Metaplanet, a publicly listed Japanese company, clearly woke up one morning, glanced at its coffee, and decided the best way to stir it was to buy ridiculous amounts of Bitcoin. One could say the caffeine kicked in hard—perhaps too hard. 🚀

Since April 2024, Metaplanet’s approach has been simple: “See Bitcoin, buy Bitcoin.” There must be a giant red “Acquire More” button in the office (next to the espresso machine), because the company has transformed the dull business of holding cash into an Olympic sport of collecting cryptocurrency. The result? Its stock price pulled off a spectacular somersault and grew more than 15 times in less than a year—leaving traditional investors and mathematicians with simultaneous heart palpitations and existential questions.

Metaplanet’s Obsessive Quest for Bitcoin, or How to Roll a Giant Digital Snowball

If you thought your online shopping habit was bad, wait for this: the most recent haul from Metaplanet was 555 Bitcoin, bringing them to a grand (and suspiciously palindromic) total of 5,555 BTC. The bill: around $481.5 million, which is the kind of number nobody with student loans wants to hear. Not content with emptying their own pockets, the company then issued a $25 million interest-free bond, presumably to see if anyone else wanted to nervously join this crypto rollercoaster for free.

Onto the board swaggered Eric Trump—because why shouldn’t things get even more surreal?—as Metaplanet’s new advisor for “Bitcoin-focused growth and innovation.” Sub Official Trump Card Holder.

“Metaplanet’s unrealized profit on their Bitcoin position is 6 billion yen. For awareness: that’s 4 times their entire capitalization before switching to the Bitcoin standard!” crowed an X user, presumably while running around with their arms in the air.

The year 2025 is already a blur of milestones and Bitcoin receipts for Metaplanet. In April, they splurged $26.3 million on 319 BTC. March turned into a bizarre crypto scavenger hunt, with them bagging 156 BTC (March 3), 497 BTC (March 5) for an eye-watering $43.9 million, and 162 BTC (March 12) at $13.5 million (because who needs a yacht when you can have another block of crypto?). All this follows a busy February, in which accountants likely asked to be paid in aspirin.

By now, Metaplanet’s Bitcoin hoard is so large, it’s been dubbed “Asia’s MicroStrategy”—proof that if you copy the homework, it helps to use some extra zeroes for flair. The big idea: lead a regional stampede of institutional investors into Bitcoin, although, as always, stampedes are best observed from a safe distance behind protective glass.

“It will also enable anyone with an account on the Tokyo Stock Exchange to gain exposure to Bitcoin without any regulatory risks,” Jason Fang, founder of Sora Ventures, declared during what was probably a jubilant Zoom call with Metaplanet. Translation: Make money, skip headaches.

Whether Metaplanet is pioneering a new era of financial genius or just found a novel way to stress test banking regulators is a question left, tantalizingly, to historians and whoever monitors the Tokyo Stock Exchange panic button.

