Attention, fellow crypto enthusiasts! It’s time to brace yourselves for some sideways action in the Bitcoin market. According to CryptoQuant CEO Ki Young Ju, the bull cycle has reached its end, and we’re in for a bearish or sideways price movement in the next few months.

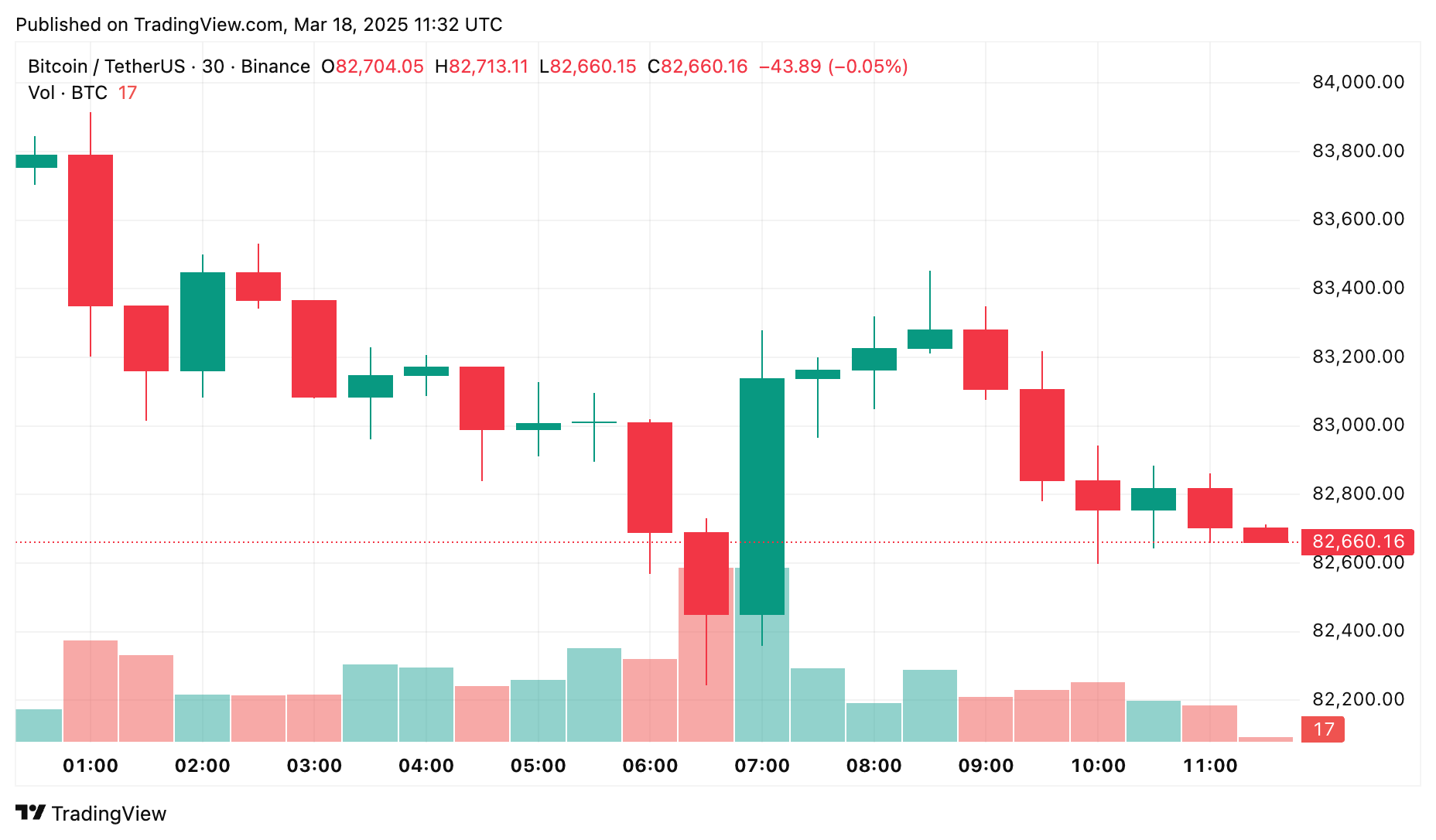

In a recent post, Ju shared a historical chart highlighting BTC‘s profit and loss index cyclical signals dating back from 2014 up to 2024. At press time, Bitcoin has gone down by nearly 0.8% in the past 24 hours of trading and is currently trading hands at $82,752.

Every on-chain metric signals a bear market. With fresh liquidity drying up, new whales are selling Bitcoin at lower prices.@cryptoquant_com users who subscribed to my alerts received this signal a few days ago. I assume they’ve already adjusted their positions, so I’m posting…

— Ki Young Ju (@ki_young_ju) March 17, 2025

Enormous whales selling Bitcoin in large portions

In a separate post, Ju shared his analysis which applied the Principal Component Analysis method to on-chain metrics such as Market Value to Realized Value Ratio, Spent Output Profit Ratio, and took into account Net Unrealized Profit/Loss. He used it to calculate a 365-day moving average to identify turning points within the one-year moving average trend.

“Every on-chain metric signals a bear market. With fresh liquidity drying up, new whales are selling Bitcoin at lower prices,” said Ju in his post.

Not long after Ju posted his analysis, a whale was detected on-chain closing its Bitcoin short position and earned a profit of $4.06 million in just three days of trading. The whale is famous for opening an Ethereum (ETH) long position at 50x leverage, worth around $200 million on Hyperliquid on March 12, which led to the platform suffering a loss of $4 million.

According to data from SpotOnChain, the whale was found depositing around $17.82 million USD Coins (USDC) to Hyperliquid as a margin over the past three days to short BTC with 40x leverage. Recently, the address has closed all its positions and withdrew around 21.88 million USDC back to its wallet.

After it closed all its positions, the whale spent 6.11 million USDC to purchase 3,202 ETH. Not only that, the trader also sold 3.28 million USDC in exchange for 1,040 PAXG (PAXG) tokens.

In recent days, traders have seen an influx of whales opening enormous long and short positions with high leverage on Hyperliquid. On March 17, an anonymous whale was “hunted down” by crypto traders for starting a short position for around $450 million worth of Bitcoin at 40x leverage.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-03-18 14:40