Ah, the enigmatic Ethereum price, a creature of habit, has decided to take a leisurely stroll this month, leaving cryptocurrency investors twiddling their thumbs on the sidelines. But fear not, dear reader! There are whispers of fundamental and technical catalysts that might just give it a little nudge upwards. 🚀

As of this fine Tuesday, Ethereum (ETH), the second-largest cryptocurrency, is lounging at a cozy $2,700. This is a staggering 35% drop from its lofty heights in November, a price point that seems to have a peculiar affinity for the same date in 2024. Time is a funny thing, isn’t it? ⏳

Now, let’s talk about the catalysts that might just send Ethereum soaring like a caffeinated pigeon. First up, the data reveals that spot Ethereum ETFs are still attracting Wall Street investors like moths to a flame. Daily inflows have graced us with their presence in 7 out of 10 days this month, amassing a grand total of $3.15 billion since their inception. Not too shabby, eh? 💸

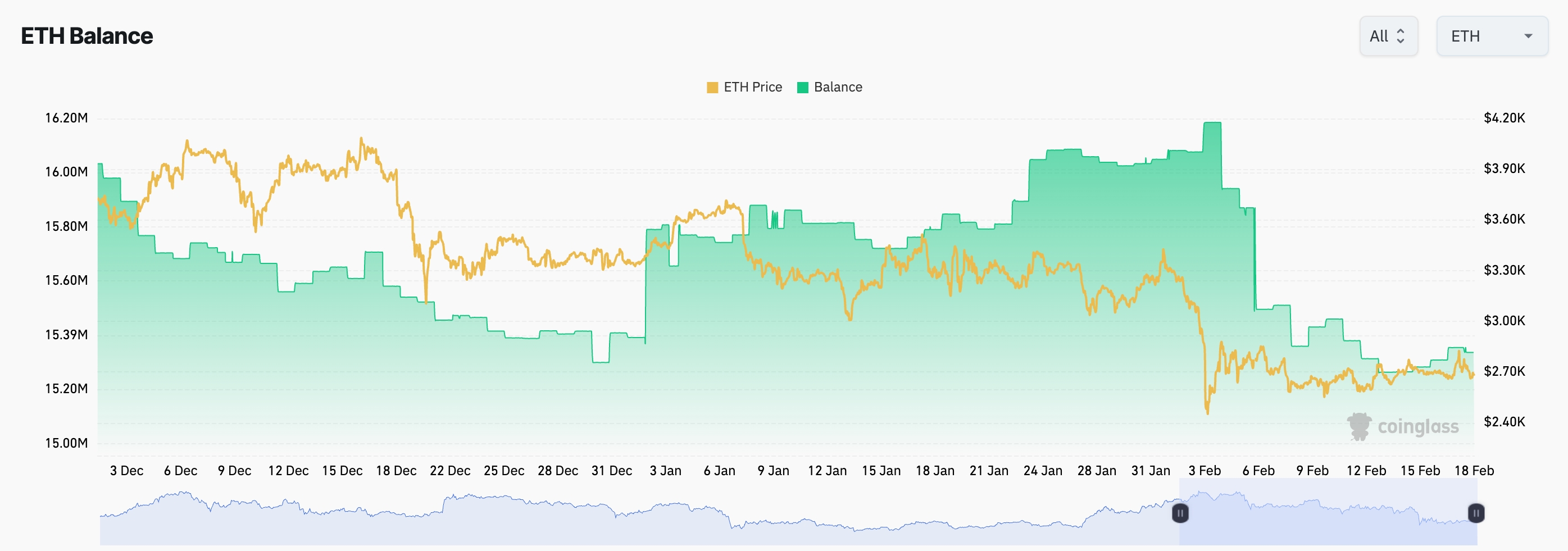

Next, we have the CoinGlass data, which shows that Ethereum balances in centralized exchanges have taken a nosedive in recent days. We’re now at 15.34 million coins, down from a high of 16.2 million this month. It seems many ETH holders are playing the long game, opting for self-custody instead of selling. Smart cookies! 🍪

And let’s not forget the Ethereum network, which is catching up with Solana (SOL) in the thrilling world of decentralized exchange transactions. In the last 24 hours, Ethereum protocols handled over $2.28 billion, while Solana has been busy dodging criticism after a series of meme coin rug pulls. The latest casualty? Libra, which soared and then plummeted faster than a lead balloon last weekend. 🎈

Ethereum Price: The Technical Tango

Now, let’s peer into the crystal ball of short-term charts, which ominously suggest a strong bearish breakdown after forming a death cross pattern. This delightful pattern occurs when the 50-day and 200-day moving averages decide to cross paths. How romantic! 💔

However, don’t lose hope just yet! A closer examination of the longer-term charts reveals a potential ETH price rebound. The weekly chart indicates that the accumulation and distribution indicator is on the rise, signaling that investors are still keen on hoarding this token like it’s the last cookie in the jar. 🍪

Moreover, it appears that an ascending triangle pattern is forming, consisting of an ascending trendline and a horizontal resistance. A bullish breakout occurs when these two lines get cozy near their convergence. And let’s not overlook the megaphone pattern, another bullish sign waving its flag! 📈

But patience is a virtue, dear reader. The bullish breakout may take its sweet time, as signals on a weekly chart can take months or even over a year to materialize. ⏳

Should we witness a bullish breakout above the upper side of the triangle at $4,061, we could be looking at more gains, possibly reaching the all-time high of $4,945, and then—dare we dream?—$5,000! 🎉

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

2025-02-18 17:00