Ah, dear reader, imagine Ethereum—a creature as mercurial as a Moscow night—stirring from its uneasy slumber with a modest pump that sent whispers through the crypto bazaar. After endless weeks of selling like a kindly old Chekhovian shopkeeper finally giving in to the march of time, hope flickered anew. But beware: the world outside bubbles with tensions as tangled as a bureaucrat’s red tape—between the West’s eagle and the East’s dragon, a geopolitical chess game threatening to topple pawns and kings alike.

Yet amidst this tumult, voices emerge from the shadows, most notably one Carl Runefelt, the prophet of price and parabolic dreams. With the flair of a magician revealing a rabbit from his hat, Carl boldly declares that Ethereum may soon “go absolutely parabolic,” as if caught in a whirlwind of caffeinated optimism. His crystal ball, a daily descending trendline, hints at the bulls preparing to dance a reckless tango on the market floor.

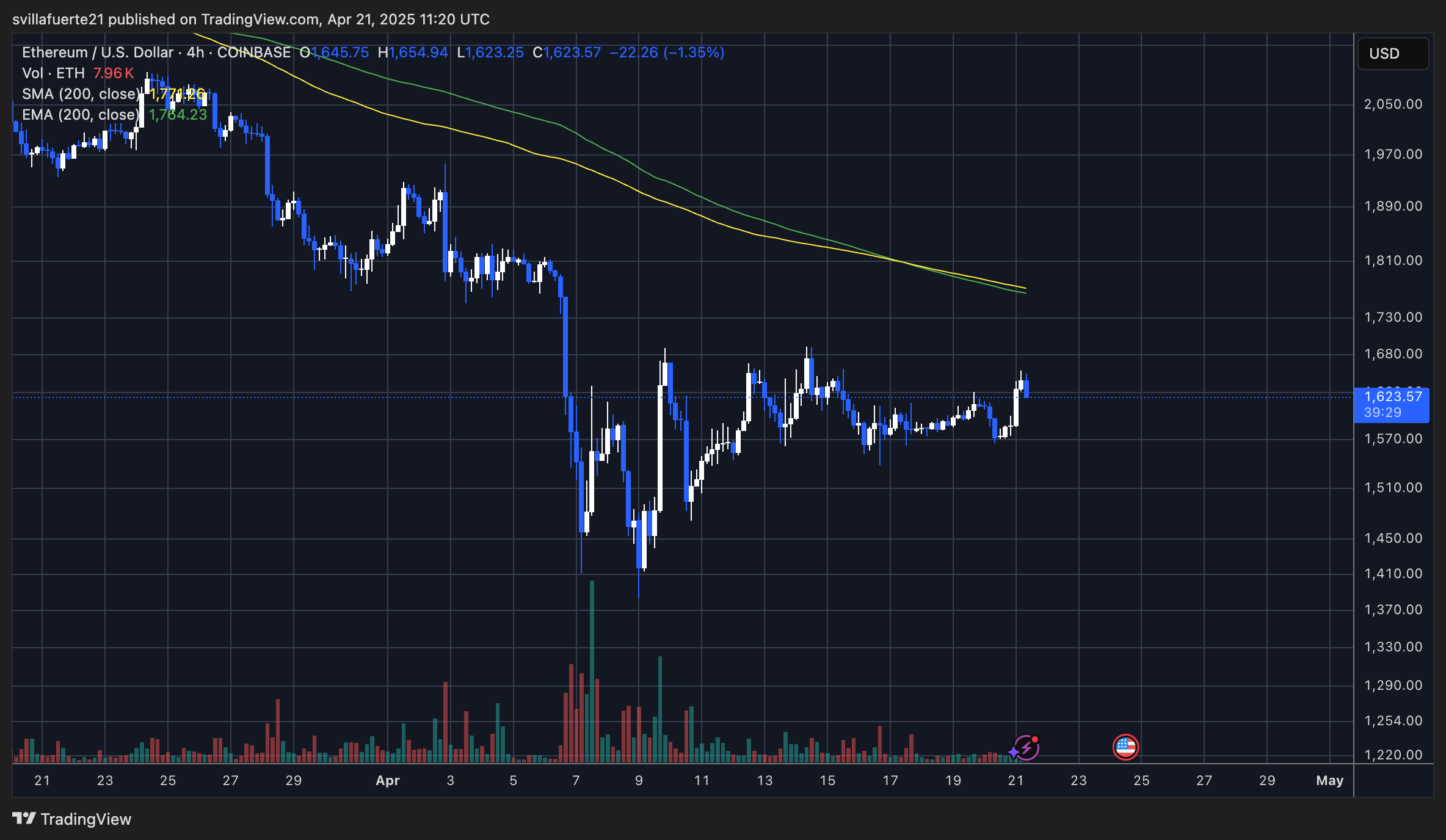

Ethereum clings to its lifeline around $1,500, tiptoeing closer to a grand reversal that promises either salvation or yet another tragic comedy. Investors, those eternal jugglers of risk and reward, peer anxiously for signal flares—volume and sentiment—hoping for a rally so grand it might reset the whole miserable cycle of despair and hope.

Ethereum Schemes Amidst the World’s Storm

Outside the digital amphitheater, harsh economic squalls whip the sails—trade wars, a tempest between the mighty US eagle and China’s cunning dragon, shaking equities like a Jester’s trick gone awry. Yet, Ethereum, ever the cunning survivor, finds refuge in its $1,500 stronghold, attempting a climb that seems part dance, part desperate scramble. After a reign of selling that erased dreams dearer than a lover’s last letter, this crypto rebel flirts with recovery.

This price ballet—higher lows, looming resistance, a descending trendline—is the kind of intricate minuet traders analyze like chess moves played under the moonlight. Carl, ever the oracle, eyes $3,000 with the certainty of a Tolstoyan hero declaring battle. If the breakout arrives, the crowd will roar—or at least murmur in excited disbelief.

Despite the gnashing of global teeth and unpredictable winds of fortune, Ethereum’s foundation remains firm—its tendrils wrapping round DeFi and tangible assets like ivy on a forgotten mansion. Should this breakout finally break free from the crypt’s grasp, ETH might well lead the next cryptic waltz of recovery.

Resistance: The Bitter Nemesis of Bulls

Currently hovering at $1,630, Ethereum makes another effort to breach the $1,700–$1,800 fortress—a fortress that has repelled many an enthusiastic charge. The bulls, those persistent Don Quixotes, must reclaim last week’s local high at $1,691, if only to pretend this siege might yield fruit or at least delay defeat.

Succeed, and the gates to $2,000 swing ajar, an ominous, psychological milestone where dreams weigh as heavily as a Soviet novel. Fail, and the market’s cold embrace may pull ETH back to that familiar $1,500 safety net—or worse, deeper into the abyss of corrections where hopes go to die with dignity.

So, will our hero—the dazzling Ethereum—rise or succumb? Will bulls roar or merely grunt in exhaustion? Only time, and a few more caffeine-fueled analyses, will tell.

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- Silver Rate Forecast

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-04-21 20:18