Now trading above $2.27, XRP‘s recent price action and on-chain developments are fueling expectations of a breakout—potentially leading to a 600% rally if historical patterns repeat.

Crypto analysts are now watching XRP closely as it emerges from a long consolidation phase, with tightening technical indicators and institutional interest aligning for what could be the biggest move in years.

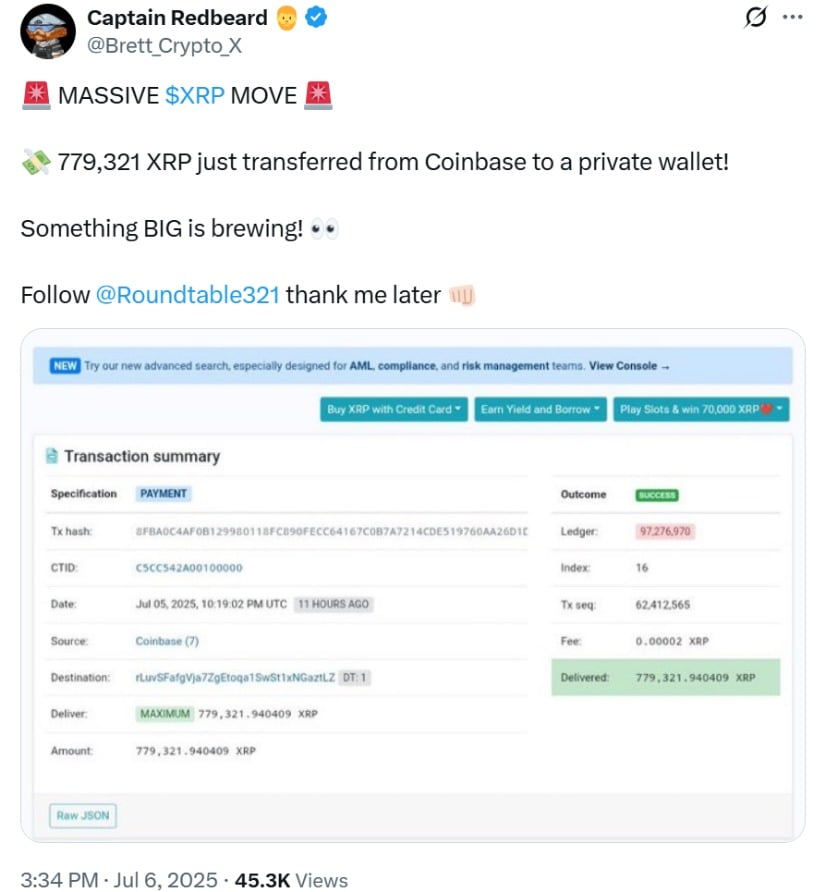

Massive Coinbase Withdrawal Triggers Whale Alert 🚨

A large XRP transaction on July 5 has caught the market’s attention. According to on-chain data, 779,321.94 XRP—worth over $1.7 million—was transferred from a Coinbase wallet to an unknown private address. While the fee was minuscule (just 0.00002 XRP), the timing and size of the move have led to speculation that a major player is preparing for a significant price breakout.

Crypto commentators quickly flagged the move, with some calling it a signal that “smart money” is positioning ahead of a big market shift. Given XRP’s 32-week-long price consolidation and the narrowing of Bollinger Bands—now at their tightest in over eight months—this transfer is being interpreted by traders as more than a routine withdrawal.

“It’s not retail,” said one crypto commentator on X. “Someone’s gearing up for something major.”

This whale movement has reignited talk of a parabolic rally, especially as Ripple pushes forward with its U.S. banking license application and ETF speculation gains traction.

XRP Capital Inflows Hit $10.6 Million: Institutional Demand on the Rise 📈

Adding to the momentum, XRP-related investment products saw $10.6 million in weekly inflows, according to CoinShares. That brings XRP’s total assets under management to $1.4 billion, part of a broader $1.03 billion influx into crypto markets last week—most of it from the U.S.

This institutional buying spree signals renewed confidence in XRP’s long-term prospects. “Price gains over the week pushed total assets under management to a new all-time high of $188 billion,” CoinShares noted, highlighting a wave of optimism across the digital asset sector.

Futures and Technicals Confirm Bullish Setup for XRP 🚀

Futures market activity is mirroring this optimism. Open Interest in XRP futures surged by 25% to $4.69 billion, while daily trading volume hit $4.72 billion. These spikes in derivatives activity typically reflect increased speculative interest and a bullish shift in sentiment.