The Stock Market Reacts: Panic, Joy, and Repeated Refreshing of the Trading App

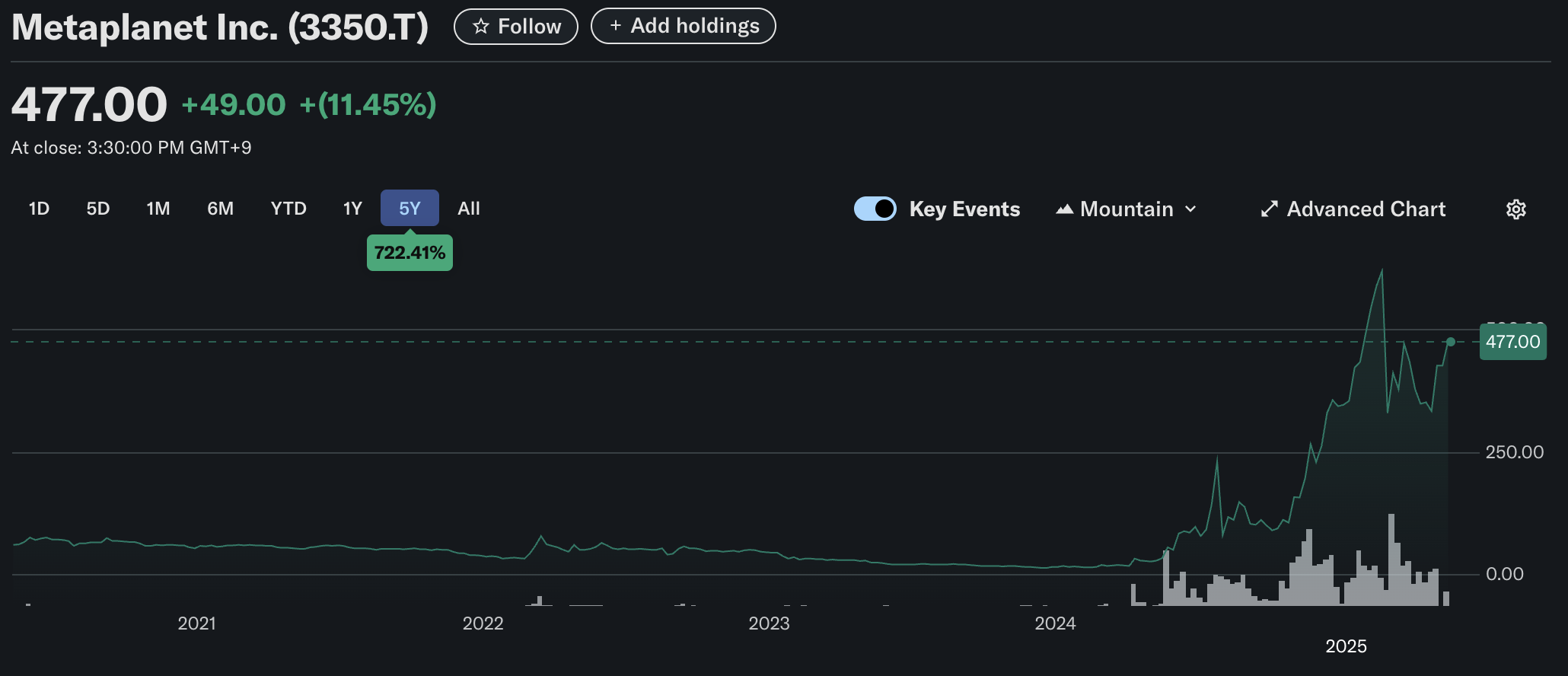

Quick recap: Yahoo Finance proves people are still watching. On May 7, 2025, the infamous 555 BTC announcement sent stock flying up 11.45% to 477 JPY per share ($3.33 for those still using units of currency likely to survive the decade).

Even more absurd: since Metaplanet started mainlining Bitcoin in April 2024, its stock price went from around 34 JPY to current, eyebrow-raising heights. If you blinked, you missed one of Japan’s top-performing stocks morphing into a rocket with yen as exhaust fumes.

This isn’t subtle. Each chonky Bitcoin buy triggers applause in the form of price spikes. March 12, 2025: stock up 7.93% following a 162 BTC snack; March 5, 2025: a 19% jump after 497 fresh Bitcoins are dumped into the vault. At this stage, you’d think the board meetings consist of someone shouting “Buy!” every time Bitcoin trends on X.

In all seriousness (which Douglas Adams would, thankfully, keep to a minimum), there are knock-on effects: massive faith in crypto’s long-term charm, a 15-fold stock price increase that’s likely making traditional bankers wish they’d paid better attention in tech class, and, just maybe, the sparks of a regional trend that could make shareholder meetings in Asia much livelier.

The company’s ambitions are galactic. They’re gunning for 10,000 BTC by end of 2025, and a Douglas-Approved 21,000 BTC by end of 2026. If Metaplanet pulls this off, they’ll not just break records—they’ll force future finance textbooks to add footnotes that begin, “Don’t Panic.”

Read More

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- 10 Most Anticipated Anime of 2025

- USD CNY PREDICTION

- Silver Rate Forecast

- Brent Oil Forecast

- USD MXN PREDICTION

- EUR CNY PREDICTION

- Hero Tale best builds – One for melee, one for ranged characters

- Capcom has revealed the full Monster Hunter Wilds version 1.011 update patch notes

2025-05-07 16:34