According to Dragonfly Capital, U.S. crypto enthusiasts may have missed out on a staggering $5.02 billion in airdrops. That’s right, while the rest of the world was busy cashing in, Americans were left staring at their screens, wondering why their wallets were as empty as a politician’s promises. 🤑

Back in the day, before every other crypto project was run by a pseudonymous dog meme enthusiast, blockchain developers had this brilliant idea: reward users for supporting their projects. They called it an “airdrop,” which sounds like something you’d do with humanitarian aid, but in this case, it was more like dropping cash from the sky. Sometimes, it was life-changing money. Other times, it was enough to buy a cup of coffee. Either way, it was free money, and who doesn’t love that? ☕

But then, as always, the U.S. government stepped in. Fearing regulatory crackdowns, blockchain startups started geoblocking U.S. users faster than you can say “tax evasion.” Now, Dragonfly Capital’s data shows that American crypto holders have been left out in the cold, missing out on billions. It’s like being the only kid not invited to the birthday party, except the party favors are worth thousands of dollars. 🎉

Billions in Missed Opportunities

Between 920,000 and 5.2 million U.S. crypto users were geoblocked in 2024 alone. That’s a lot of people staring at their screens, wondering why their wallets are still empty. Dragonfly Capital estimates that 22-24% of all active crypto addresses worldwide belong to U.S. residents, many of whom have been excluded from airdrops. It’s like being locked out of a casino where everyone else is winning big. 🎰

“The current regulatory landscape in the United States, with its focus on enforcement and lack of tailored frameworks, has created significant challenges for projects seeking to utilize this mechanism effectively.”

Dragonfly Capital

Jessica Furr, Dragonfly Capital’s legal counsel, noted that there’s a “clear change in the regulatory winds in the U.S.” She’s optimistic, but let’s be real: when it comes to government policy, “optimistic” is just another word for “delusional.” 🌬️

“Policy changes are never linear — they ebb and flow, making it hard to predict exactly when we’ll see concrete action. In terms of legislation passing, the present conditions are the most favorable we’ve seen for some time. So, we’re optimistic we’ll see some movement.”

