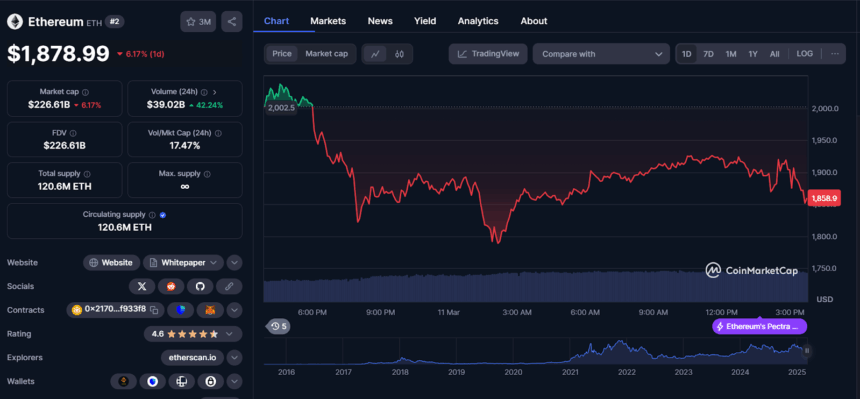

Ah, Ethereum! The once-mighty titan of the crypto realm, now reduced to a mere shadow of its former self, languishing in the depths of despair for nearly three months. Once, it soared to a dizzying height of $4,100 in December 2024, but alas, it has since plummeted over 53%, now languishing at a paltry $1,878, as reported by the ever-reliable CoinMarketCap. One can only imagine the investors, clutching their pearls, as they watch their fortunes evaporate like morning mist.

According to the sage analysts at Bitfinex, the root of this calamity lies in the murky waters of U.S. import tariffs. Investors, in a fit of panic, fear a trade war that could rattle the very foundations of financial markets, leaving risky assets like cryptocurrencies quaking in their boots. And let us not forget the developers, who seem to have taken a sabbatical from building new projects on Ethereum, perhaps due to the exorbitant operating fees that would make even a millionaire wince.

“The dearth of new projects or builders flocking to ETH, primarily due to those pesky high fees, is likely the principal reason behind ETH’s lackluster performance,” mused one analyst, as if delivering a eulogy. “We believe that for ETH, $1,800 will be a strong level to watch,” they added, as if that were a comforting thought.

But fear not, dear reader! It is not just Ethereum that is feeling the chill; the entire crypto market is caught in this tempest. Even Bitcoin, once a beacon of hope at $80,155, now teeters on the brink of a descent to $70,000. How the mighty have fallen!

Nansen analyst Aurelie Barthere, with a flair for the dramatic, declared this a “macro correction,” a euphemism for financial markets adjusting to the whims of fate. Yet, she reassures us that the market is still technically in a bull cycle, so perhaps all hope is not lost—at least until the next calamity strikes.

Another delightful twist in this saga is the outflow of ETFs. Investors, in a fit of pique, have been withdrawing their funds from U.S. spot Ether ETFs for four consecutive weeks. Data from Sosovalue reveals that over $119 million fled the market just last week, as if it were on fire.

This exodus has made it increasingly difficult for ETH’s price to stage a recovery. Stella Zlatareva, an editor at Nexo, lamented, “ETH’s 20% decline last week pushed its price below the key $2,200 trendline that had supported its bull market recovery since 2022.” One can almost hear the violins playing in the background.

Yet, amidst this chaos, some optimistic souls still believe in Ethereum’s potential. VanEck, an investment firm, predicts that ETH could rise to $6,000 by 2025, while Bitcoin might soar to a staggering $180,000. For now, however, ETH remains ensnared in a rather sticky predicament.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-03-11 19:02