Ah, Bitcoin! The digital gold that dances just below the lofty heights of $111K, like a tired performer at the end of a long show, gasping for breath and showing signs of fatigue. The market, a restless crowd, waits with bated breath for the next act—will it be a grand encore or a dismal flop? 🎭

In this theater of finance, anticipation hangs thick in the air, as traders clutch their popcorn, eager for fresh demand or supply to dictate the next dramatic twist. Despite this pause, the overarching narrative still leans towards a bullish continuation—because who doesn’t love a good comeback story? 📈

Technical Analysis

The Daily Chart

Bitcoin, our star, is currently meandering through a consolidation phase beneath its recently established all-time high of $111K, like a hero who has lost their way after a triumphant breakout above the former ATH at $109K. The momentum? Slowing down, folks! 🐢

The market is caught in a web of indecision, waiting for a fresh wave of demand to reignite the uptrend. It’s like waiting for a sequel that never comes! Despite a modest pullback to the $109K region, now acting as support, the bulls seem to be tiptoeing around, cautious and unsure. 🐂

For BTC to resume its upward trajectory and hit that magical psychological level of $120K, we need buyers to step up and join the party. If not, we might just see a dramatic fall, potentially targeting the $100K support zone—cue the dramatic music! 🎶

The 4-Hour Chart

Now, let’s zoom in on the 4-hour timeframe, where Bitcoin continues to respect an ascending channel structure, consistently forming higher lows and higher highs—like a well-rehearsed ballet! 💃

After being rejected from the $111K resistance zone, the price retreated to the lower boundary of the channel near $106K, finding temporary support and rebounding slightly. The market is currently a balancing act between bulls and bears, suggesting that further consolidation may occur in the short term. 🎭

A breakdown below the channel support could open the door for a sharper decline toward the $100K range. But as long as the structure remains intact, BTC is more likely to oscillate between the lower trendline and the $111K resistance, building pressure for an eventual decisive breakout that will define the next major move. Talk about suspense! 🎬

On-chain Analysis

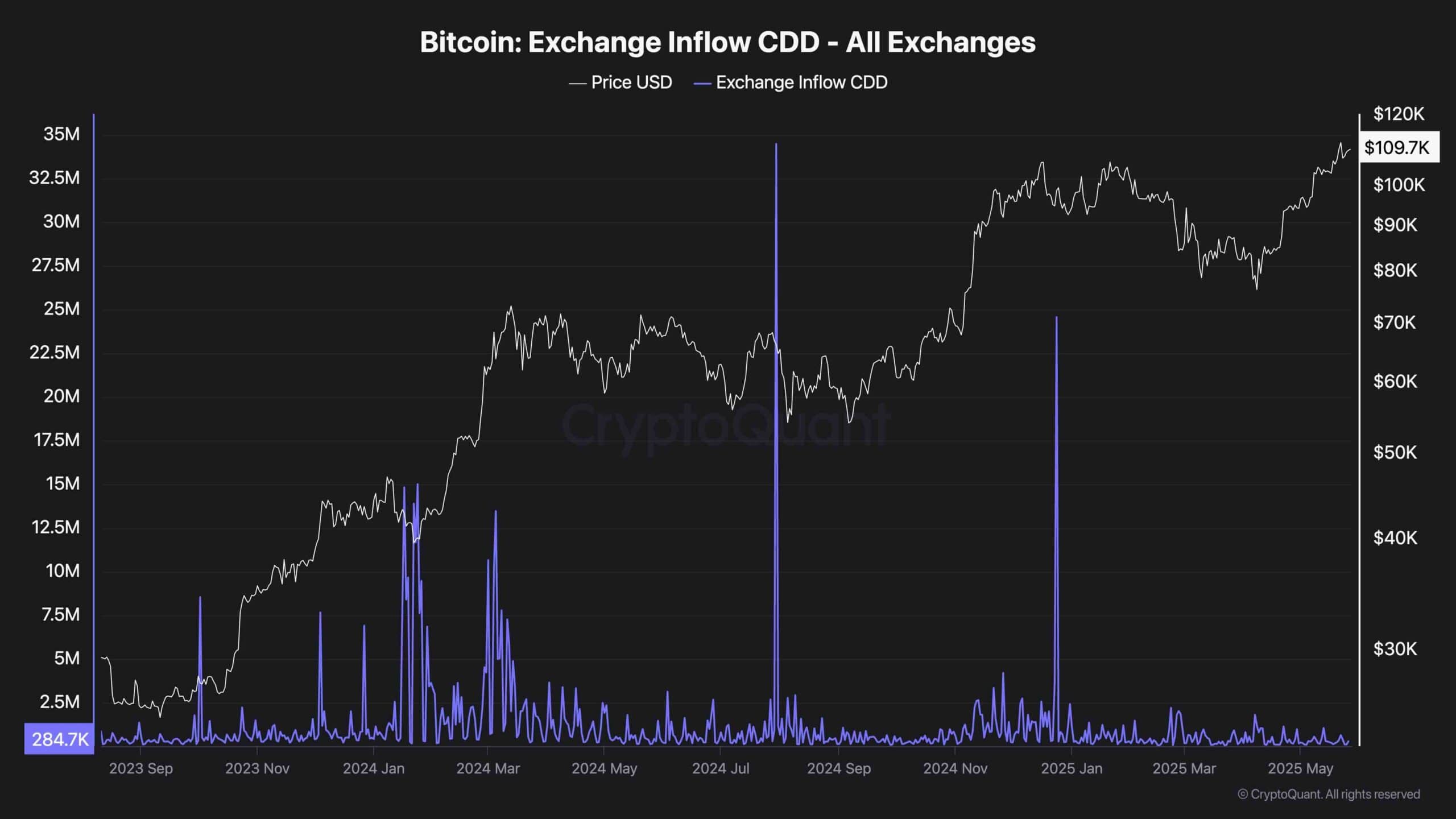

Despite reaching a new all-time high at $111K, a wave of profit-taking is typically expected. If long-term holders start to sell, it could trigger a significant correction—like a plot twist no one saw coming! To evaluate whether this cohort is distributing, the Exchange Inflow Coin Days Destroyed (CDD) metric serves as a key indicator. 📊

Historically, each major peak in Bitcoin’s price during previous bullish cycles has been accompanied by sharp spikes in this metric, reflecting the movement of long-dormant coins to exchanges, often signaling that long-term holders are offloading their assets. But wait! This current rally paints a different picture. Despite the price climbing to a new high, the Exchange Inflow CDD has remained subdued. 💤

This lack of activity from seasoned holders suggests they are not yet participating in profit-taking and instead continue to hold their coins with conviction. This behavior underscores strong confidence in the continuation of the uptrend, with expectations for even higher price targets in this cycle. As long as this group remains inactive and does not exert significant sell pressure, the path remains open for Bitcoin to push toward new highs in the mid-term. The drama continues! 🎉

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD MXN PREDICTION

- Gold Rate Forecast

- USD CNY PREDICTION

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD JPY PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-05-27 19:08