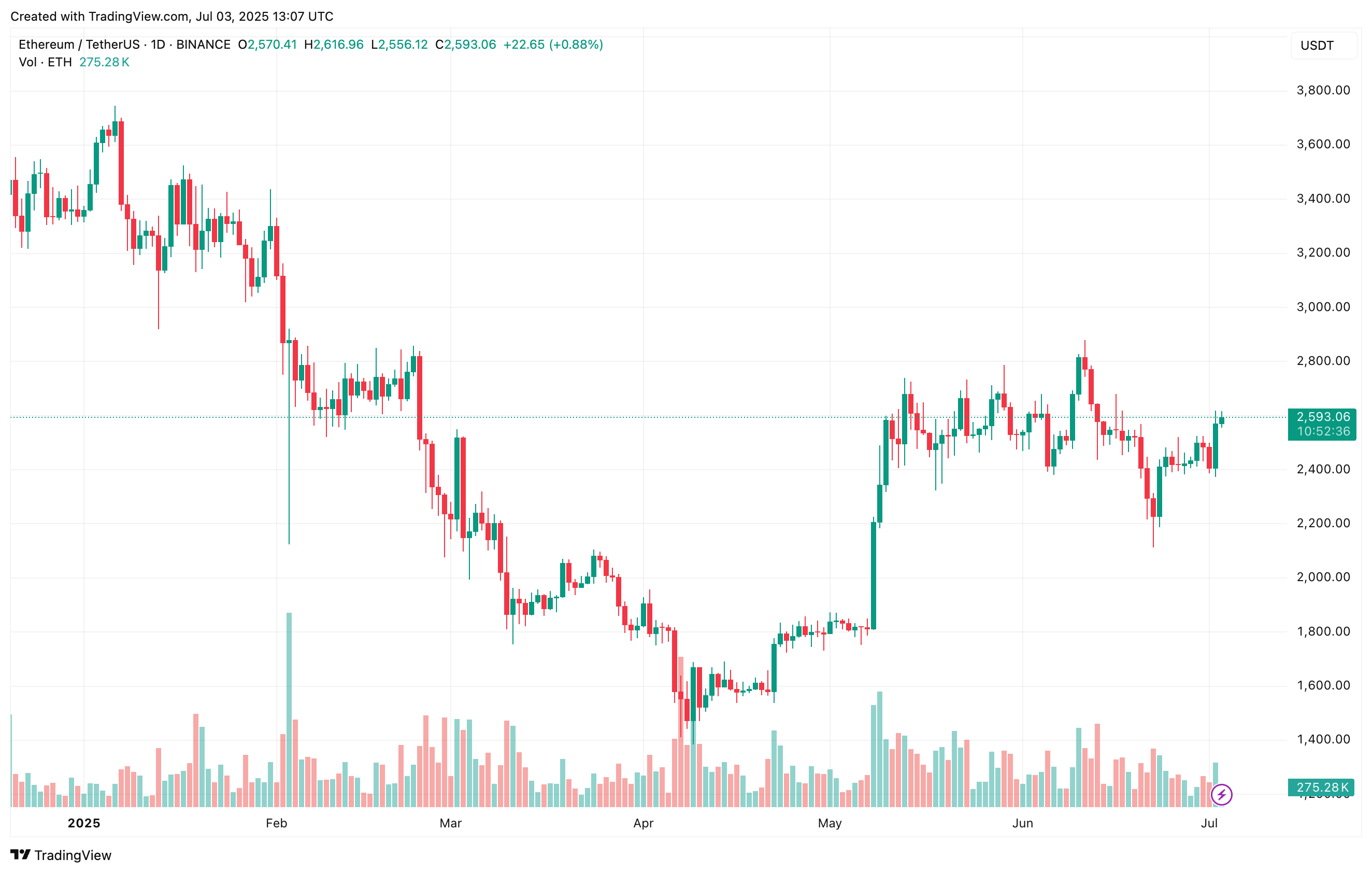

It’s been a wild ride for Ethereum (ETH) lately, with the price jumping up by 8% in just 48 hours 🚀. It’s like the whole crypto world is holding its breath, waiting to see what happens next. And what’s behind this sudden surge, you ask? Well, it seems that both accumulation addresses and liquid staking volume are reaching all-time highs (ATH) 🤯.

The Great Ethereum Staking Adventure

According to some clever folks at CryptoQuant, Ethereum’s liquid staking activity has been on the rise since June 1. The total amount of ETH staked went from 34.54 million to 35.52 million in just one month – that’s nearly one million ETH, if you’re counting 🤑. And as of July 1, ETH set a new record in liquid staking, reaching a whopping 35.56 million ETH 🎉.

But who’s behind this staking frenzy? It seems that most accumulation addresses are linked to institutional investors, exchange-traded funds (ETFs), and other big players 🤑. They’re earning yield through liquid staking while waiting for the price to skyrocket 🚀. And the biggest winners in this game are decentralized finance (DeFi) protocols like Lido and Binance Liquid Staking 🏆.