Technically, XRP is showing strength. It’s printed two consecutive green daily candles, and the MACD has issued a bullish crossover. The Relative Strength Index (RSI) has climbed to 57, suggesting sustained upward momentum. Key resistance levels lie at $2.33 and $2.47, with a potential retest of the May high at $2.65 on the horizon.

However, traders should keep an eye on macro risks, including potential volatility from expiring U.S. tariff exemptions. In the event of a dip, XRP has solid support between $2.00 and $2.22, bolstered by the 100-day EMA.

Could XRP Really Surge 600%? Analysts Weigh In 🤔

The idea of a 600% rally isn’t pulled out of thin air. Analysts are pointing to XRP’s explosive history as evidence it could repeat such a move. During the 2017 bull run, XRP surged from $0.0055 to $3.80—a staggering 68,990% gain. More recently, from November 2024 to January 2025, XRP rallied 580%, moving from $0.50 to $3.40.

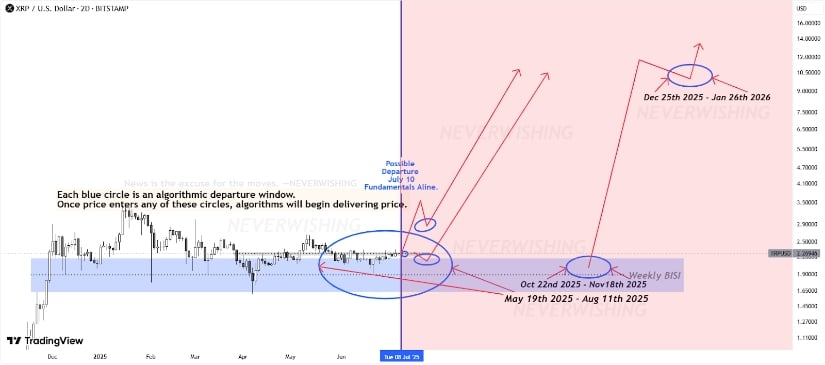

This XRP analysis identifies “algorithmic departure windows”—zones where price historically initiates explosive moves toward the $10-$16 zone. @Brett_Crypto_X on TradingView

Applying a similar growth model to the current price of $2.28, some analysts now project a possible move toward $16, while others see a more conservative target around $4.60, XRP’s previous all-time high.

XRP Price Prediction 2040: Could $5,000 Turn Into Millions? 🤑

Looking far ahead, forecasts for XRP’s long-term potential vary widely. According to Telegaon, XRP could reach $119 to $160 by 2040, turning a $5,000 investment today into $354,000. Changelly offers an even more bullish scenario, projecting XRP could hit $1,938 by 2040—transforming a $5,000 stake into over $4.28 million. Even Google’s Gemini AI predicts a more cautious but still impressive $64.20, which would grow $5,000 into $142,000.

These forecasts highlight the high-risk, high-reward nature of XRP as a long-term asset.

Legal Landscape: XRP Lawsuit Update Still Influential ⚖️

While the Ripple vs. SEC lawsuit is no longer front-page news, its resolution continues to shape sentiment. Any new update on the SEC appeal, XRP ETF approval, or Ripple’s regulatory progress could act as a major catalyst—or a stumbling block—for the token.

For now, investor focus has shifted more toward capital flows, technical indicators, and real-world adoption. But legal clarity remains an essential part of XRP’s broader investment case.

Looking Ahead: Will XRP Go Up? 🔮

With a major whale transfer, institutional buying on the rise, tightening technical patterns, and Ripple’s push into U.S. banking and ETF territory, XRP appears poised for a major move. A breakout above $2.65 could pave the way for a rally toward $4.60, or even higher.

Still, volatility remains a factor. Investors should stay tuned to macro headlines and XRP court case developments that could sway sentiment. For now, the outlook remains decidedly bullish, and XRP continues to position itself as a leading contender in the evolving digital asset space.

Read More

- Gold Rate Forecast

- 10 Most Anticipated Anime of 2025

- Grimguard Tactics tier list – Ranking the main classes

- USD MXN PREDICTION

- Castle Duels tier list – Best Legendary and Epic cards

- PUBG Mobile heads back to Riyadh for EWC 2025

- Silver Rate Forecast

- Brent Oil Forecast

- How to Watch 2025 NBA Draft Live Online Without Cable

- USD CNY PREDICTION

2025-07-08 14:55