The cost of Bitcoin once again moved upward, approaching its maximum historical value of approximately $108,200, in the period before Donald Trump’s inauguration and following the optimistic United States inflation statistics release.

On Friday, the price of Bitcoin (BTC) reached an all-time high of $105,847, which is the highest it’s been since December 18th, and a substantial increase from its current week’s minimum of $82,055.

Enthusiasts of cryptocurrency are probably celebrating the forthcoming Trump inauguration, anticipating possible regulatory adjustments that may ensue. Trump has expressed his intention to foster a pro-crypto presidency, with the aim of making the United States a global leader in cryptocurrencies.

As a crypto enthusiast, I’ve noticed that the United States leads in cryptocurrency mining. However, it’s frequently pointed out by skeptics that Bitcoin’s energy-heavy proof-of-work mining system conflicts with efforts aimed at energy conservation.

Trump, the latest creator of a meme cryptocurrency, is simultaneously overseeing World Liberty Financial, a significant crypto venture which has garnered millions in funding, with Justin Sun being one of its notable investors.

The administration is also focusing on giving priority to digital currencies like cryptocurrencies, which could potentially result in significant investments. In the recent past, exchange-traded funds (ETFs) based on spot Bitcoin have experienced inflows of approximately $755 million and $626 million over the last two days, collectively totaling around $38 billion.

There’s been a significant increase in the likelihood, now at 42%, that Trump may establish a strategic Bitcoin reserve within the initial 100 days of his term, which was previously as low as 20% this year.

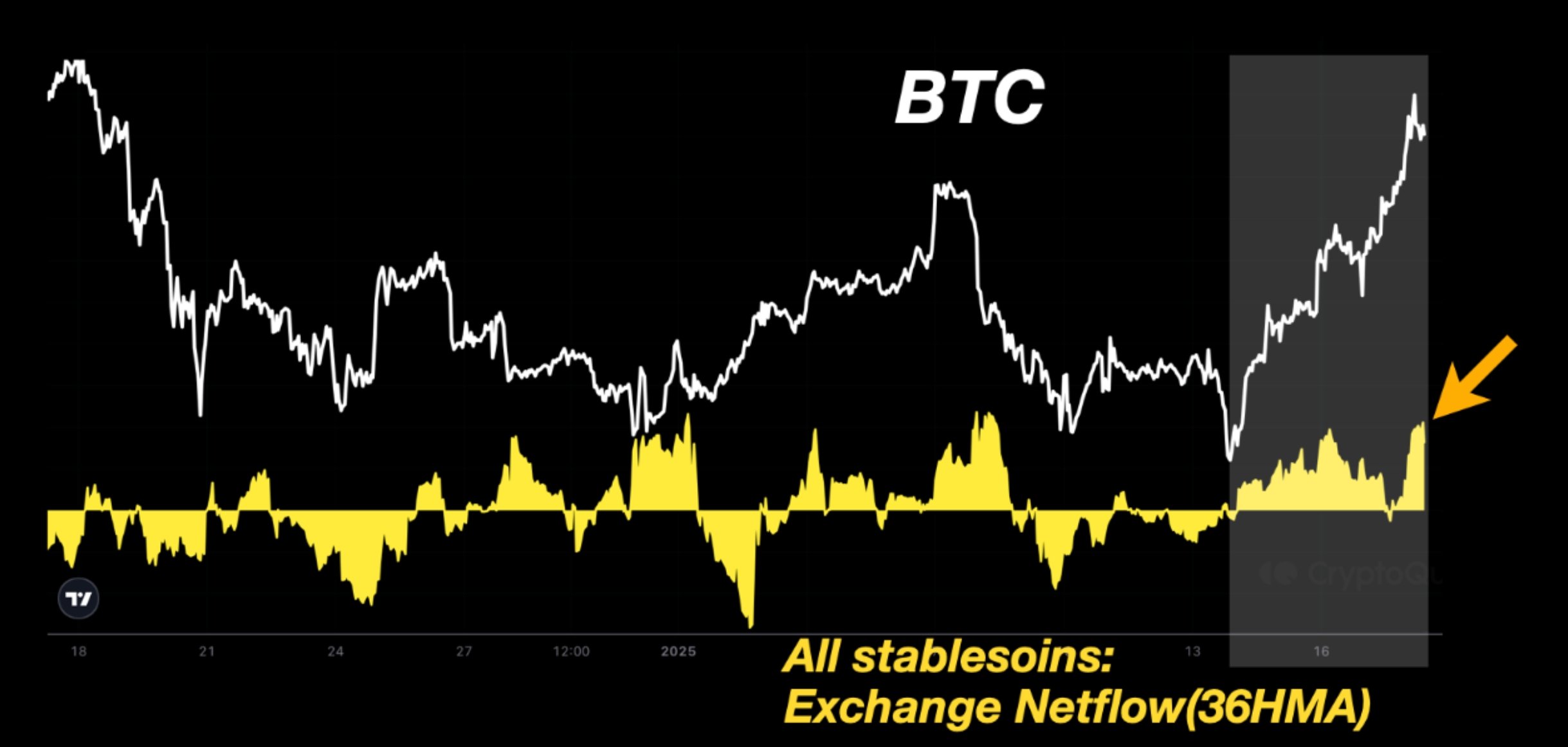

As an analyst, I’m observing that the consistent influx of stablecoins into cryptocurrency exchanges could potentially serve as a significant catalyst propelling Bitcoin prices to unprecedented highs. The reason being, these stablecoins are primarily utilized for purchasing not only Bitcoin but other digital currencies as well.

Bitcoin price has strong technicals

This week’s graph demonstrates that the value of Bitcoin has increased significantly. It has developed a bullish engulfing pattern, which is often seen as a good omen. This pattern is characterized by a large bullish candlestick that entirely envelops a previous bearish candlestick.

Bitcoin has developed a bullish pennant formation, characterized by a lengthy upward sloping line and a symmetric triangle. Such patterns usually result in a powerful surge, similar to the one observed in Ripple (XRP) this past week.

XRP was forming a pennant pattern since November last year.

From my perspective as an analyst, Bitcoin continues to maintain positions above both its 50-week and 100-week moving averages, demonstrating a robust and sustained upward trend. Furthermore, it has significantly surpassed the upper boundary of the cup and handle pattern that was established between early 2021 and last November, signifying an impressive breakout from this technical formation.

Consequently, it’s quite possible that Bitcoin will experience a significant surge, potentially reaching its peak value of $108,200 once more. If it manages to break free from this level, we might even see it climb up to the next significant milestone at $100,000.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- USD CNY PREDICTION

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- Gold Rate Forecast

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2025-01-18 19:42