In the unhurried ballet of June, the price of Bitcoin—capricious, glaring, indifferent—danced from a sullen $100,500 to a preening $111,000, and back again, as if recalling the remembered lights of past seasons. No delirium, no wild, feverish leaps—just the persistent dignity of an asset determined to hover above that mythical $100,000, as though clinging to the last branch in a storm.

The charts—how predictable their lines, their studied silences!—unfurled a week of modest pulse and quiet resolve. Bitcoin, ever the sphinx, drifted slowly between the corridor of muted hope and dogged skepticism, its traders doomed to swing between optimism and a motherly fretfulness, checking the window for better sunshine.

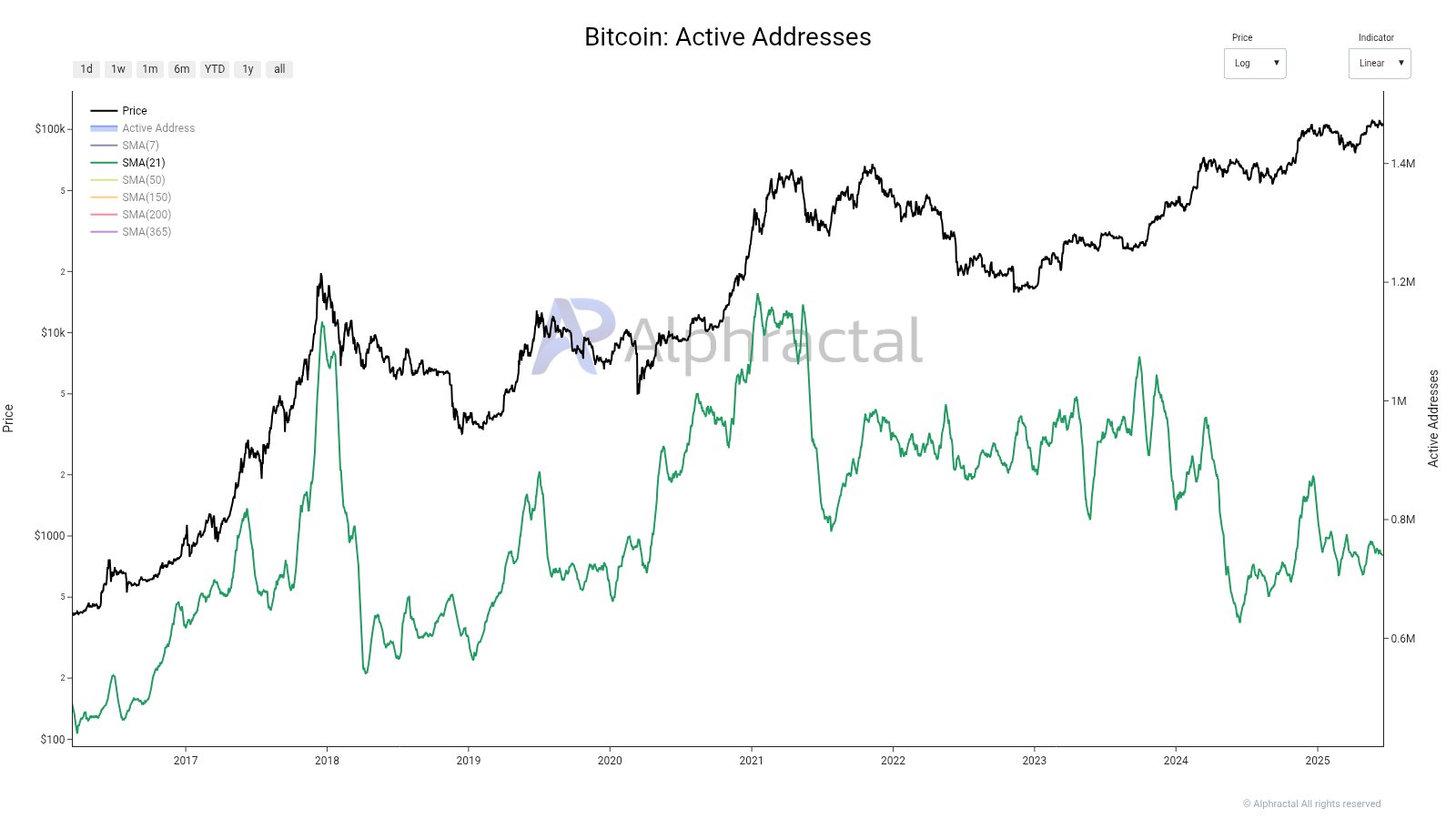

Active Addresses: Echoes From a Quieter Year

On the twentieth day of June, as birds chirped on nameless wires and the world scrolled endlessly, the analysts at Alphractal announced—with the pomp of a town crier and the subtlety of a sleeping cat—that Bitcoin’s active addresses had crept back to their 2020 beds. No parades, no euphoric marches—just the familiar rustle of digital wallets stirring in their sleep.

Active Addresses, that metric beloved by both mystics and spreadsheet devotees, tallies the count of unique digital homes putting their boots on. If an address sends or receives, it is marked in the ledger, immortalized for the span of a ticker tape.

Alphractal’s solemn chart drew a parallel between now and a world haunted by a pandemic, angst, and politicians wielding uncertainty like a theater prop. The same low hum, the same absence of thunderous applause—a déjà vu dressed in code.

Alphractal then, with a flourish, offered two theories, as if ordering from a menu with only two items and neither particularly appetizing. Possibility one: investors are jaded, unable to muster excitement in a market where “crypto influencer” means “guy who lost your money.” Bitcoin above $100k? Yawn. Pass the salt.

Or, option two: this is faith incarnate, a thousand digital monks HODLing through winter, unwilling to blink. Too bad, said Alphractal, for the other charts—volumes both on-chain and spot—are drowsy. Interest, it seems, is flatlining harder than a romantic subplot in a Soviet novel.

Thus, above $100,000, Bitcoin stands not as emperor but as survivor. “Only the most resilient,” they say, “are making use of this long-prophesied $100k-per-BTC existence”—which is poetic talk for “everyone else went fishing.”

Bitcoin Price: A Portrait in Melancholy

And now, a snapshot: at the moment of this unremarkable writing, Bitcoin fiddles with $103,290—down 1% in a day, dropping 2.4% over seven. The solemn numbers, courtesy of CoinGecko, strike no awe nor panic—merely the careful exhale of those who have seen worse.

The digital steppe is quiet now. The caravans rest. Somewhere, a trader refreshes his screen, longing for 2021—if not for the profits, then at least for the drama.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-06-21 21:47