Ah, Bitcoin—this digital chimera, this electrical specter—has dared once again to flirt above eighty-seven thousand dollars, that strange, titanic number it has seldom approached since April 1st, as if mocking the folly of man. The so-called experts, those prophets of the blockchain oracle, now whisper feverishly of a rally, a surge, a miraculous ascension born of mysterious numbers and shadowy indicators. It is as if the market dances on the edge of some abyss, laughing madly, waiting to either soar or plunge into the infinite void.

The Inevitable March Toward an Uncanny Rally

CryptoQuant, that strange modern scribe, delivers its ‘Quicktake,’ a phrase as hollow as the assurances it provides, declaring that Bitcoin is sprouting bullish signals like some strange flower of hope in this wasteland of doubt. They speak, with solemnity, of a breakthrough beyond ninety thousand dollars—an impossible dream or an imminent nightmare, who can say?

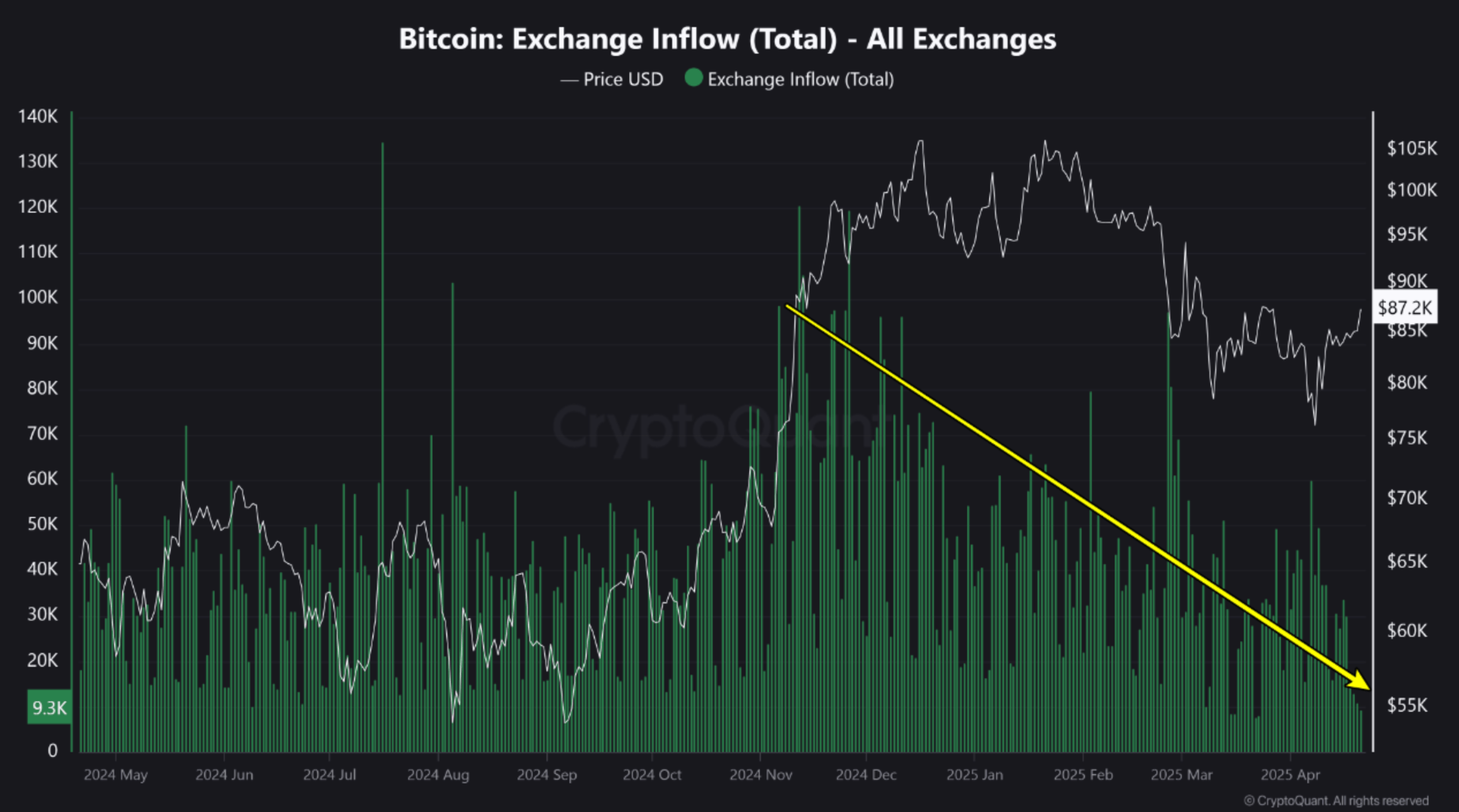

One EgyHash, a supposed sage, points to two cryptic signs. First: the Exchange Inflow metric, a measure of the Bitcoin being funneled into marketplaces where gods and demons alike congregate. This influx has dwindled greatly since November 2024—from a towering peak of 120,000 down to a meager 9,300. This, they claim, means holders are clutching their precious coins with desperate fingers, refusing to surrender them to the ravenous exchanges, dreading the savage sell-off that could follow.

