As a seasoned researcher with a penchant for blockchain technology and a soft spot for DeFi, I must admit that the recent surge of Aave (AAVE) has caught my attention. With its impressive 18.05% one-day rally to $379, it’s hard not to be intrigued. The potential integration of Chainlink’s Smart Value Recapture (SVR) oracle is a game-changer for Aave and the broader DeFi ecosystem.

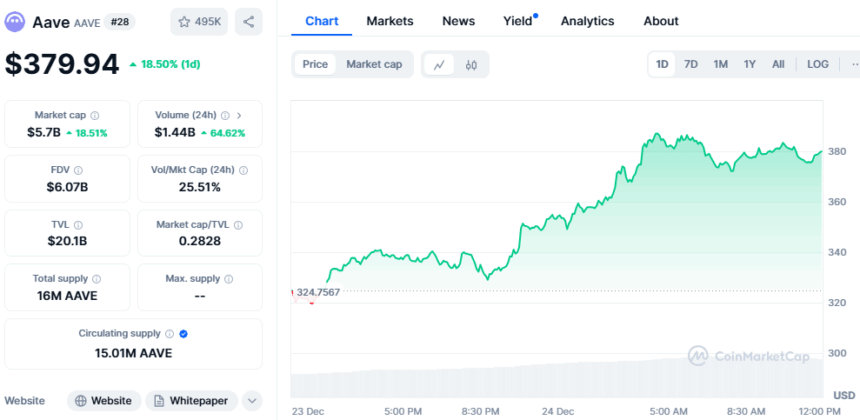

Aave (AAVE) is a prominent decentralized finance (DeFi) platform, witnessing a significant surge in its value. In just one day, it spiked by 18.05%, reaching $379. This jump was prompted by a fresh proposal for incorporating an advanced oracle service from Chainlink. If successful, this integration could significantly benefit Aave’s users and the broader DeFi sector.

The potential inclusion of Chainlink’s recently launched Smart Value Recapture (SVR) new oracle was recently discussed in the Aave governance forum. It is an oracle designed to capture profits from a process called Maximum Extractable Value (MEV).

This method includes shuffling and anticipating transactions, which historically have generated profits for miners and dealers. However, with SVR, these earnings will be rerouted to support DeFi platforms like Aave and their users instead.

As a result, the value and trading activity of the AAVE token from Aave have significantly grown. Currently, its market capitalization is approximately $5.7 billion. Moreover, the 24-hour trading volume for Aave has surged to around $1.45 billion, representing an almost 65% increase.

On December 23rd, Chainlink introduced SVR, a tool aimed at seizing profits from transaction backrunning, particularly in relation to Aave liquidations. In an Aave liquidation scenario, a borrower’s collateral deposit amount drops below a specific threshold, causing the collateral to be sold off to repay the loan. Historically, these profits have been pocketed by arbitrageurs and traders.

Read More

- 10 Most Anticipated Anime of 2025

- Silver Rate Forecast

- Pi Network (PI) Price Prediction for 2025

- USD CNY PREDICTION

- USD MXN PREDICTION

- Gold Rate Forecast

- USD JPY PREDICTION

- Brent Oil Forecast

- EUR CNY PREDICTION

- How to Watch 2025 NBA Draft Live Online Without Cable

2024-12-24 11:49