- ETH took a 9% plunge post-airstrike, but guess what? Whales splurged over $16 million like it was Black Friday!

- Ethereum is playing hard to get; drop below $2,400 and we might just see $2,150 waving hello.

So, following Israel’s airstrike on Iran, the crypto whales decided to throw a party and accumulate Ethereum [ETH] as prices crashed like my hopes of a perfect weekend. 🎉

Of course, this sparked a flurry of speculation—are we witnessing the calm before the storm of accumulation? Or just a bunch of whales having a mid-life crisis?

Ethereum whales borrow, buy, and accumulate

During the Asian trading hours (because who needs sleep?), Onchain Data Nerd reported that a crypto whale borrowed $5 million from AAVE and snagged 1,844 ETH worth approximately $4.6 million. Talk about a shopping spree! 🛍️

Meanwhile, two more crypto wallets, probably belonging to the same whale, bought 4,521 ETH for $11.7 million. Clearly, they’ve mastered the “buy the dip” strategy—someone get them a trophy! 🏆

$202 million worth of ETH outflow from exchanges

And as if that wasn’t enough, spot data from CoinGlass revealed a whopping $202.03 million Exchange Outflow from ETH wallets on June 13th alone. I mean, who needs that much ETH anyway? 😅

This massive outflow is usually a sign of accumulation, or in today’s market, it’s just a way to reduce selling pressure. Because who doesn’t love a little pressure relief? 💨

Critical battle zones for ETH

With the current market sentiment, traders are betting on short positions like it’s the latest fashion trend. 🤑

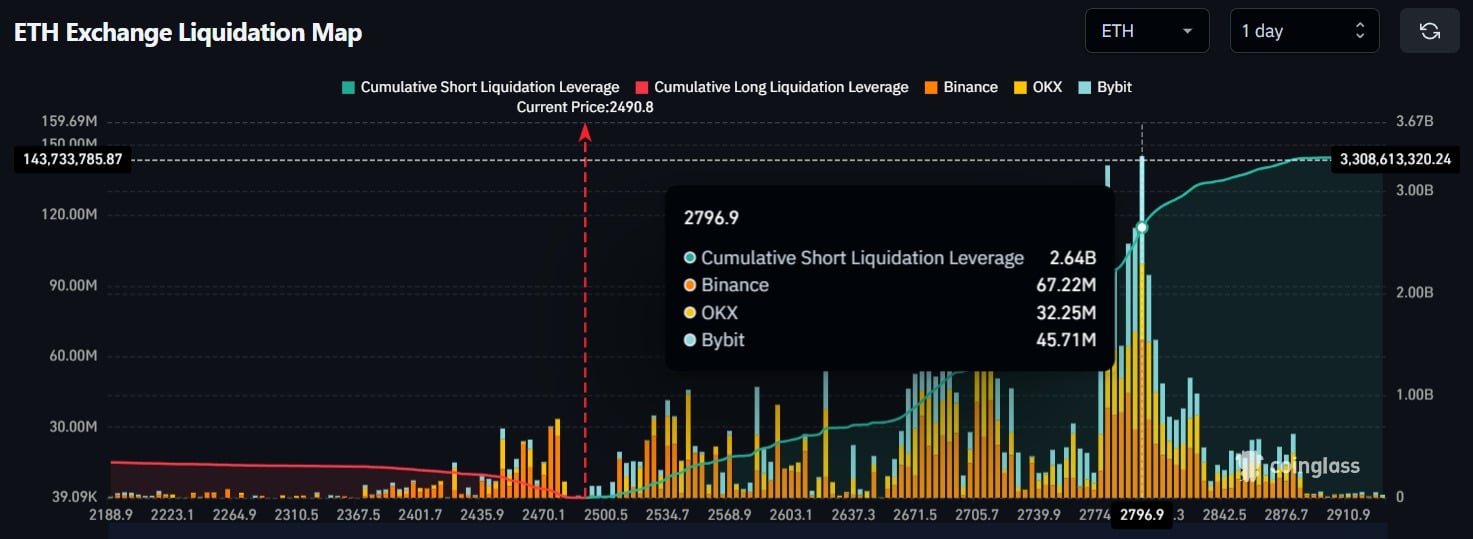

The Liquidation Map showed a massive imbalance: short positions near $2,796 ballooned to $2.64 billion, while long positions at $2,440 barely held on with just $201 million. Someone call a lifeguard!

These hefty bets on short positions scream short-term bearish sentiment among traders. At press time, ETH is trading near the $2,505 level, having recorded a price decline of over 9% in the past 24 hours. Ouch! 😬

During this rollercoaster ride, its trading volume surged by 35%, indicating that traders and investors are all in, like it’s the last round of a game show.

Price slides 9%, but….

According to AMBCrypto’s technical analysis, Ethereum is still stuck in its prolonged consolidation range between the $2,409 and $2,730 levels, creating an accumulation zone for investors. It’s like waiting for a bus that never comes! 🚌

Based on recent price action and historical momentum, whenever the asset’s price approaches the lower boundary of this range, it tends to experience an upside rally. Fingers crossed! 🤞

However, with the geopolitical tensions, a breakdown is firmly on the table. If ETH slips below $2,400, the next key support lies near $2,150—a zone bulls must defend to avoid a steeper slide. It’s like a game of tug-of-war, and we’re all just spectators! 🎭

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- Silver Rate Forecast

- USD MXN PREDICTION

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2025-06-13 18:04