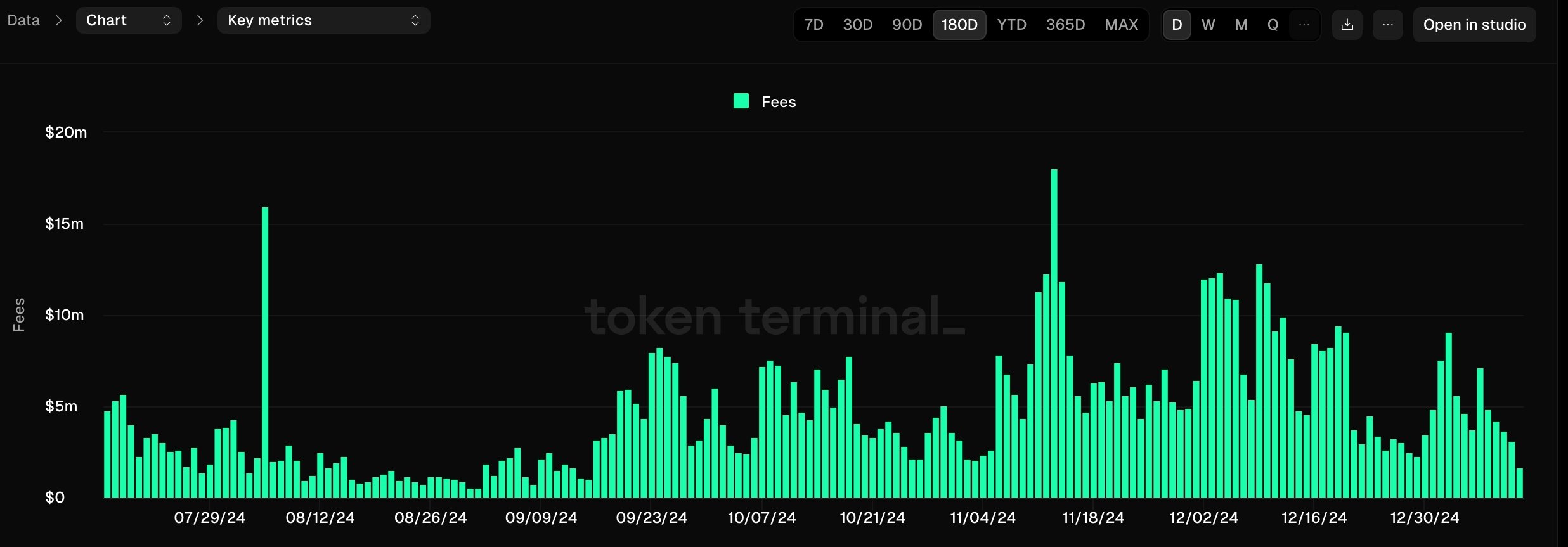

Currently, individuals who stake Ethereum are earning less compared to those staking Solana or Tron. For instance, Ethereum has a staking reward rate of 3.10%, whereas Solana (SOL) and Tron (TRX) offer rates of 7% and 4.52% respectively, according to StakingRewards. The reason for the lower yield in Ethereum staking is due to two factors: more tokens being delegated to staking pools and a decrease in transaction fees. As you can see from the graph, Ethereum’s transaction fees have been trending downward over the past few weeks.

Ethereum price chart analysis

Each day’s graph indicates that the Ethereum (ETH) price hit an all-time high of $4,104 in December. This peak created a double-top formation, and the support line for this pattern is around $3,520.

The price of Ethereum has fallen below its 50-day moving average at $3,415 and has found strong resistance at this level. However, it has received significant support from the 100-day moving average. Additionally, Ethereum’s price has also found support at the upward trendline that links its lowest points since November 15th.

It appears the coin might be shaping up as a head-and-shoulders pattern, which is often seen as a bearish signal. If it falls below its 100-day moving average and the rising trendline, this could indicate a bearish collapse, possibly down to around $2,820 – a level not seen since last August.

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2025-01-12 16:00