Ah, the Bitcoin price, that fickle mistress, continues to dazzle us this weekend, rising from the depths of despair where it languished near $101,000. As if it were a phoenix, BTC now sets its sights on the lofty $110,000, yearning to reclaim its former glory. But lo! As it flirts with the $106,000 threshold, one must ponder: what lies ahead in this tumultuous journey?

BTC Price Faces Significant Resistance Above $106K

In a recent proclamation on the social media platform X, the oracle of on-chain analysis, Burak Kesmeci, unveiled two pivotal levels that could dictate the Bitcoin price’s fate in the mid to long term. This revelation is drawn from the realized price of a peculiar breed of investors known as short-term holders (STH) — those who flit about like butterflies, reacting to every price flutter.

These short-term holders, bless their hearts, are notorious for their impulsive nature, often swayed by the slightest tremor in the market. They are the ones who open and close their positions faster than you can say “HODL!”

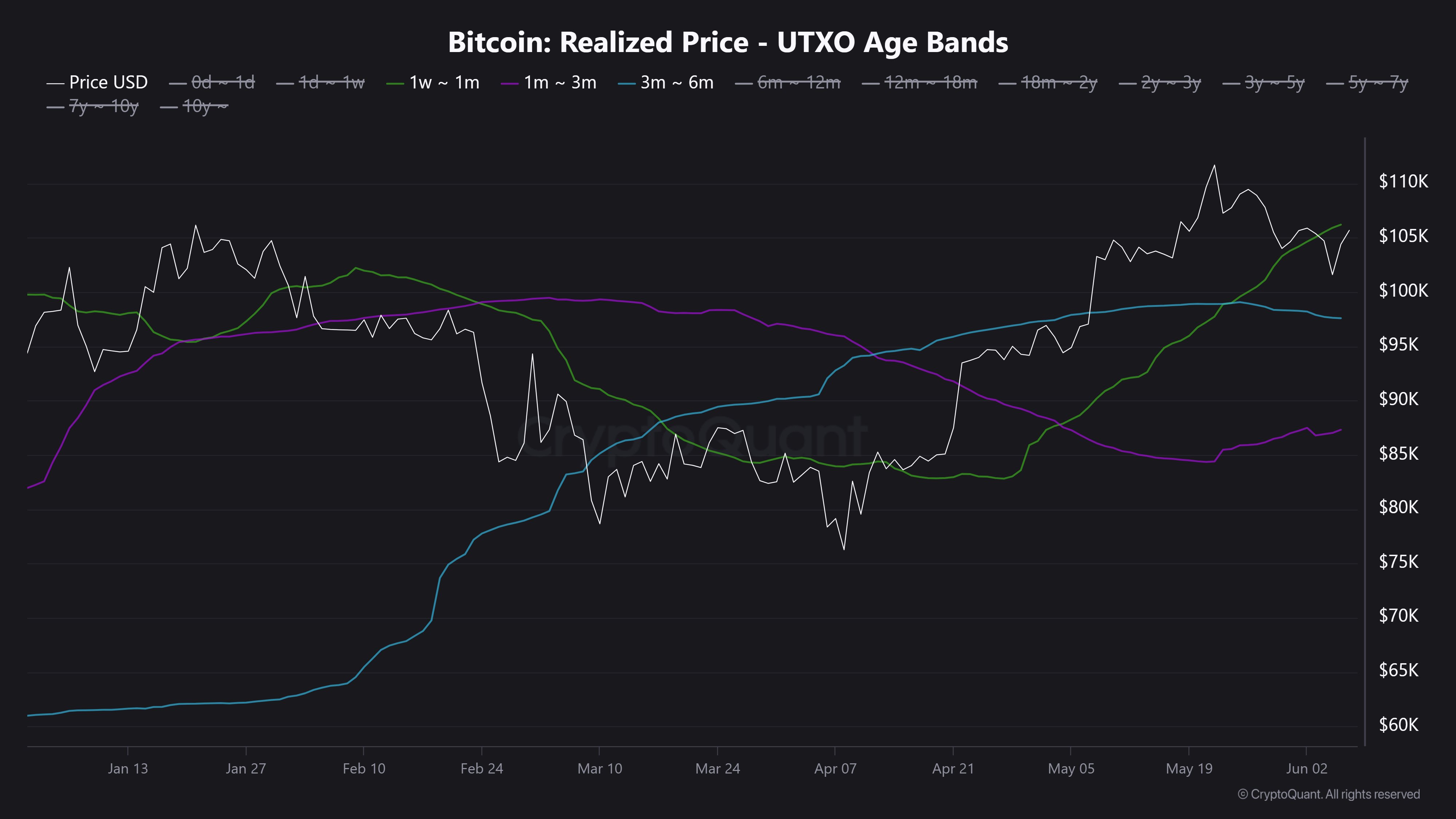

Kesmeci, in his digital scroll, highlighted three critical levels based on the realized prices of investors within certain unspent transaction output (UTXO) age bands. Specifically, he pointed out the cost bases of investors within 1 week – 4 week ($106,200), 1 month – 3 month ($87,300), and 3 month – 6 month ($97,500) age bands. Quite the buffet of numbers, isn’t it?

According to our sage Kesmeci, the Bitcoin price is poised to encounter formidable resistance at the $106,200 mark, where the 1-week – 4-week investors have set their stakes. The logic is simple: those STHs nursing losses may scurry to close their positions as they approach their cost basis, creating a downward pressure akin to a game of musical chairs.

Conversely, Kesmeci also pointed out the realized price of $97,500 for short-term investors within the 3-month – 6-month age band as another crucial level. These investors might see this price as a chance to defend their turf, forming a support cushion that could rival a plush sofa.

In essence, this on-chain data suggests that Bitcoin is inching toward a significant resistance level just above $106,000. Should it manage to breach this barrier, we might witness the premier cryptocurrency gallivanting back to its all-time high of $111,871. What a spectacle that would be!

Bitcoin Price At A Glance

As of this moment, the price of BTC hovers around $105,700, reflecting a modest 1.3% increase in the past 24 hours. According to the wise sages at CoinGecko, our market leader has risen by more than 1% over the last week. A true champion of resilience!

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Gold Rate Forecast

- Grimguard Tactics tier list – Ranking the main classes

- Pi Network (PI) Price Prediction for 2025

- Castle Duels tier list – Best Legendary and Epic cards

- How to Watch 2025 NBA Draft Live Online Without Cable

2025-06-08 20:16