It has come to my attention that NEAR Protocol [NEAR], at present, doth exhibit signs of a potential rebound, bolstered by a rising market capitalization and, dare I say, moderate price gains. Indeed, its market capitalization hath risen by a trifling 4.47% to reach $2.55 billion – a token of cautious optimism amongst investors, or so they would have us believe. However, this most agreeable rise coincides with a rather precipitous plunge of 15.66% in its 24-hour trading volume, landing at a mere $148.48 million. One might raise an eyebrow at such a contradiction, don’t you think? 🤔

At the time of this writing, NEAR trades at $2.12, up by a modest 4.26%. Yet, despite this price uptick, the aforementioned volume drop doth indicate a distinct lack of commitment from traders. This doth suggest that the recent gains may lack the necessary vigor to incite a sustained rally, unless, of course, buying pressure increases with considerable enthusiasm.

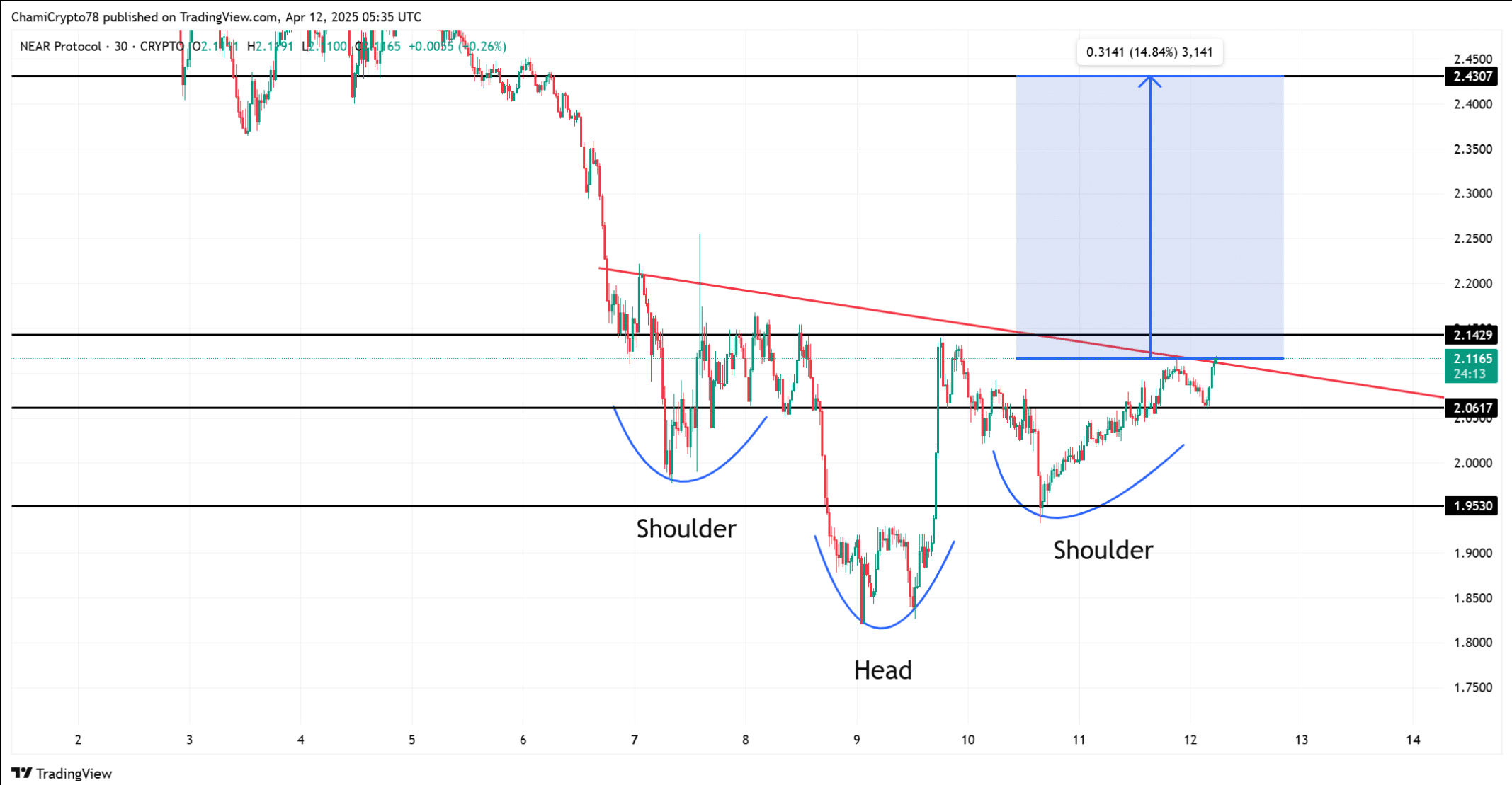

Can the inverse head-and-shoulders pattern truly drive a breakout, or is it merely wishful thinking?

