- Ah, the SPX Price! It soared over 230% from May to mid-June, flirting with its all-time high of $1.77 like a lovesick teenager. 💔

- Open Interest skyrocketed to a staggering $171M before plummeting 25%, as if overleveraged longs were flushed down the proverbial toilet. 🚽

- On June 14, spot outflows hit $6.4M, signaling that some traders were making strategic exits—probably to avoid the impending doom! 😱

SPX6900USD Technical Analysis: A Classic Parabolic Advance

It all began with a golden cross on May 6, when the 50-day EMA decided to play nice and crossed above the 200-day EMA—a bullish signal that had analysts dancing in the streets! 💃

After this crossover, the SPX coin took off like a rocket, blasting through resistance zones as if they were mere paper walls. 🚀

From May 7 to June 11, SPX Price followed a parabolic rally that would make even the most seasoned traders weep with joy, climbing from $0.50 to nearly $1.77 in just over a month. Talk about a meteoric rise! 🌠

But beware! This structure often signals a blow-off top or exhaustion phase, especially when volume and sentiment spike at the peak—like a party that gets out of hand! 🎉

On June 11, a temporary top formed as the SPX price began to fade under $1.70. The correction intensified on June 14, driven by heavy profit-taking, and now it’s consolidating above key support at $1.30—like a cat that’s had too much catnip. 🐱

Indicators Point to Cool-Off, Not Collapse

- RSI has dropped from 75 to 40.19, cooling off from overbought territory—like a hot summer day turning into a refreshing evening. 🌅

- MACD shows a bearish crossover, confirming that momentum is waning—like a balloon slowly deflating. 🎈

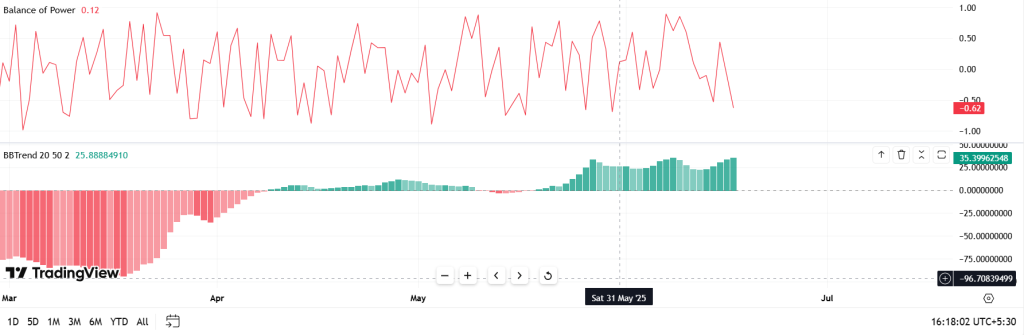

- Balance of Power is soft at 0.12, while BBTrend and BBP show weakening bullish energy—like a tired athlete after a marathon. 🏃♂️

The indicators align with a standard post-rally reset. A base is likely forming between $1.30–$1.35, like a solid foundation for a house of cards. 🏠

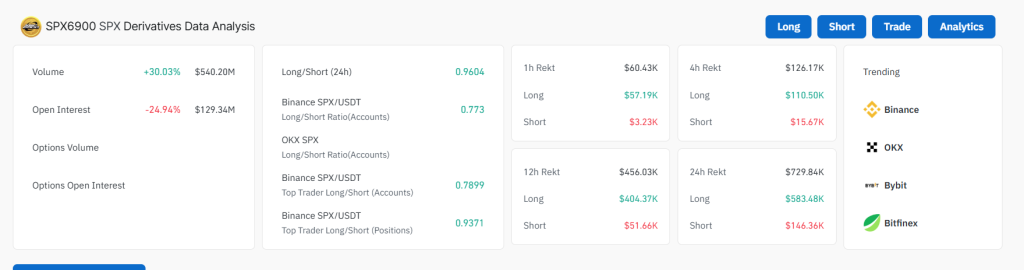

Derivatives Flash Warning: Open Interest Collapse, Sentiment Flip

Open interest reached an ATH of $171.7M on June 13, but then it fell faster than a lead balloon—down 25% as the price retraced. Meanwhile, long/short ratios flipped bearish across major exchanges:

- Binance L/S (accounts): 0.773

- 24h Global L/S: 0.9604

This shift indicates that traders began aggressively closing long positions or opening shorts as the rally lost momentum—like rats abandoning a sinking ship! 🐀

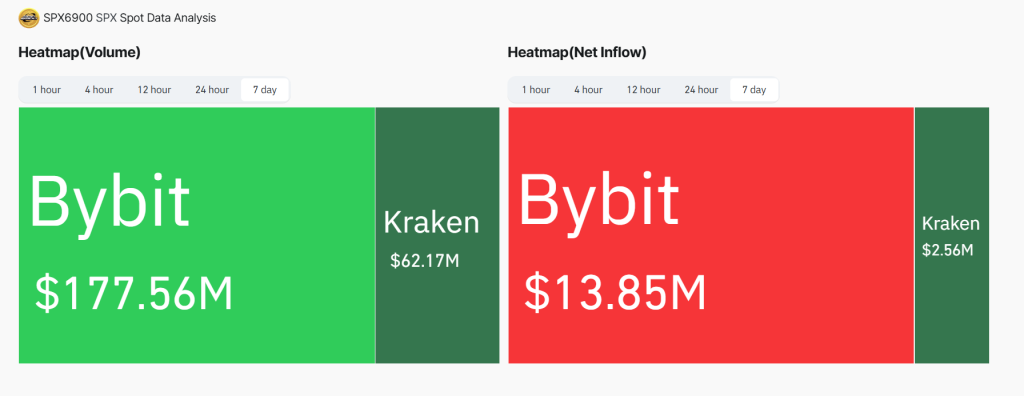

Spot Flow Reversal Confirms Profit-Taking

On-chain flows show over $6.4M in net outflows on June 14 alone, with additional daily exits continuing through June 17. Coinbase saw light inflows (~$367K), but Kraken and OKX recorded significant net exits—confirming that this was not a retail-driven accumulation but a strategic unloading. 🎭

SPX6900 Price Prediction: Bounce or Breakdown?

SPX coin trades at $1.39. If it holds the $1.30 support, we might see a price test of $1.50 and potentially retarget the $1.71 ATH by late June. A breakout could push SPX toward $2.00—if only it could find its way! 🧭

If $1.30 fails, downside targets include $1.18 and $1.05 (Fib retracement levels)—a sobering thought for the overly optimistic. 😬

For now, SPX shows signs of stabilizing. Traders should watch for volume return near $1.50 and RSI flattening to confirm bullish continuation—like waiting for the other shoe to drop. 👠

SPX6900’s rally followed technical structure, and its cooldown reflects healthy market rotation. A breakout or breakdown in coming sessions will define the next meme cycle leg—stay tuned! 📺

Read More

- USD MXN PREDICTION

- 10 Most Anticipated Anime of 2025

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Silver Rate Forecast

- USD JPY PREDICTION

- USD CNY PREDICTION

- Brent Oil Forecast

- Gold Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

2025-06-17 17:37