Jessica Furr

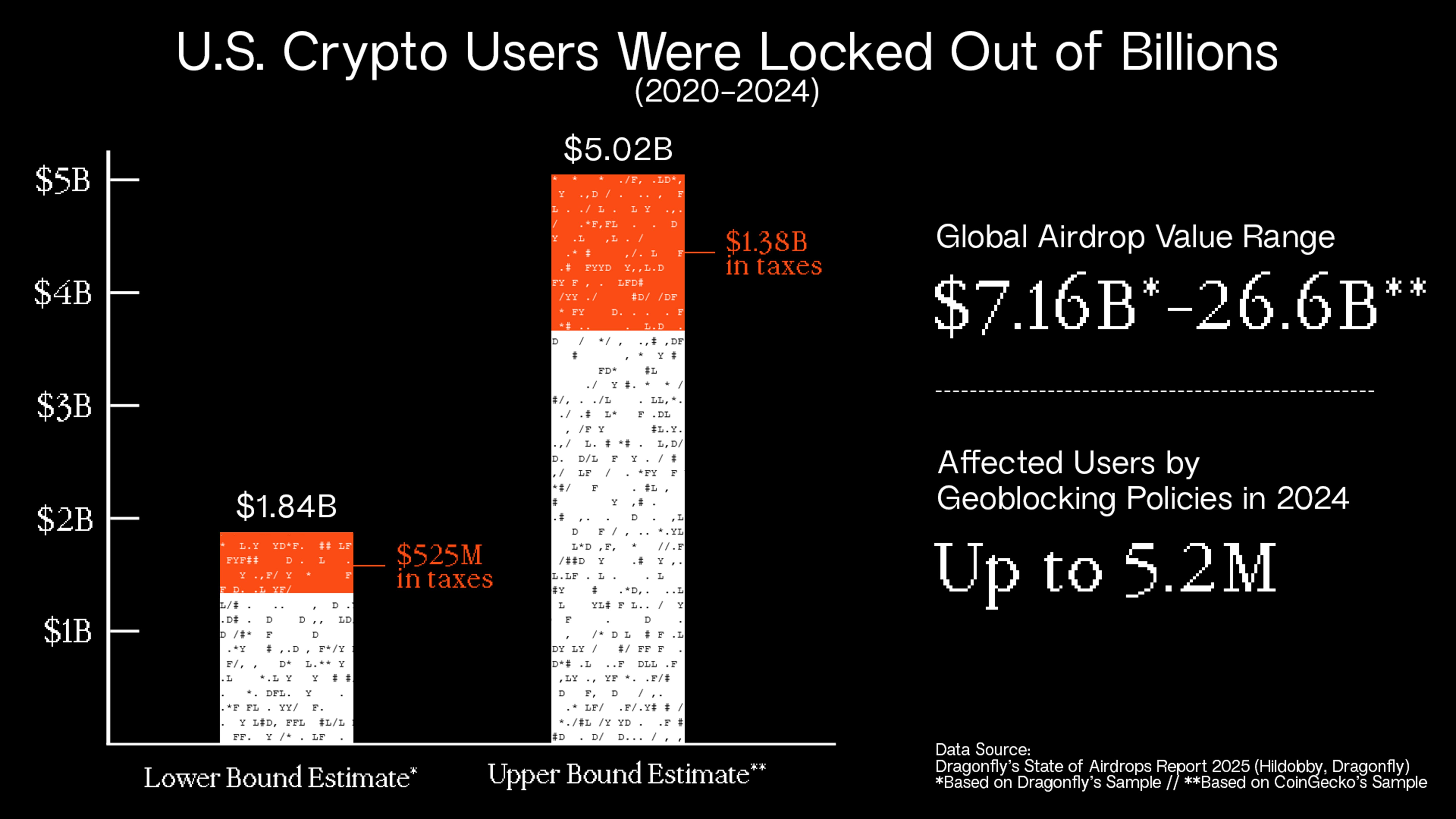

A sample of 11 blockchain projects analyzed by Dragonfly Capital generated approximately $7.16 billion in total value, with around 1.9 million claimers worldwide. The average median claim per eligible address was $4,600. But thanks to geoblocking, U.S. residents missed out on $1.84 billion to $2.64 billion in potential airdrop revenue between 2020 and 2024. That’s a lot of missed lattes. ☕

The report also points to a sharp drop in the share of active addresses and crypto developers in the Americas since 2015 — falling from 31% and 45% back then to 22% and 24% in 2024. Hildobby, Dragonfly Capital’s data scientist, says the decline likely has multiple causes. One of them? People are leaving crypto for AI, which is like trading one overhyped bubble for another. 🤖

“You have seen some people leave crypto frustrated by the current regulatory conditions and the promise of AI, but perhaps more significantly, there’s likely a rise in the number of non-U.S. developers entering the space.”

Hildobby

Furr says the U.S. should “nurture this nascent industry” rather than drive talent abroad. But let’s be honest, when has the U.S. ever nurtured anything other than its military-industrial complex? 🛠️

Looking at a broader dataset, a CoinGecko report reviewing 50 airdrops found that approximately $26.6 billion in total value has been distributed globally. Using CoinGecko’s figures alongside Dragonfly Capital’s calculations, the estimated total revenue lost to U.S. users due to geoblocking could range from $3.49 billion to $5.02 billion across 21 projects. That’s enough to buy a small country. Or at least a very large yacht. 🛥️

Tax Revenue Losses

Beyond individual losses, the U.S. government is also missing out on substantial tax revenue. Based on lost airdrop income ranging from $1.9 billion to $5.02 billion between 2020 and 2024, federal tax revenue losses are estimated at $418 million to $1.1 billion. State tax revenue losses could add another $107 million to $284 million, bringing the total estimated tax revenue loss to between $525 million and $1.38 billion over the period. That’s a lot of potholes left unfilled. 🚧

Offshore Migration

Regulatory uncertainty has also driven major crypto firms offshore, further reducing U.S. tax revenue. A prime example is Tether, the issuer of the (USDT) stablecoin, which is incorporated in the British Virgin Islands. In 2024, Tether reported a $6.2 billion profit, surpassing even financial giant BlackRock. If Tether were headquartered in the U.S., it would have owed approximately $1.3 billion in federal taxes and $316 million in state taxes. Instead, the U.S. is missing out on $1.6 billion annually in tax revenue from Tether alone. That’s a lot of missed opportunities to fund things like healthcare and education. Or, you know, more military spending. 🏝️

Given that Tether is just one of many high-revenue firms operating offshore, the cumulative effect of these corporate relocations represents a massive lost opportunity for the U.S. government. It’s like watching your neighbor win the lottery while you’re stuck paying off your student loans. 🎰

Read More

- 10 Most Anticipated Anime of 2025

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Silver Rate Forecast

- USD JPY PREDICTION

- EUR CNY PREDICTION

- Brent Oil Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-03-13 19:27