Crypto Wizard or Just Another Gambler? 3Jane Emerges to Save or Sway the Onchain World!

In the murky depths of Ethereum’s chaotic swamp, emerges a new hero—3Jane! With $5.2 million shiny dollars snagged in an eager seed round led by Paradigm, this brave protocol aims to build a colossal, scalable beast—unsecured, crypto-native credit! As if the DeFi world wasn’t chaotic enough, now they’ve got a new sheriff in town—chasing after that elusive Holy Grail of debt without the usual collateral crutches. Genius? Madness? Time will tell. 🤡💰

Paradigm Turns Fortune-Teller for 3Jane’s Wild Credit Dreams

3Jane—pronounced “Jane” as if calling your ex—decided to come out of hiding with a bang, bagging a cool $5.2 million from a constellation of big names like Coinbase Ventures, Wintermute Ventures, and Robot Ventures. The lineup of angels was equally impressive, including the likes of Andre Cronje, Guy Young, Julian Koh, and other folks who probably think “DeFi” is an Olympic sport. They’re all betting that this new kid on the block will somehow turn uncollateralized credit into a functioning reality—because who needs collateral when you have sheer bravado? 🦄✨

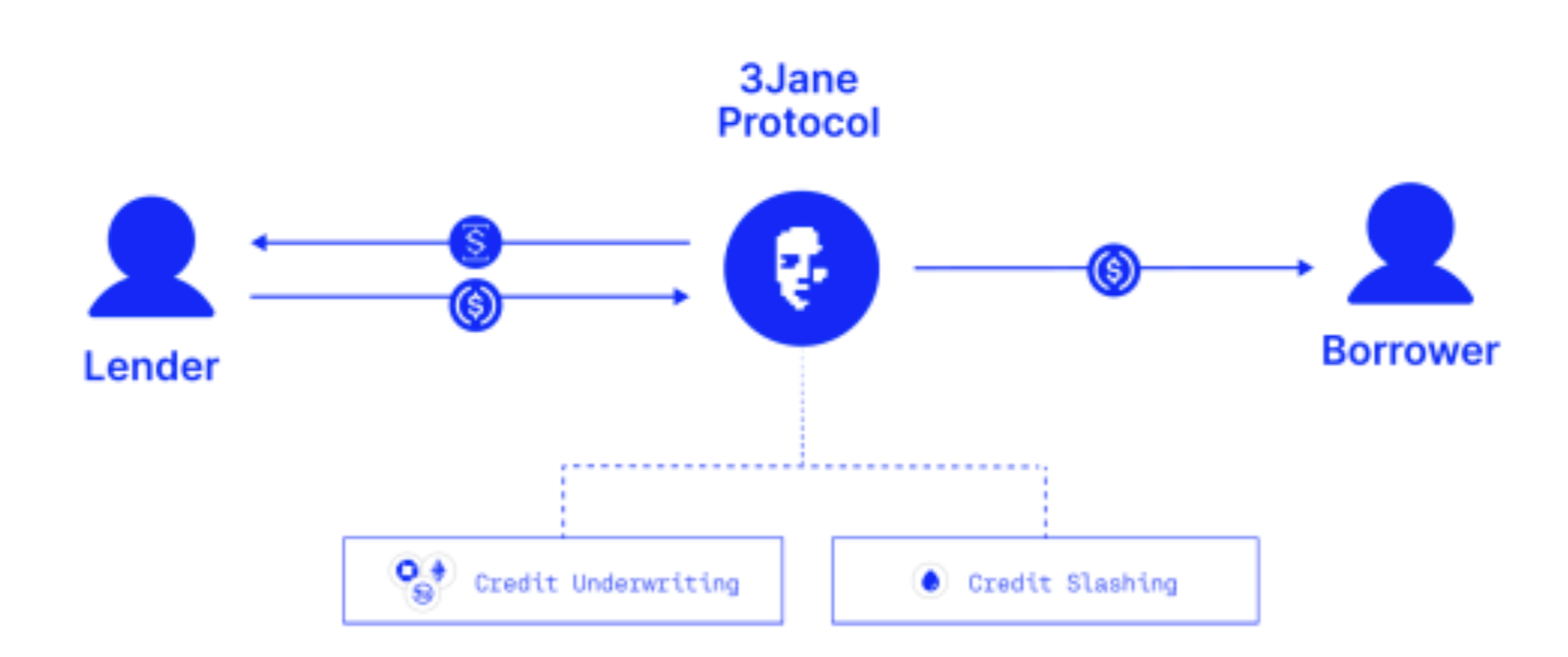

So what’s the grand plan? To be the Robin Hood of crypto banks, offering USDC-denominated credit lines to traders, yield farmers, and even AI robots that probably dream of accumulating more yield. Unlike those old-fashioned DeFi platforms that demand you overcollateralize your house and your grandmother’s vintage jewelry, 3Jane boldly claims it can lend you money based on your “credit scores”—which means they’re gambling on your reputation instead of your assets. Borrow against your DeFi assets, CEX holdings, or even your future cash flows, just like in a Hollywood heist movie! 🤪💥

According to 3Jane, traditional finance is a stodgy dinosaur stuck in outdated methods—overcollateralized lending is like trying to run a race with a stone around your neck, and unsecured loans? Only for the rich or the shady. Enter 3Jane, with dreams of launching a peer-to-pool credit market right on Ethereum—aiming to unlock a whopping $60 billion in dormant crypto capital buried across EVM chains. It’s like digging up treasure chests buried under a mountain of tokens! 🚀🤑

The protocol plans to roll out a two-token system: USD3, a stablecoin-yieldcoin backed by actual credit lines—because everyone loves a stablecoin with a backbone—and sUSD3, which offers a leveraged yield for the daring adventurer. To keep things honest (or at least pretend to), they’ll use a cocktail of on-chain and off-chain credit data, with names like Cred Protocol, Blockchain Bureau, and VantageScore 3.0—just enough jargon to confuse the most seasoned degenerate! 🤓🔧

And to keep the creditors in check, 3Jane has devised a scheme involving onchain auctions and U.S. debt collectors—because what’s more American than a good old-fashioned debt auction? The rollout is staged, starting with testing credit models, onboarding suppliers, and gradually giving out unsecured loans—each cycle sharpening the credit sword, or so they hope. Maybe next, they’ll try to lend to your grandma—or to the moon! 🌝💸

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Grimguard Tactics tier list – Ranking the main classes

- PUBG Mobile heads back to Riyadh for EWC 2025

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

- Silver Rate Forecast

- Cookie Run Kingdom: Lemon Cookie Toppings and Beascuits guide

2025-06-05 00:59