Currently, Cardano (ADA) is experiencing a dip, having decreased by approximately 4% over the past 24 hours and about 10% over the course of the last week. The daily trading volume has also dropped by 15%, reaching $869 million. This decline in value and activity follows several indicators suggesting a weakening trend and increasing doubt.

The trend for ADA has changed from bearish to volatile, with large investors causing turbulence and the possibility of a ‘death cross’ on its moving averages. This means ADA is going through a crucial phase. Whether it can maintain its ground, recover and grow stronger or keep falling will largely be influenced by short-term market sentiment and overall conditions within the crypto market.

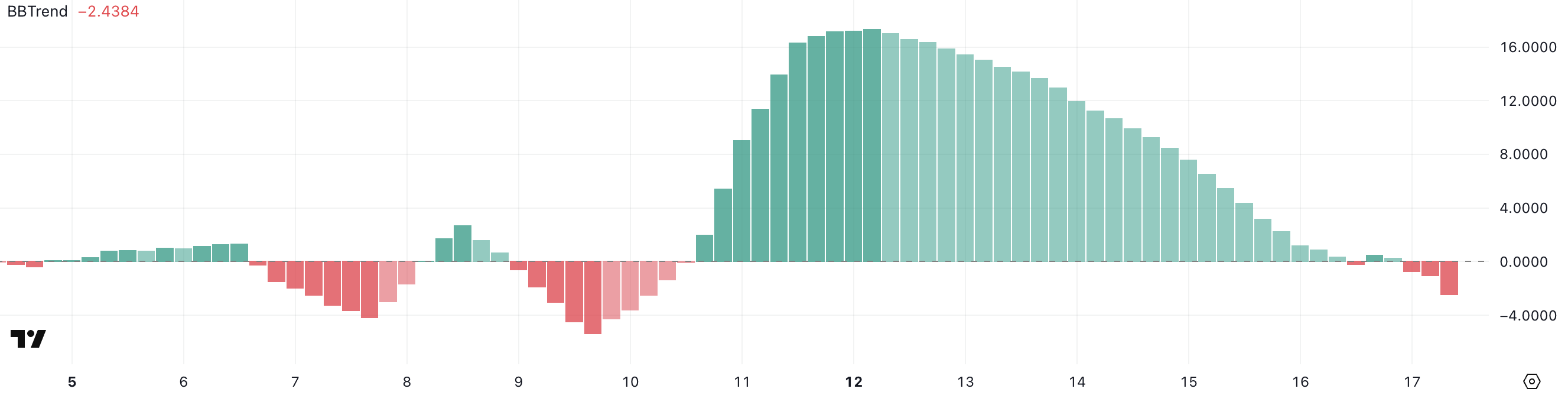

ADA Signals Weakness With BBTrend Falling Below Zero

The trend for Cardano’s BBTrend has shifted to a decline, currently standing at -2.43 following approximately five days of being in the positive zone.

From May 11th through May 16th, the value stayed above zero, peaking at a recent maximum of 17.34 on May 12th.

This change indicates that the current surge might be slowing down, potentially leading the asset into a period of decreased strength or stabilization.

The BBTrend (or Bollinger Band Trend) provides an analysis of the extent to which prices deviate from their average in comparison to market volatility. This information helps determine the intensity and direction of price movements or trends.

In simpler terms, numbers greater than zero usually mean the market is moving up or ‘bullish’, whereas figures less than zero often indicate a downturn or ‘bearish’ pressure. The current Cardano trend (BBTrend) stands at -2.43, suggesting there might be a tilt towards a negative trend or downward bias.

Should this downward pattern continue, it might cause prices to become even weaker or experience a phase of stability until fresh demand arises again.