But wait, there’s more! ETH accumulation addresses are also nearing record highs 📈. These addresses grew by 35.97% in just one month – from 16.72 million on June 1 to 22.74 million by June 30 🤯.

So, what does it all mean? Well, it seems that these accumulation addresses are signaling long-term investor confidence 💪. They’re acquiring and holding ETH without significant outgoing transactions, which means they’re not selling anytime soon 🙅♂️.

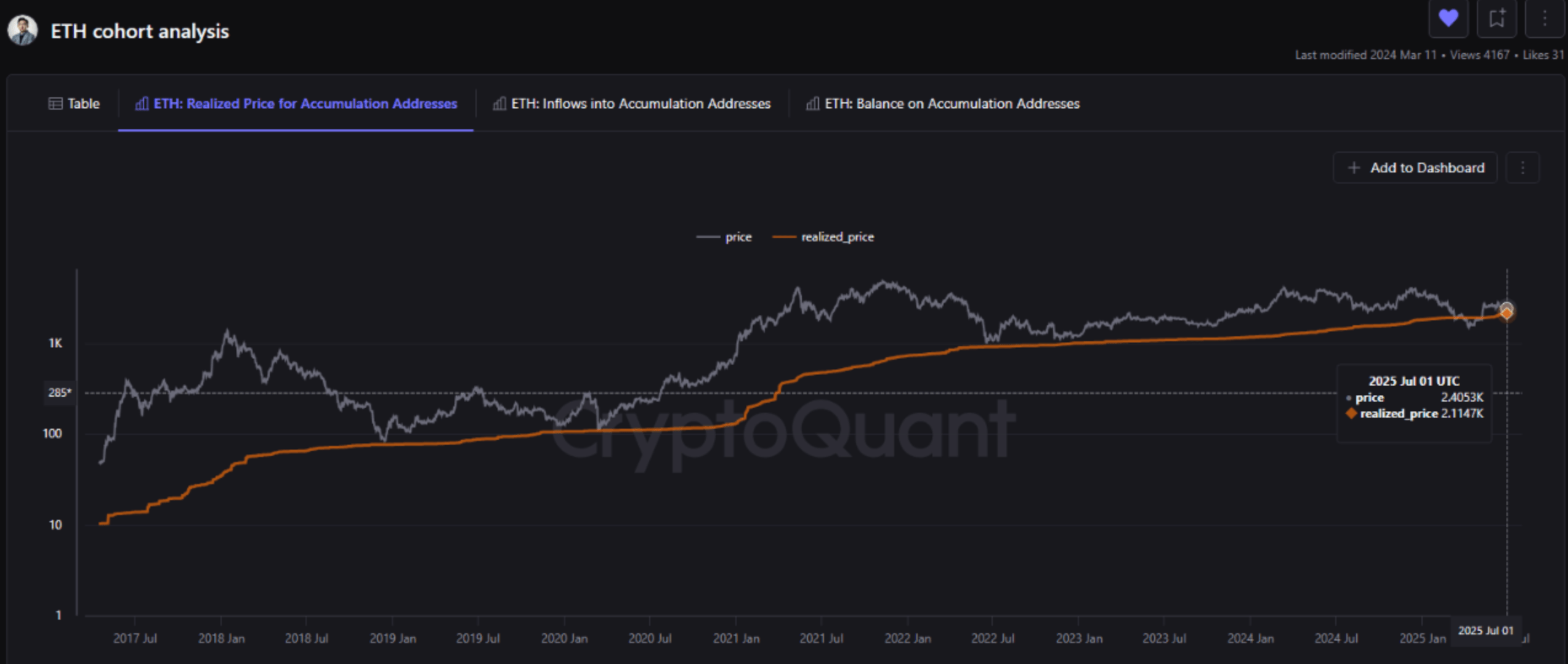

And the cherry on top? The Realized Price of these accumulation addresses – their average acquisition cost – stood at $2,114 on July 1 📊. With ETH trading at $2,593 at the time of writing, these accumulation addresses are sitting on a healthy profit of approximately 22.65% 🤑.

Will ETH Break Out of Its Shell?

Technical analysis suggests that ETH could be poised for a breakout in the near term 🔮. Some clever crypto analysts think that ETH appears ready to break out of a broadening wedge pattern on the weekly chart, with a potential upside target of $4,200 🚀.

And it’s not just the technicals – institutional interest in Ethereum is also strengthening 💼. Some big players, like Tom Lee and Joe Lubin, are revealing plans to accumulate significant ETH positions 🤑.

But, as always, there’s a catch 🤔. ETH must maintain support above the $2,200 level. A breakdown below this threshold could open the door for a drop to as low as $1,160 😱. At press time, ETH is trading at $2,593, up 1.7% in the past 24 hours 📊.

Read More

- 10 Most Anticipated Anime of 2025

- USD MXN PREDICTION

- Brent Oil Forecast

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD JPY PREDICTION

- USD CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

- Gold Rate Forecast

- Castle Duels tier list – Best Legendary and Epic cards

2025-07-04 05:20