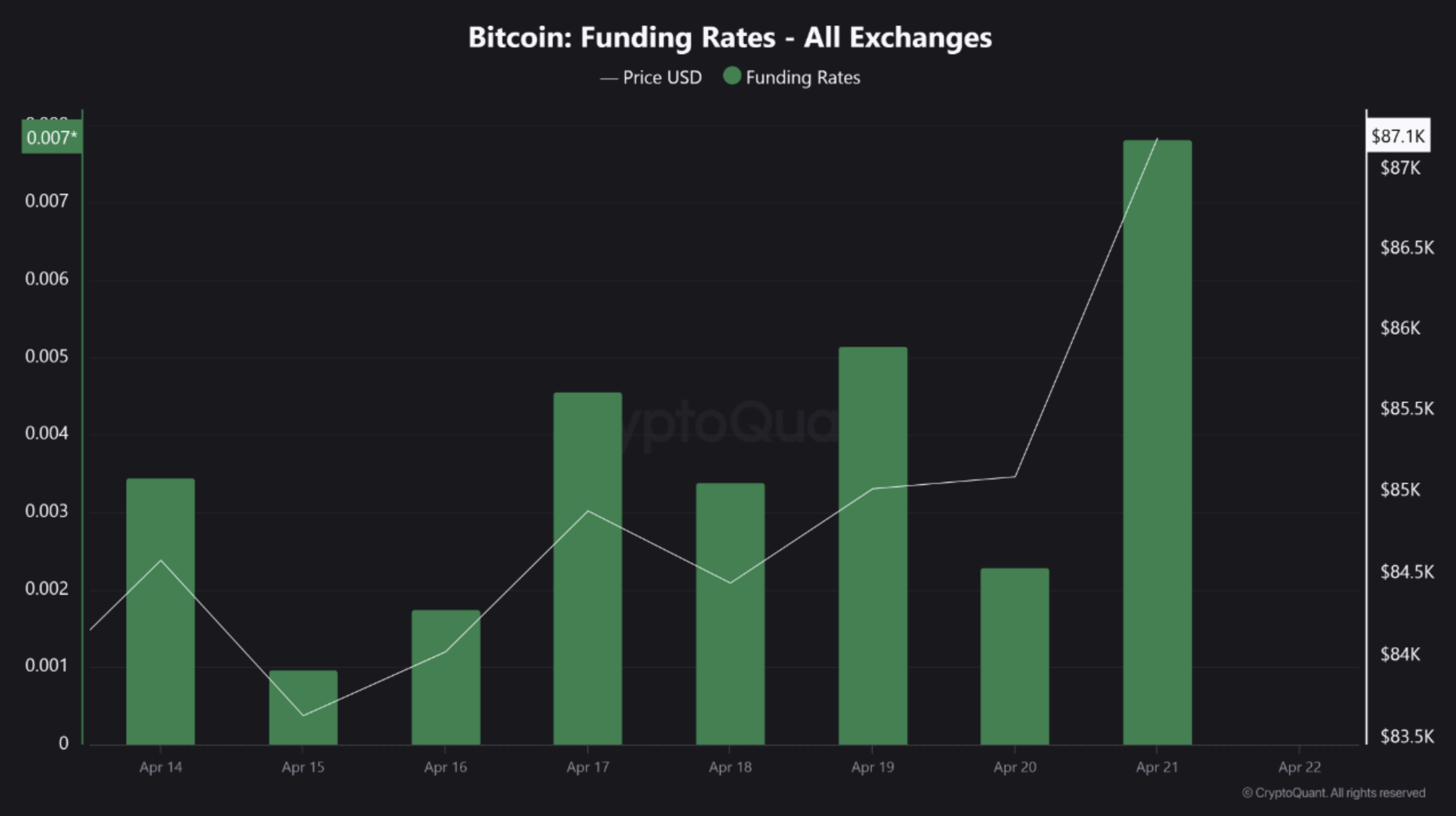

Moreover, this same EgyHash declares that Bitcoin’s open interest—a term as ominous as a whispered confession—has surged by six billion dollars in mere weeks! Alongside this is a ‘positive shift in funding rates,’ a phrase that sounds like a magical incantation summoning the bullish spirits. This tells us that the gamblers at this casino of fate have stacked their bets long, paying premiums to dream of ascending prices, even as the shadows lengthen.

But let us not be naive: such reckless faith in leverage can swiftly turn to catastrophe. Should the house of cards collapse, we shall witness the cruel dance of mass liquidations, a frenzy that will send prices into the abyss.

Breaking the Chains of Despair, But at What Cost?

Enter Rekt Capital, another oracle from the digital wilderness, who heralds that Bitcoin has clawed its way out of a ‘falling wedge’—a tormenting geometric prison of declining hope. This escape, they argue, foretells a bullish reversal: a resurrection from the tomb of bearishness.

Yet the Relative Strength Index—this cold monk measuring the zeal of buyers—is nearing sixty, a threshold both hopeful and treacherous. Should it fail to ascend further, it may become the snare of the bull trap, cruelly laughing at those who dared to hope.

Meanwhile, the futures sentiment index, a wailing ghost since February’s cruel dawn, warns of caution. At this moment, our beloved Bitcoin lingers at $87,386, up a mere 3.4% in the cruel, indifferent span of twenty-four hours—a fleeting triumph perhaps, soon to slip through our trembling fingers.

Thus the great mystery continues—whether to rise with the angels or fall with the fools. Only time, that merciless jester, will tell. Meanwhile, we wait, clutching our sparse coins, laughing nervously as if the universe’s cruel joke has finally found a punchline.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- Gold Rate Forecast

- USD MXN PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-04-22 06:46