NEAR’s chart reveals what some might call a well-defined inverse head-and-shoulders structure – often touted as a sign of a bullish reversal in the making. The neckline, no less, sits just above $2.14, with notable support levels at $2.06 and $1.95. A most precarious position, wouldn’t you agree?

The price, it seems, is testing this neckline, and a breakout above it could, in theory, fuel a 14.84% move to the projected target of $2.43. This pattern’s symmetry, with its clearly formed shoulders and central low, allegedly enhances its reliability. A rather bold claim, if I may say so myself! 🧐

However, traders of sound mind should remain cautious, as this bullish setup requires, nay, demands, strong volume confirmation. Without such a catalyst, the rally could falter, and the pattern may lose its much-vaunted significance. One must always be skeptical, mustn’t one?

Short liquidations mount as bearish bets backfire – a most satisfying turn of events! 😂

Liquidation data doth underline growing pressure on those short sellers. Over the past few sessions, short liquidations reached $31.42k, far surpassing long liquidations, which totaled a paltry $10.46k. Binance alone accounted for $21.25k in short liquidations, proving that many traders have, indeed, misread the market’s direction. Serves them right, I say!

Additionally, Bybit and OKX also witnessed notable short-side wipeouts, suggesting that bears are being rather unceremoniously squeezed as the price edges higher. This imbalance in liquidations can act as a hidden driver of momentum, as forced exits from short positions create sudden upsurges in price. A delightful spectacle, indeed!

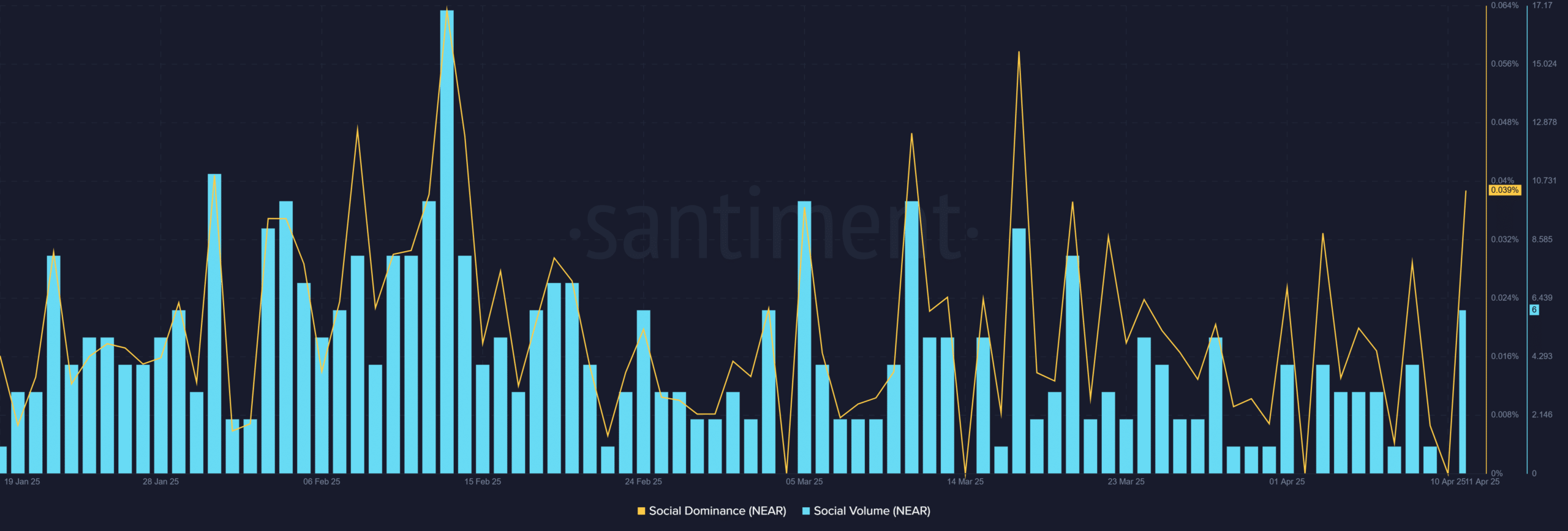

Rising social volume hints at growing interest – or is it merely idle chatter? 🗣️

Social metrics also highlight that NEAR is regaining visibility amongst retail traders. The social volume climbed to a grand total of 6, while dominance rose to 0.039% – marking the highest activity in recent weeks. One can scarcely contain one’s excitement!

