Ah, mesdames et messieurs! A most curious milestone has graced our financial stage, revealing a most delightful trend of dwindling exchange balances for our dear Ethereum (ETH). One might ponder, what implications does this carry for the fickle hearts of market sentiment and price action? 🤔

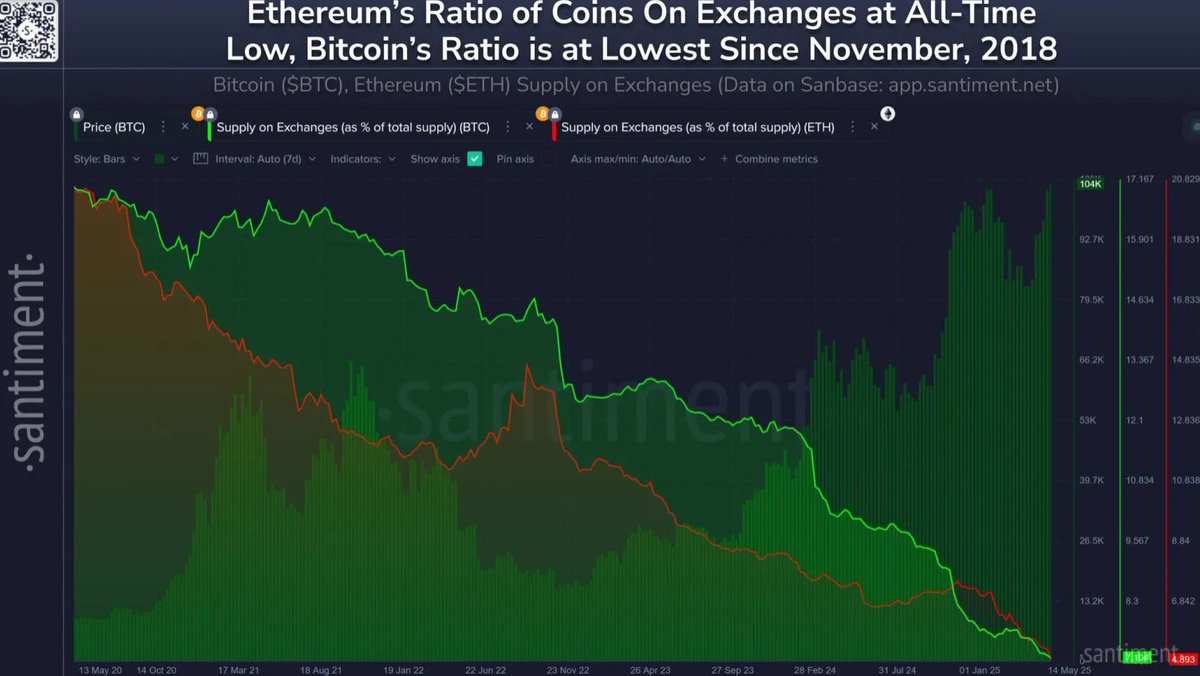

Behold the chart! It displays a steep and consistent decline in the ratio of ETH held on exchanges—a pattern that has galloped forth with great speed over the past year. Meanwhile, our old friend Bitcoin (BTC) follows a similar, albeit more leisurely, path, with its exchange supply now at its lowest since the autumn of 2018. How quaint! 🐢

This trend, dear audience, is widely interpreted as bullish! Fewer coins on exchanges generally means reduced selling pressure. When our noble holders whisk their assets away from exchanges, it is often a signal that they intend to clutch them tightly for the long haul, rather than toss them about like a jester’s cap. 🎭

As the confidence of investors in Ethereum’s long-term prospects swells—fueled by staking, the wondrous Layer 2 development, and an ever-growing institutional interest—this data may well reflect an evolving investment mindset. A mindset as fickle as a Parisian café patron! ☕️

In summary, the record-low ETH supply on exchanges suggests a tightening market, and may herald an incoming supply squeeze, should demand continue to rise. So, let us raise our glasses to the whims of the market! 🥂

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-05-22 02:51