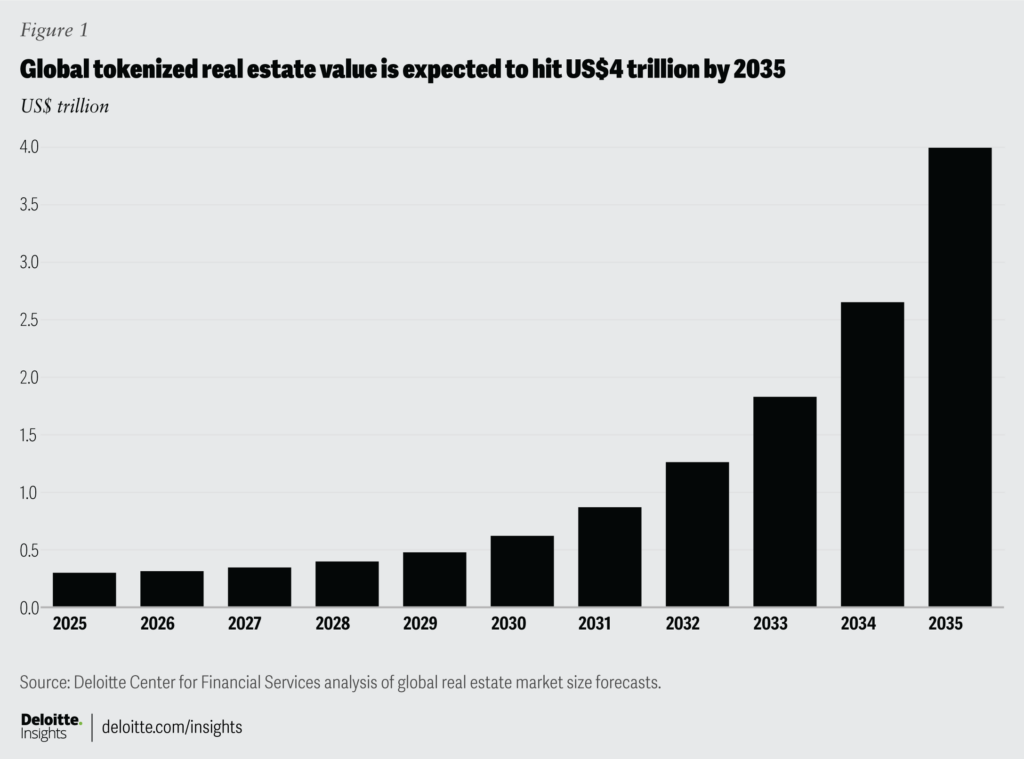

Imagine, dear reader, a world where the venerable brick and mortar of real estate turns into shimmering tokens, flickering on the screens of investors far and wide—much like the ghostly flames of a fading lantern in some gloomy Russian winter. Deloitte, that grand seer of financial fortunes, dares to predict that this spectral transformation will balloon to a staggering $4 trillion by the year 2035.

Now, asset tokenization—an idea so modern it makes the balalaika sound like ancient history—is heralded as the grand opportunity for mortals yearning to dabble in real estate without ever smelling the damp of a cellar or the creak of an old parquet floor.

On a blustery Thursday in April, Deloitte released their predictions, as confident as a merchant peddling wares in the bustling market square of Moscow. They see tokenized real estate growing at 27% annually, swelling from today’s humble $300 billion to something that could make the Tsars weep.

Amongst this tokenized arsenal, a cool $1 trillion will supposedly be locked inside private real estate funds. Once the secret playgrounds of the wealthy, these funds may soon throw open the doors for anyone with a few kopeks and a taste for digital speculation.

Tokenized Real Estate—Or How To Sell Your House Without Ever Leaving the Sofa

Gone are the days of shares and paper certificates—now, investors clutch tokens representing parcels of sprawling estates and creaky cottages alike, spinning on invisible blockchains as if the spectral hand of fate itself dictated the market. Buying in or backing out becomes simpler than dodging your landlady’s angry gaze over unpaid rent.

Meanwhile, a further $2.39 trillion is set to morph into tokenized loans wrapped in what sounds suspiciously like mortgage-backed securities—the financial equivalent of nesting dolls: complex, layered, and occasionally hiding something unpleasant. Deloitte, in its usual sagacity, predicts this will bring real-time payment data and fewer headaches—but perhaps no less confusion.

True, blockchain promises to shrink the monstrous beast of administration costs, while coaxing in investors from all corners of the world—not unlike a carnival beckoning passersby with shiny lights and the scent of roasted chestnuts. Yet, like all great novelties, this brave new world is shadowed by questions of custody, accounting, and the ever-looming specter of default. And heaven help us, cybersecurity breaches threaten like bandits on the road to investment bliss.

But such is the comedy and tragedy of progress: from estate deeds to cryptic tokens, perhaps we are all just pawns in an endless game whose rules keep changing—at least until the next shrewd Deloitte prophecy.

Powered by Pollinations.AI free text APIs. [Support our mission](https://pollinations.ai/redirect/kofi) to keep AI accessible for everyone.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- EUR CNY PREDICTION

2025-04-25 20:27