While these numbers remain, shall we say, moderate, they underline a shift in sentiment that could accelerate if price action confirms the bullish pattern. Therefore, should the breakout materialize, growing chatter across social platforms may help fuel further demand and FOMO-driven buying from those previously sidelined participants. Such is the nature of speculation, is it not?

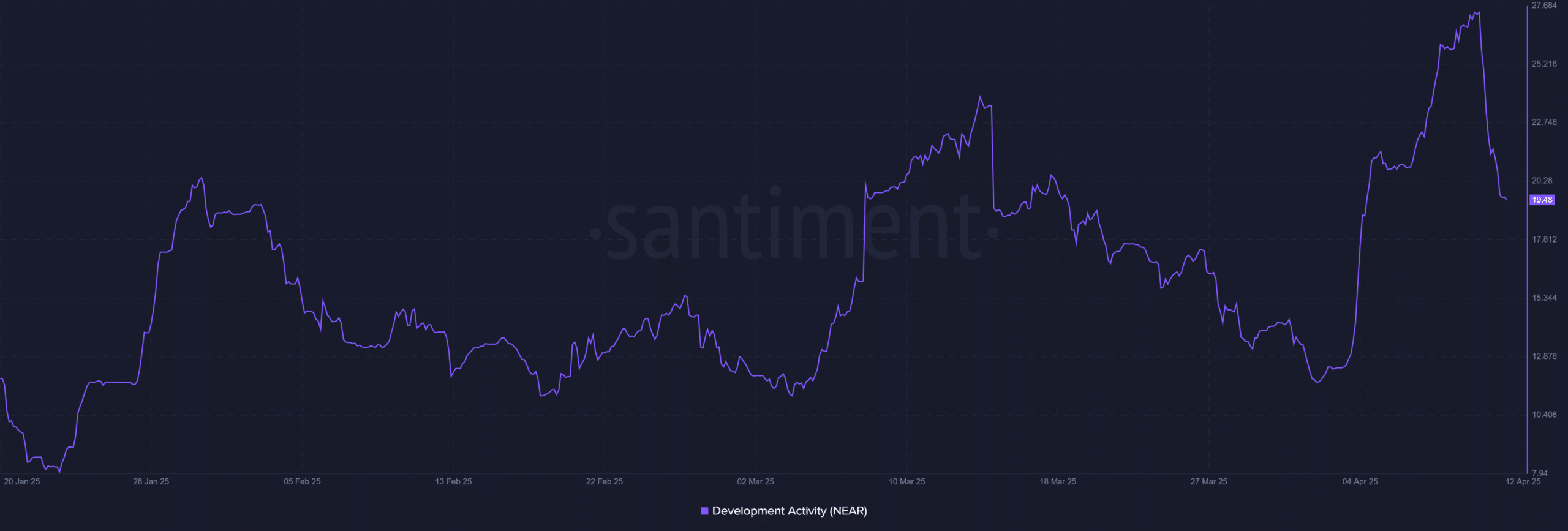

Developer activity cools down, but remains strong – a most curious state of affairs. 🤔

Finally, on-chain development metrics reveal a slight slowdown in builder activity. NEAR’s development activity score dropped from a peak of 27.68 to 19.48 by the 12th of April. Although this decline may signal a temporary pause after intense upgrades, it doth not yet suggest a reversal in trend. A most perplexing situation!

In fact, developers remain actively engaged, and NEAR continues to outperform many projects in its category in terms of code-level contributions. Therefore, any rebound in activity could further reinforce investor confidence in NEAR’s long-term viability. One can only hope, can’t one?

Could NEAR be gearing up for its next major rally? Only time will tell, my dears. ⏳

NEAR Protocol is shaping a bullish structure that could set the stage for a breakout. The inverse head-and-shoulders pattern highlights a potential 15% move, while short-side liquidations and rising social engagement hint at growing momentum. A most intriguing prospect, indeed!

However, the real test lies in breaking the $2.14 neckline with strong volume. Should this occur alongside renewed developer commitment and rising interest, NEAR could be on track for a significant rally towards $2.40. But, as always, one must remain cautiously optimistic and prepared for any eventuality. After all, the market is a fickle mistress, is it not?

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-04-13 04:11