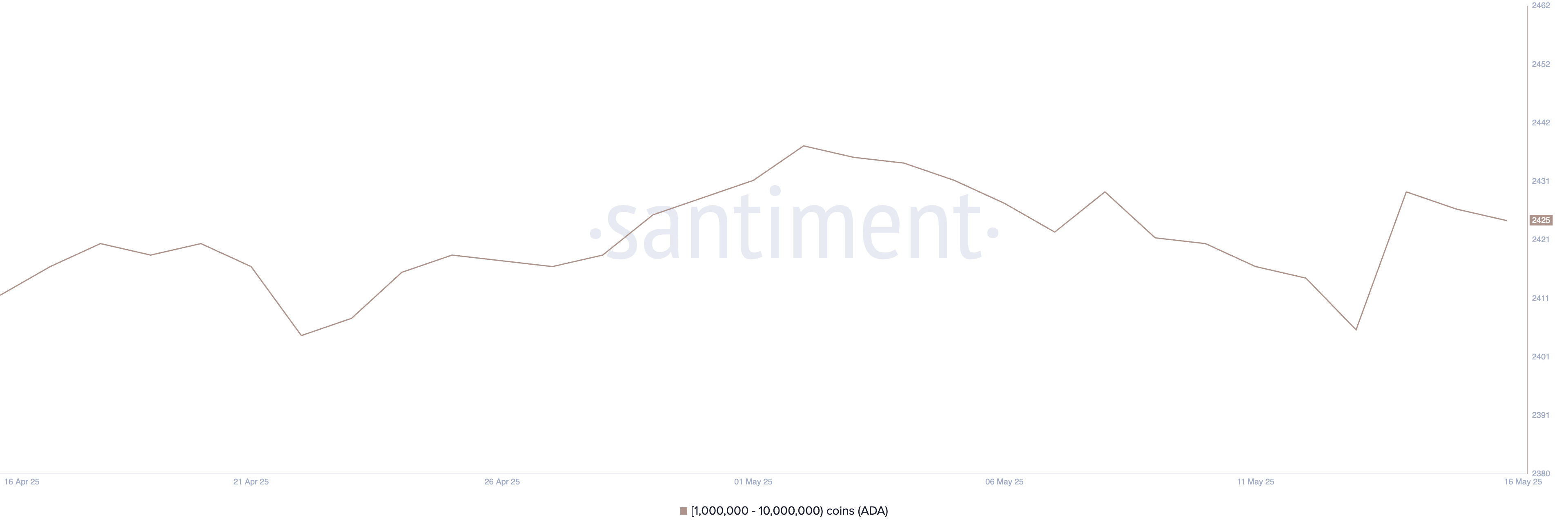

Cardano Whale Activity Cools After Short-Lived Spike

Over the recent days, there’s been a significant fluctuation in the number of Cardano whale accounts (accounts holding between 1 million and 10 million ADA). On May 13, this count dipped to approximately 2,406, which is one of the lowest figures seen in the past month.

On May 14th, there was a noticeable surge or bounce-back, as whale wallets rose to 2,430, which indicates that large investors momentarily regained their interest.

On the contrary, this increase didn’t persist, as the number dropped once more during the following two days, now stabilizing at 2,425. These ups and downs suggest that influential figures are uncertain, with no clear pattern of accumulation or distribution emerging.

Keeping an eye on whale actions is crucial, as these significant stakeholders have the potential to influence market trends substantially thanks to the vastness of their investments.

An increase in the number of whales (large investors) usually indicates an accumulation, indicating long-term optimism and possibly driving further price increases. Conversely, a decrease or stability in these whale numbers may indicate uncertainty or selling pressure, which could slow down the price trend.

Given that the current tally hasn’t yet reached its maximum and exhibits uncertainty, it might be challenging for Cardano to generate robust upward pressure in the near future unless there is a clear increase in buying activity.

Cardano at Risk of Death Cross as Bears Eye Key Support Levels

The structure of Cardano’s Exponential Moving Averages (EMA) is indicating some initial vulnerability, as the shorter-term EMAs are starting to decline towards the longer-term ones, which might lead to what’s known as a ‘death cross.’ This could signal an impending downtrend.

A bearish cross-over frequently hints at the beginning of a more significant drop in price for Cardano. If this pattern holds, the price might approach the potential support level at $0.729.

If the price dips below this point, it might trigger additional declines, potentially reaching $0.68. In a severe selling scenario, the prices could drop even lower to $0.642.

But should the present trend flip and the bulls retake charge, there’s a possibility that ADA could change direction.

Initially, our primary objective is to surpass the resistance at $0.781. Once we do so, there’s a possibility for Cardano to advance towards $0.841. In a particularly strong bullish surge, it might even touch $0.86.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD JPY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-05-17 23:19