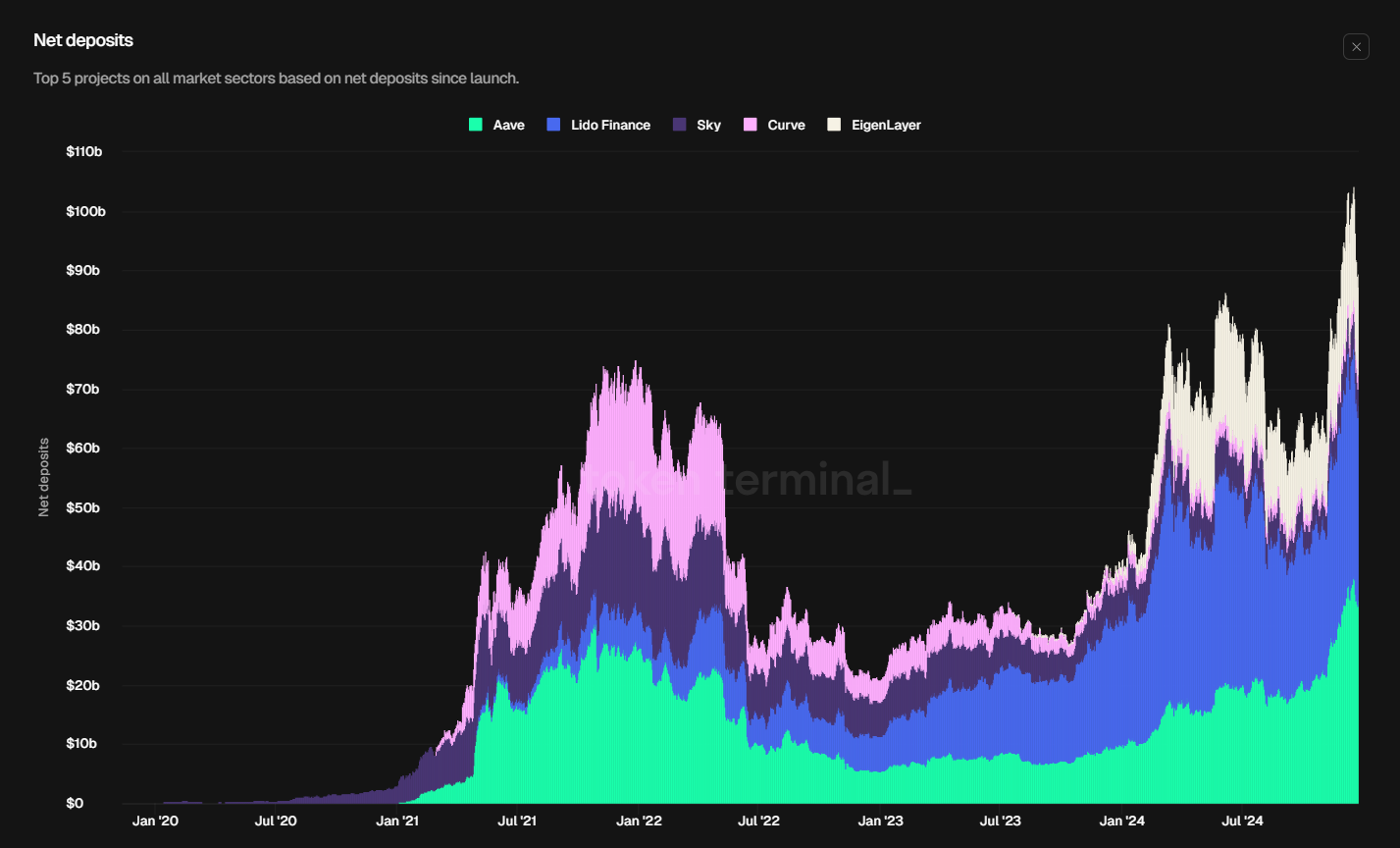

As an analyst with over two decades of experience in the financial industry, I have witnessed the evolution of various sectors, from traditional finance to decentralized finance (DeFi). The recent milestone achieved by Aave and Lido, surpassing $70 billion in net deposits together, is not just a significant leap for these protocols but also for the DeFi sector as a whole.

As a crypto investor, I’m thrilled to be part of a groundbreaking moment in digital finance! For the very first time, the combined total net deposits on platforms like Aave and Lido have soared beyond $70 billion, according to Token Terminal. This milestone is a testament to the growing trust and confidence in decentralized finance (DeFi) solutions. I can’t wait to see what the future holds for this exciting space!

In December 2024, Aave (AAVE) and Lido Finance (LDO) are dominating the Decentralized finance (DeFi) scene with a combined allocation of approximately $67.7 billion, making up 75.25% of the total $89.52 billion allocated to the top five DeFi applications. This is the highest ever percentage for the top five. The two projects together represent 45.5% of the total funds allocated among the top 20 DeFi applications, which amounts to $67.42 billion out of a total net deposit of $148 billion across the sector. Notably, LDO currently holds the highest amount of value locked at approximately $33.8 billion, with AAVE following closely behind at around $20.6 billion.

In summary, the Decentralized Finance (DeFi) industry witnessed a significant increase in value, with Total Value Locked (TVL) growing by approximately 107% so far this year. Reaching an all-time high on December 16, TVL surpassed $200 billion for the first time, amounting to $212 billion.

The financial success achieved by AAVE ($12.5 million in 30 days, up 27.5%) and LDO ($9.6 million, increased by 24% due to platform expansion) underscores the robustness of these protocols.

Additionally, it’s worth noting that alongside an increase in deposits, the Decentralized Finance (DeFi) sector also achieved significant milestones in the trading volumes of decentralized exchanges. In November alone, these volumes surpassed a staggering $380 billion, according to TheBlock. Interestingly, the proportion of trading volume executed on decentralized exchanges (DEXes) versus centralized exchanges rose to 13.86% in October. This is the second highest ratio ever recorded, trailing only the 14.18% observed in May 2023.

The DeFi lending sector experienced substantial growth last December, reaching a total loan amount of $21 billion – the highest monthly figure yet. A significant portion of this growth is attributed to yield farming and staking, which contribute to a robust $200 billion stablecoin market within the DeFi landscape. These tools enable users to earn returns or borrow funds using stablecoins, and are optimized by Decentralized Exchanges (DEXs) and liquidity pools, reducing price volatility in bustling markets. Additionally, stablecoins can seamlessly move across various blockchain networks, enhancing their adaptability and user-friendly nature.

Read More

- 10 Most Anticipated Anime of 2025

- Brent Oil Forecast

- USD MXN PREDICTION

- Silver Rate Forecast

- PUBG Mobile heads back to Riyadh for EWC 2025

- Grimguard Tactics tier list – Ranking the main classes

- Gold Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- How to Watch 2025 NBA Draft Live Online Without Cable

- Castle Duels tier list – Best Legendary and Epic cards

2024-12-25 10:17